by NelsonCorp Wealth Management | Mar 7, 2024 | Indicator Insights

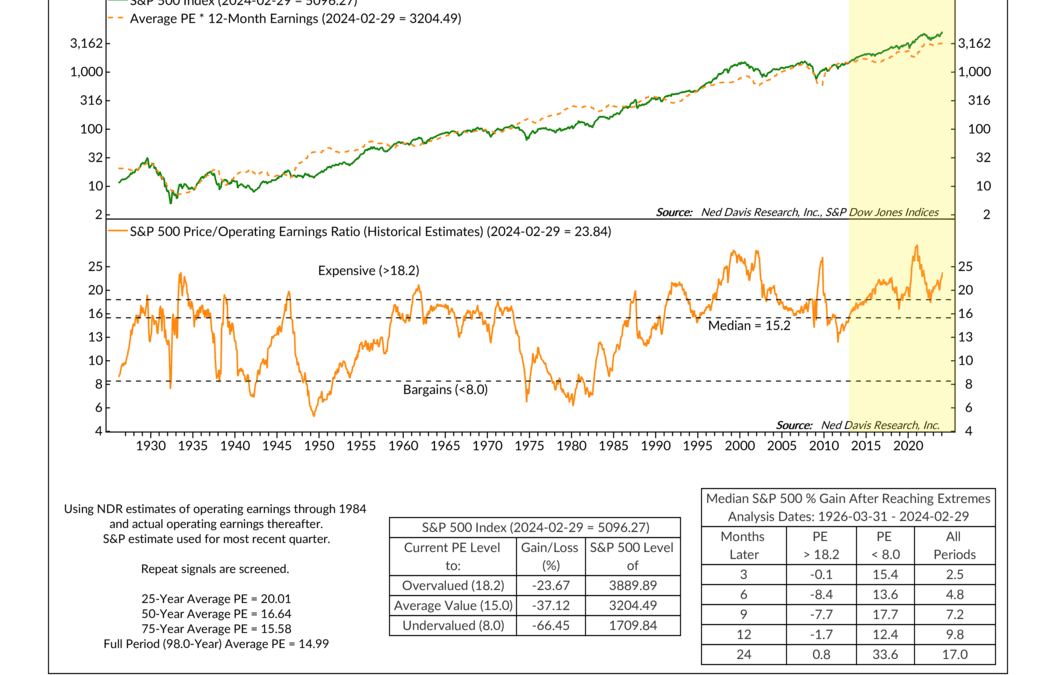

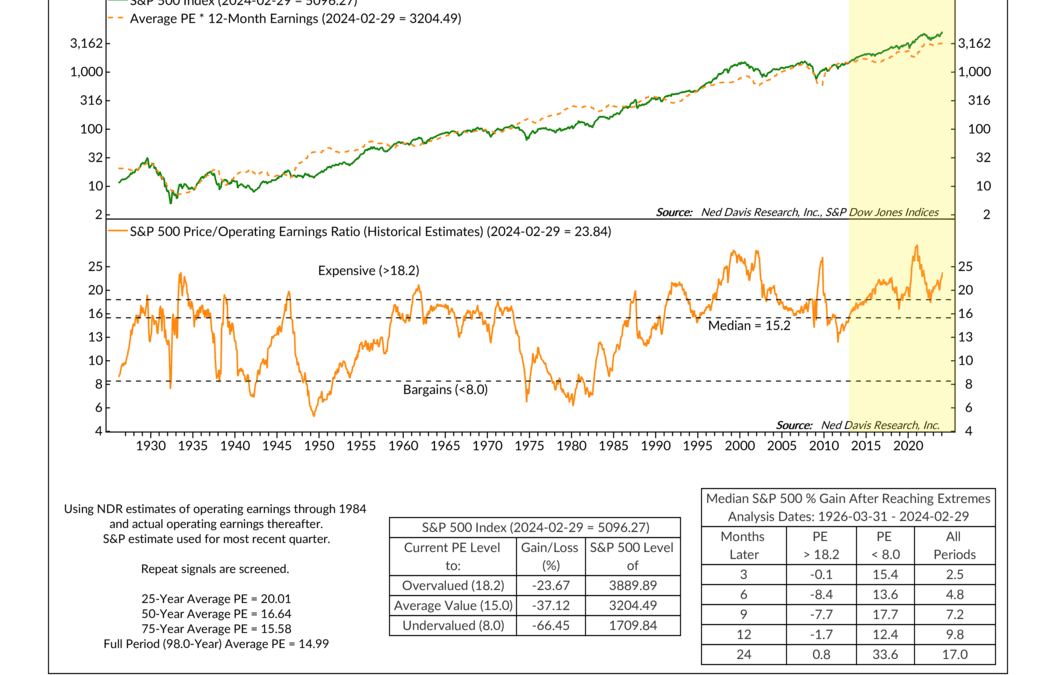

The stock market is rising, and valuations are, too. But what exactly do we mean by valuations? Well, it’s all about a metric called the price-to-earnings ratio (P/E ratio). This ratio measures the price of a stock market index, like the S&P 500...

