by NelsonCorp Wealth Management | Mar 1, 2024 | Chart of the Week

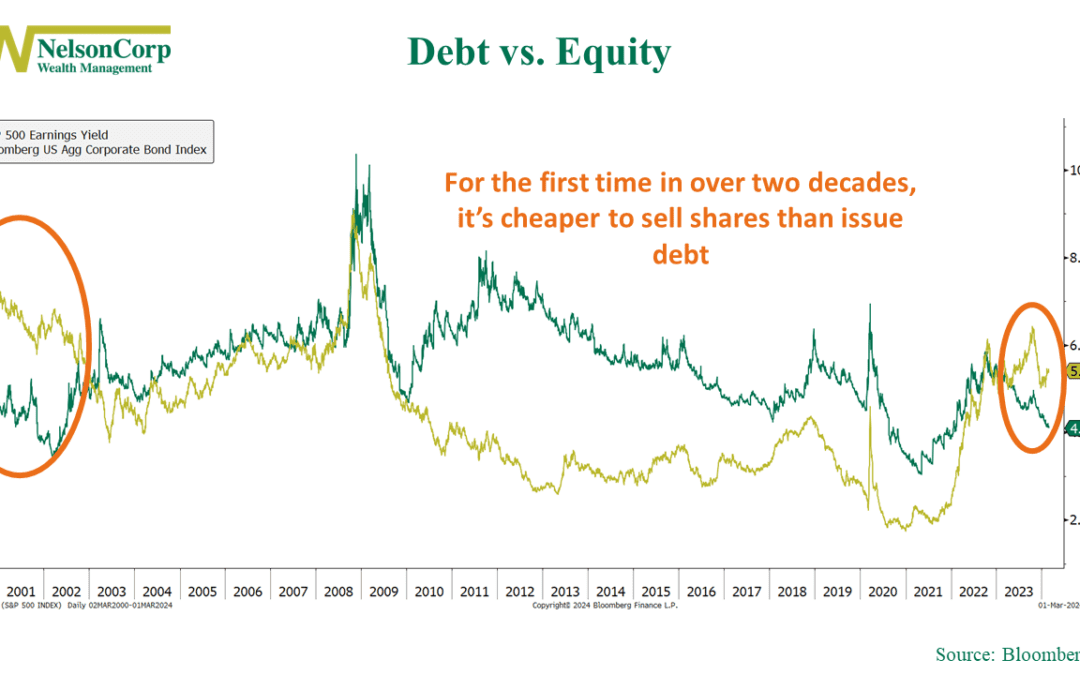

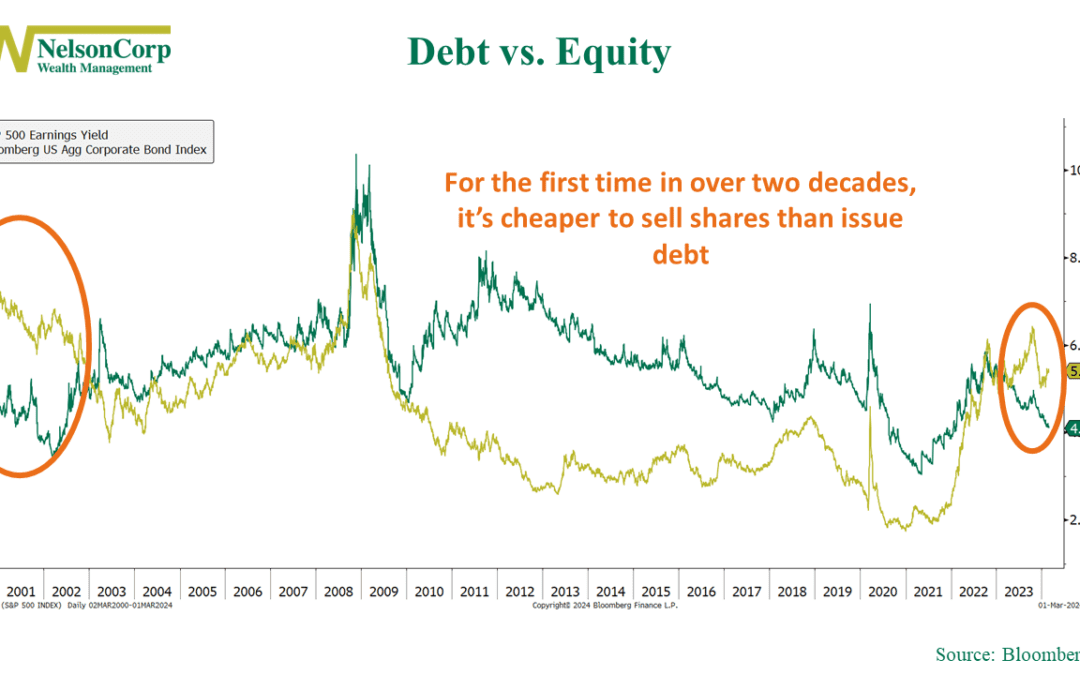

Let’s say you’re a big company and need to raise some cash. You’ve generally got two options: borrow money or sell a piece of your company. Borrowing money has largely been the go-to choice for the past couple of decades. That’s because not only is...

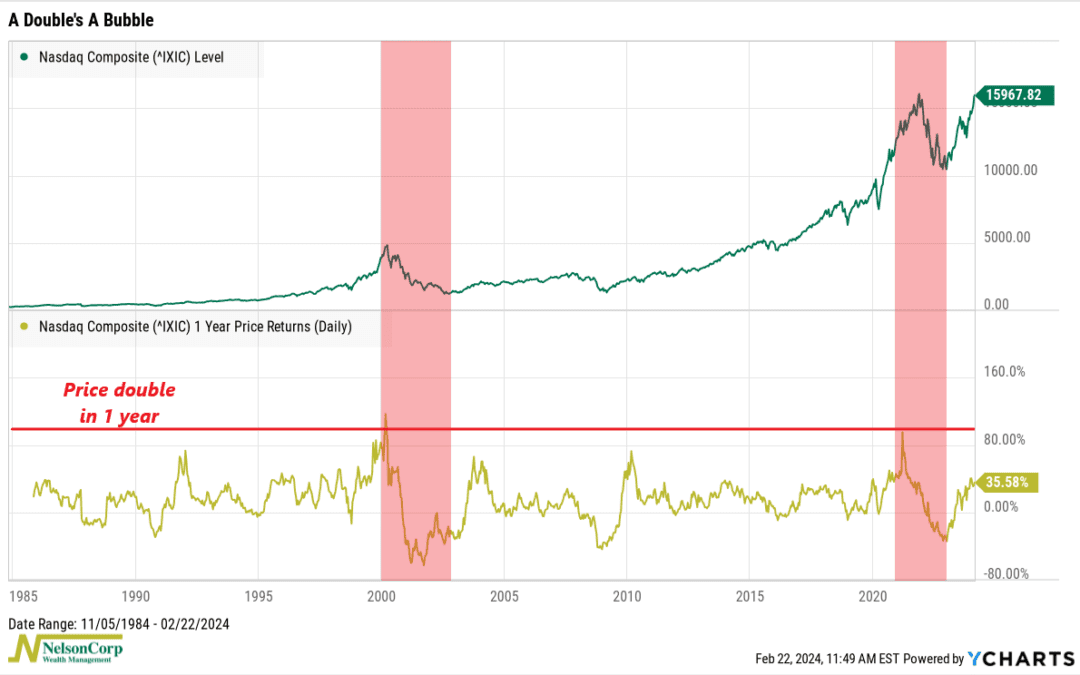

by NelsonCorp Wealth Management | Feb 23, 2024 | Chart of the Week

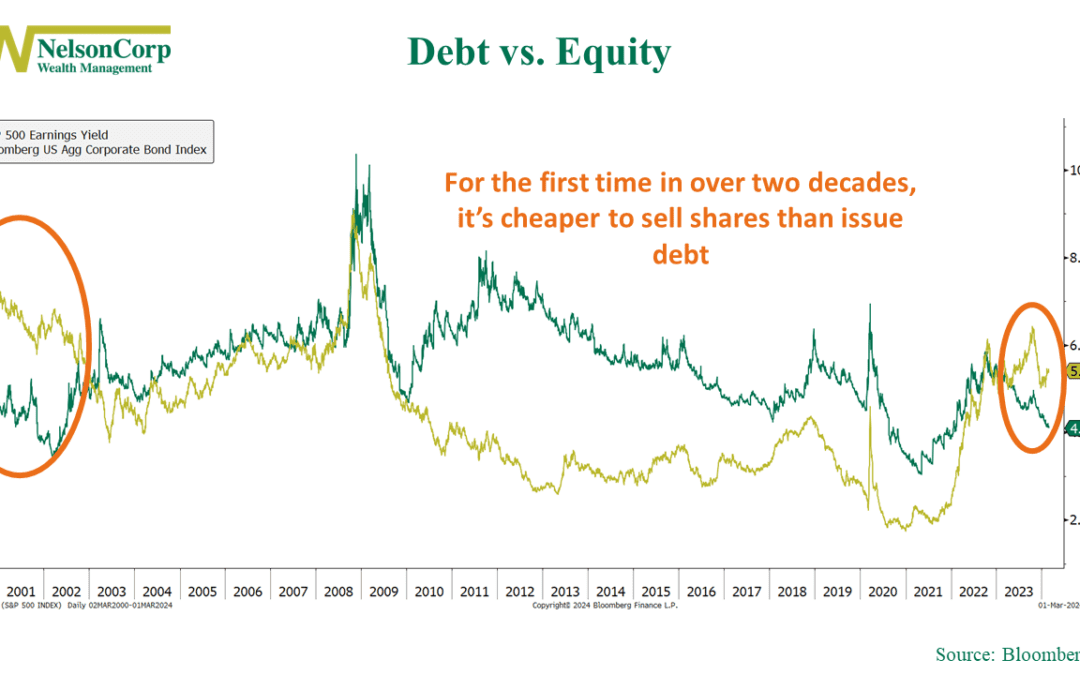

The tech sector has been booming lately. Since the January 2023 low, the Nasdaq Composite—a good measure of tech stock performance—has gained roughly 55%. Naturally, that’s got investors asking: is the tech sector overvalued? One way to answer this is by...