by NelsonCorp Wealth Management | Feb 29, 2024 | Indicator Insights

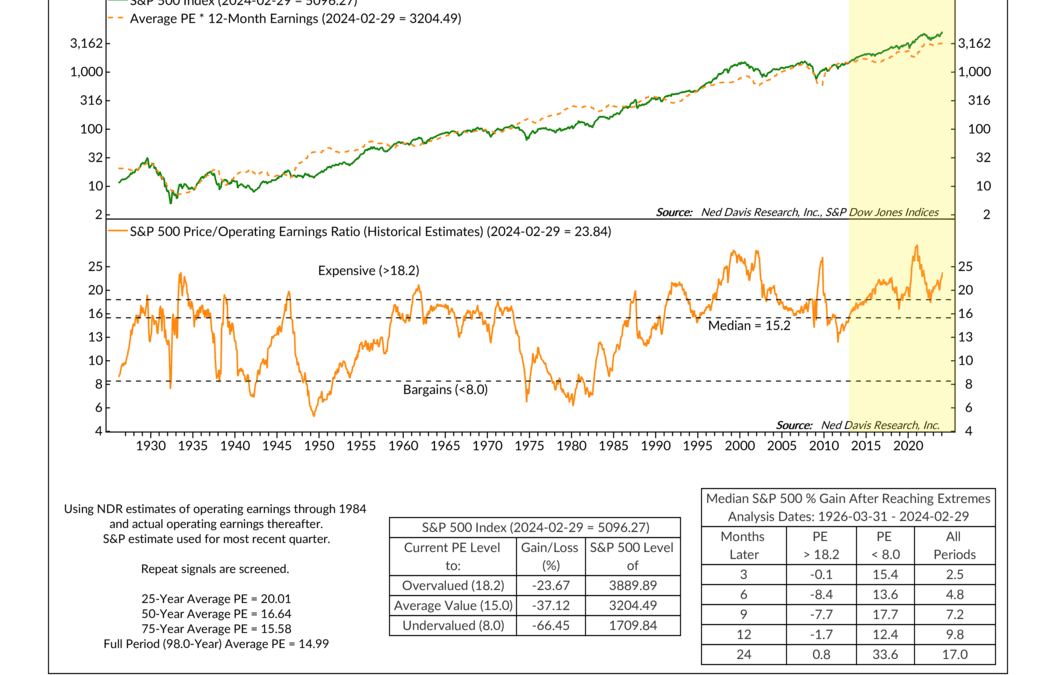

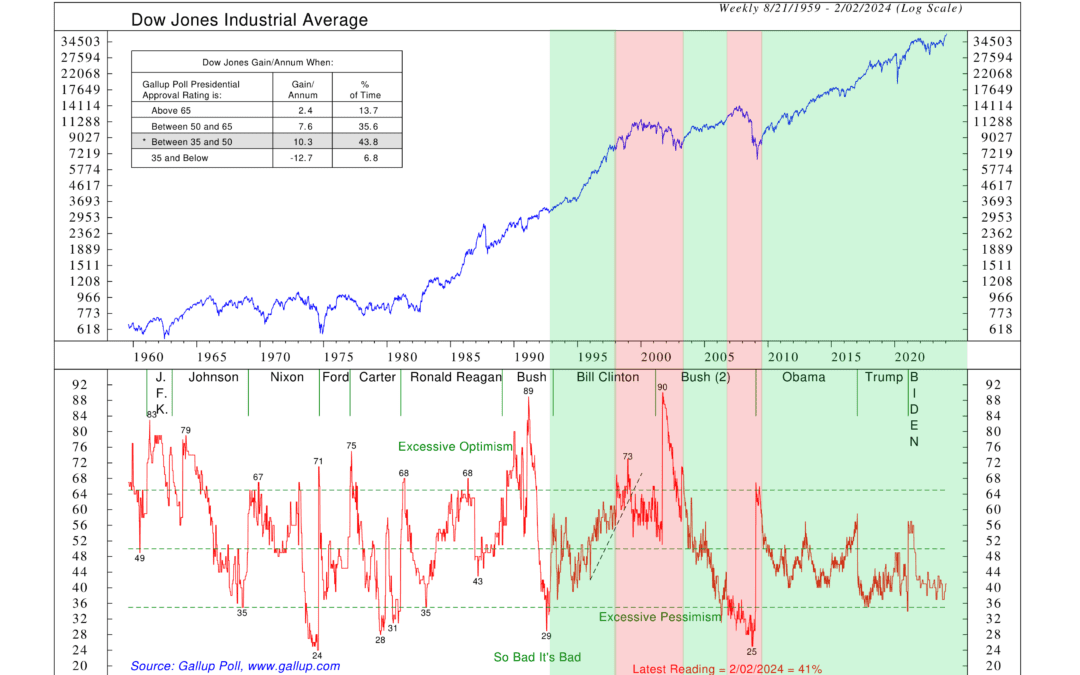

It’s an election year, and naturally, investors are wondering how it might impact their investments. Perhaps