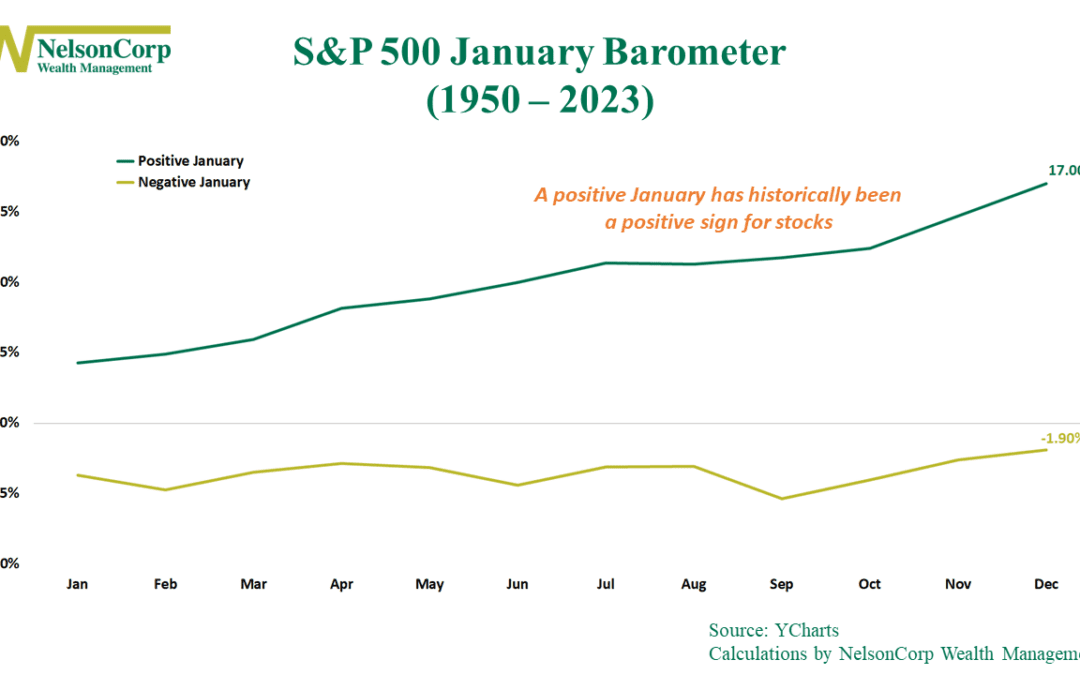

by NelsonCorp Wealth Management | Feb 16, 2024 | Chart of the Week

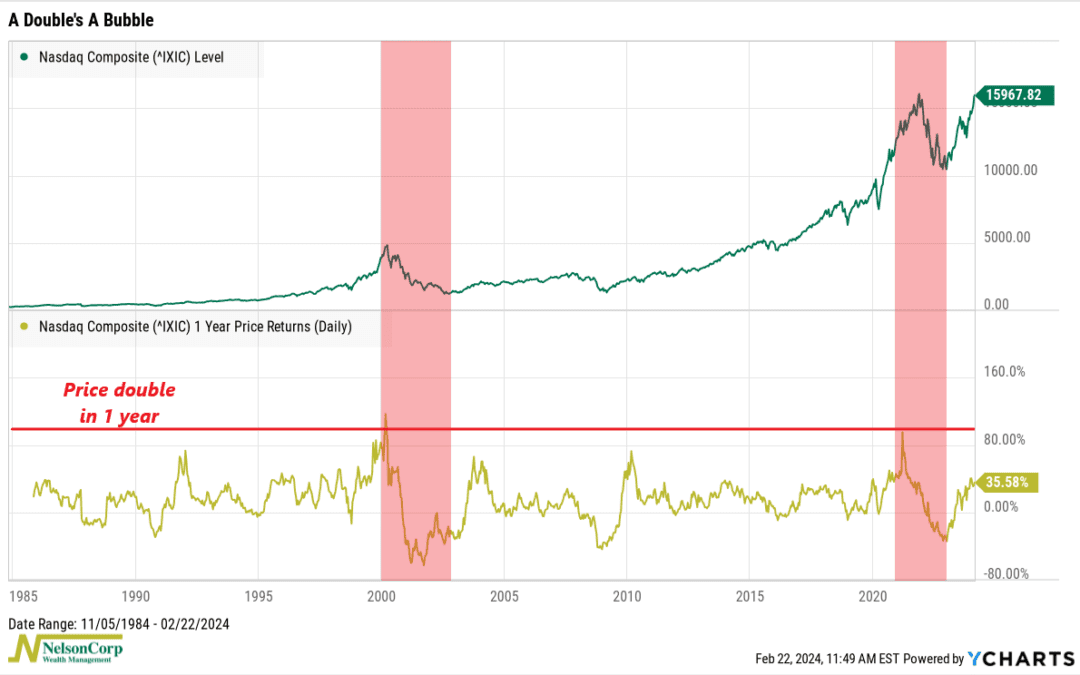

In 1972, Yale Hirsch, the author of the popular investment guide the “Stock Trader’s Almanac,” uncovered a fascinating stock market pattern he dubbed the “January Barometer.” Simply put, he observed that how the S&P 500 Index performs in January...

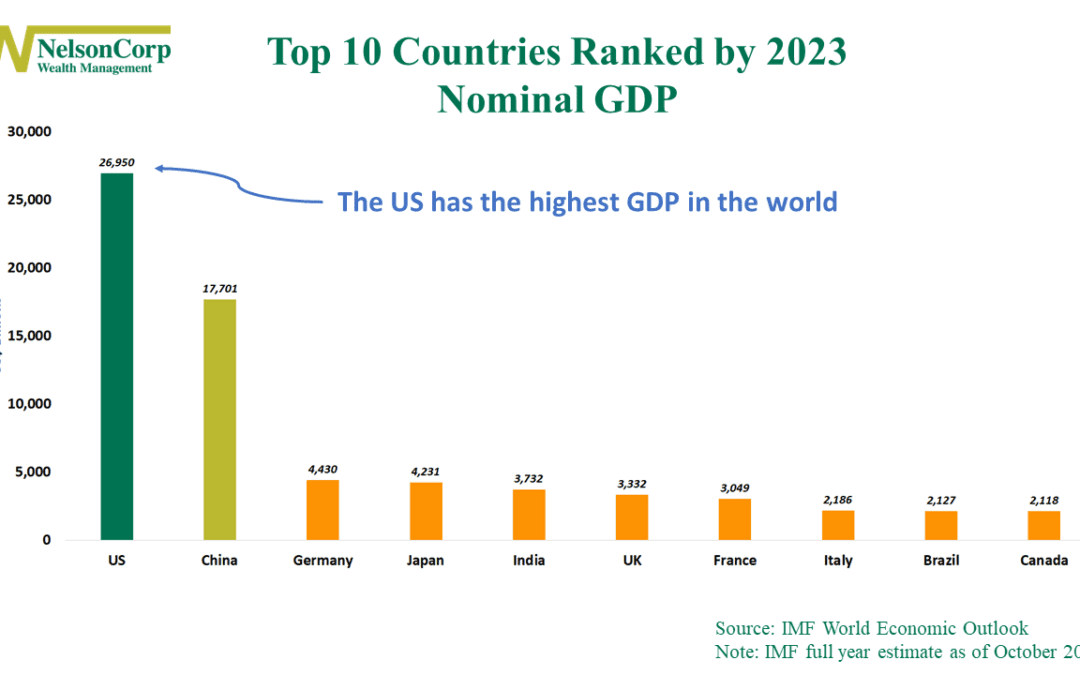

by NelsonCorp Wealth Management | Feb 9, 2024 | Chart of the Week

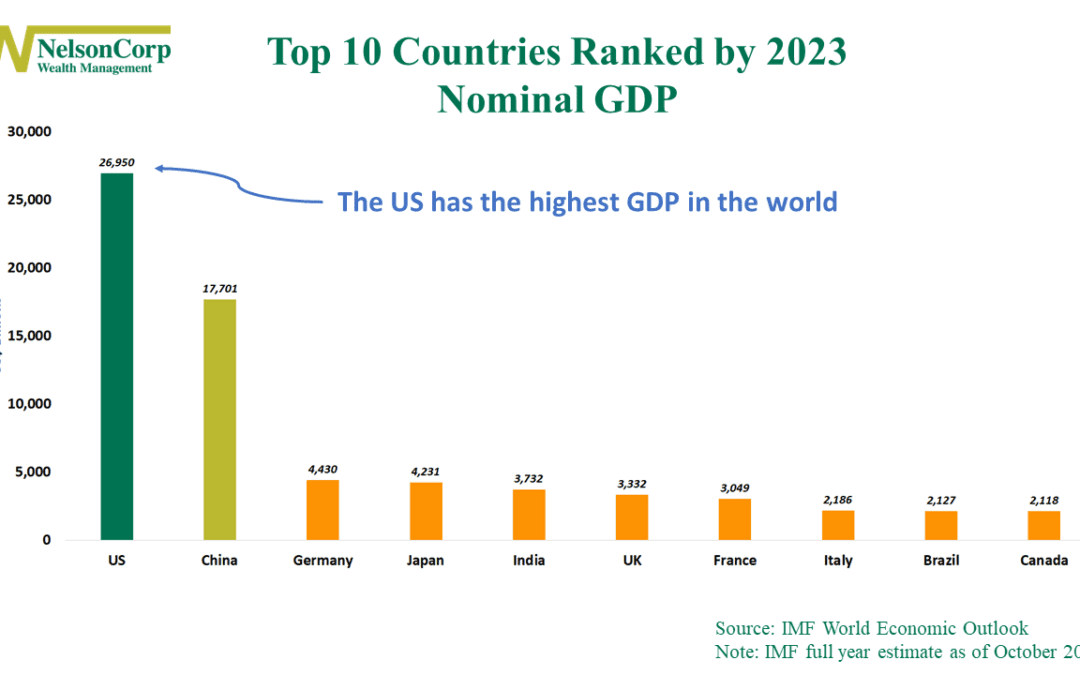

This week’s chart shows the top 10 countries in the world ranked by nominal GDP or economic growth. As you can see, the U.S. continues to dominate the rest of the world—and by a pretty wide margin. According to the latest IMF World Economic Outlook report, the...

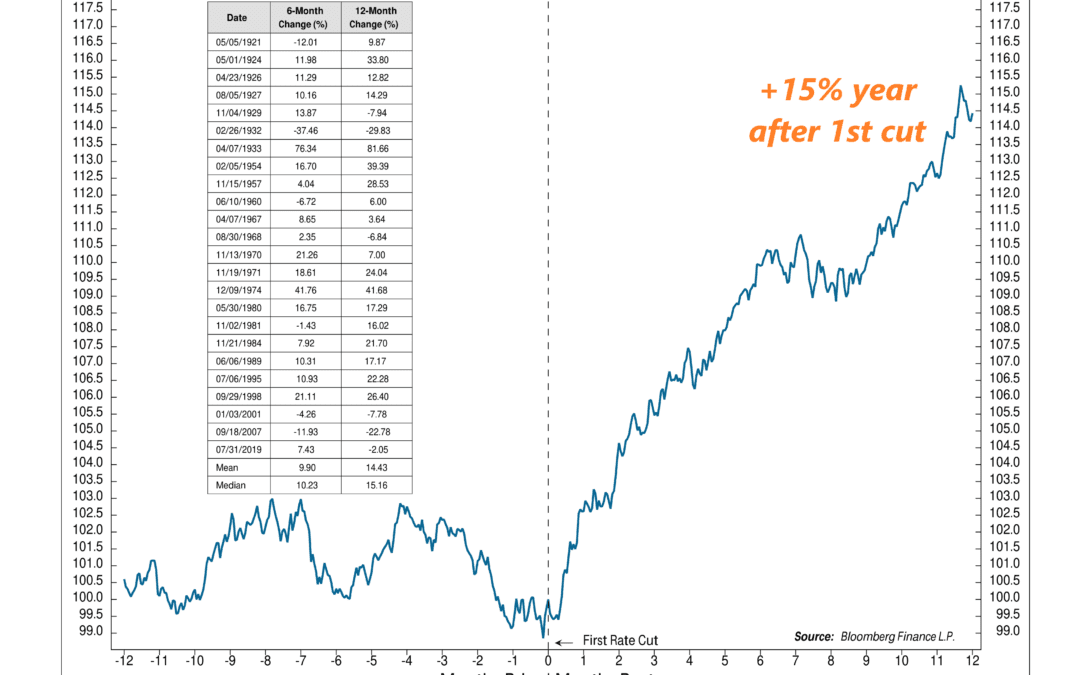

by NelsonCorp Wealth Management | Feb 2, 2024 | Chart of the Week

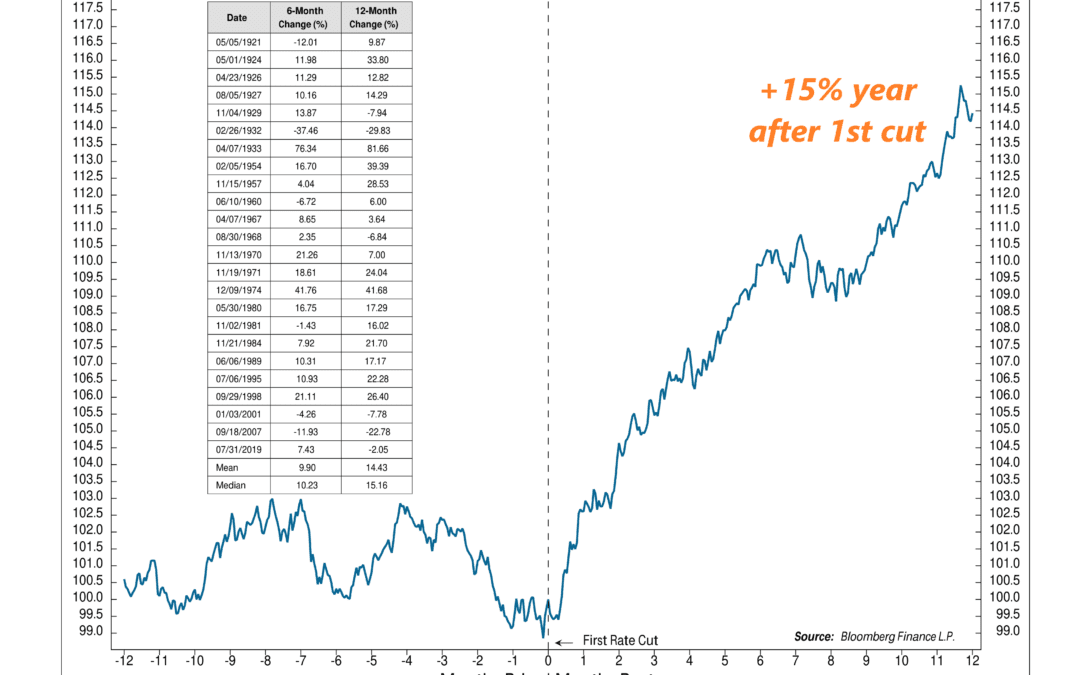

At this week’s FOMC meeting, the Fed threw cold water on the possibility of a rate cut in March. But investors anticipate that one is still coming—perhaps as soon as this summer. That raises an interesting question: how does the stock market typically respond...

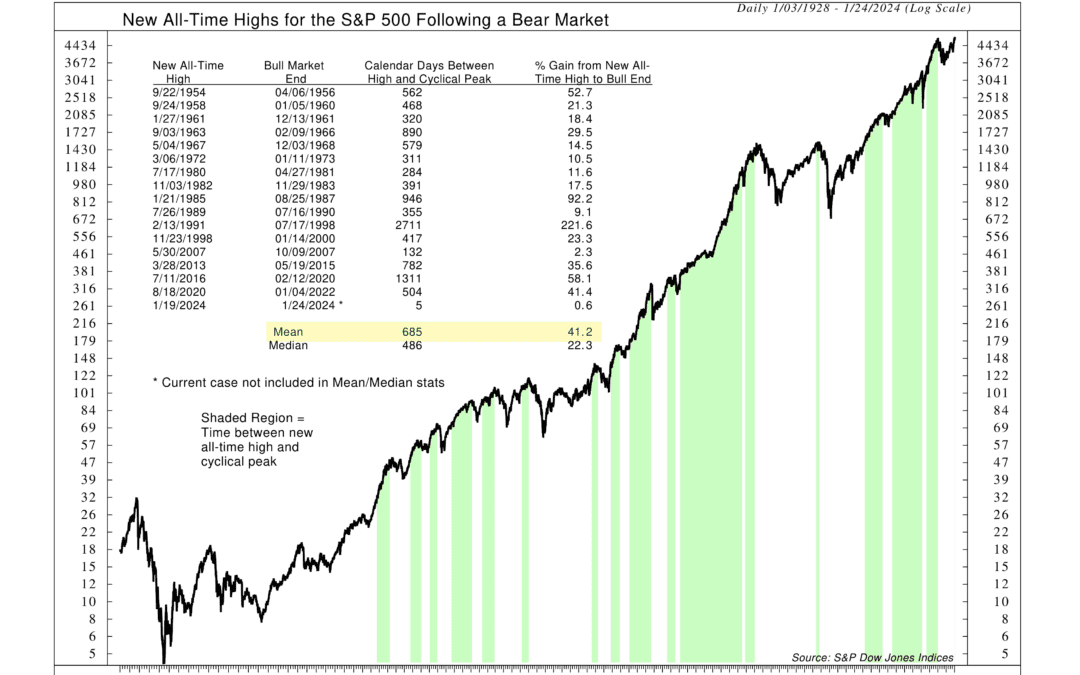

by NelsonCorp Wealth Management | Jan 26, 2024 | Chart of the Week

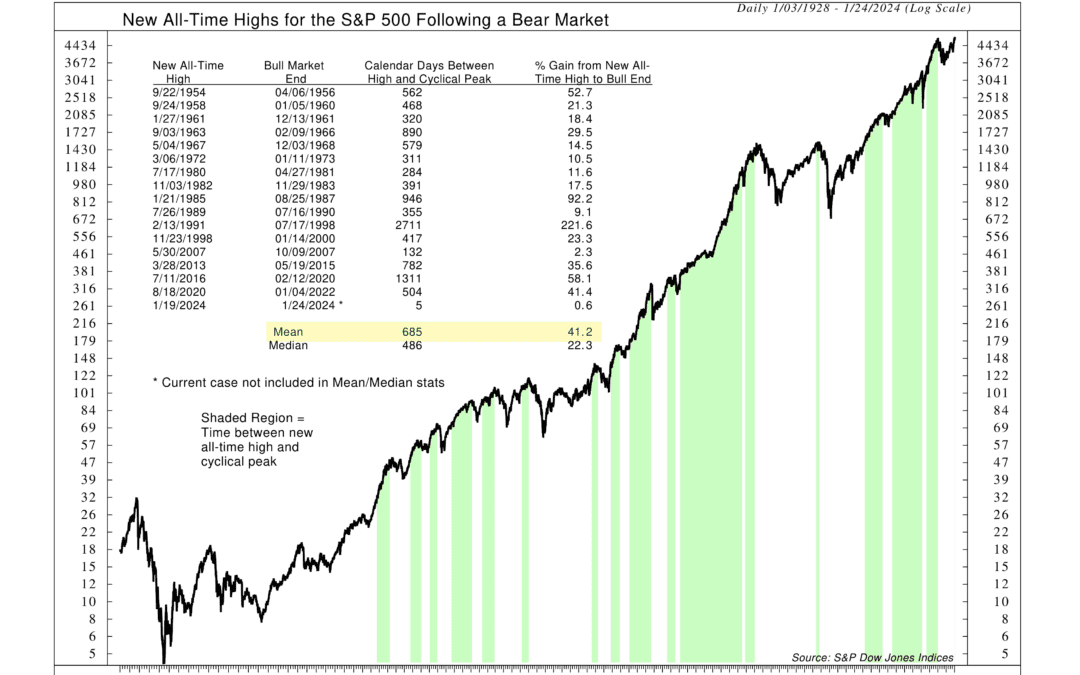

The U.S. stock market has climbed its way back to new all-time highs. But now that we’re at the summit, what does it mean for stocks going forward? If history is any guide, the outlook is likely positive. This week’s featured chart illustrates the S&P 500...