surprisingly, we find that the president’s influence on markets isn’t as significant as many believe. However, our data does suggest...

by NelsonCorp Wealth Management | Feb 22, 2024 | Indicator Insights

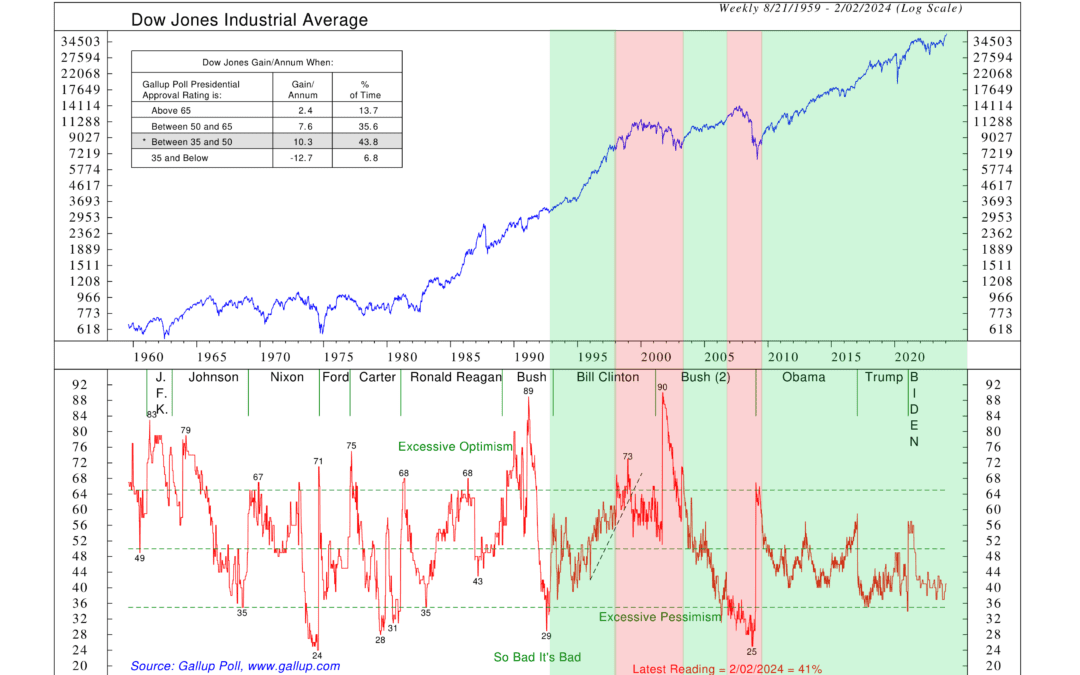

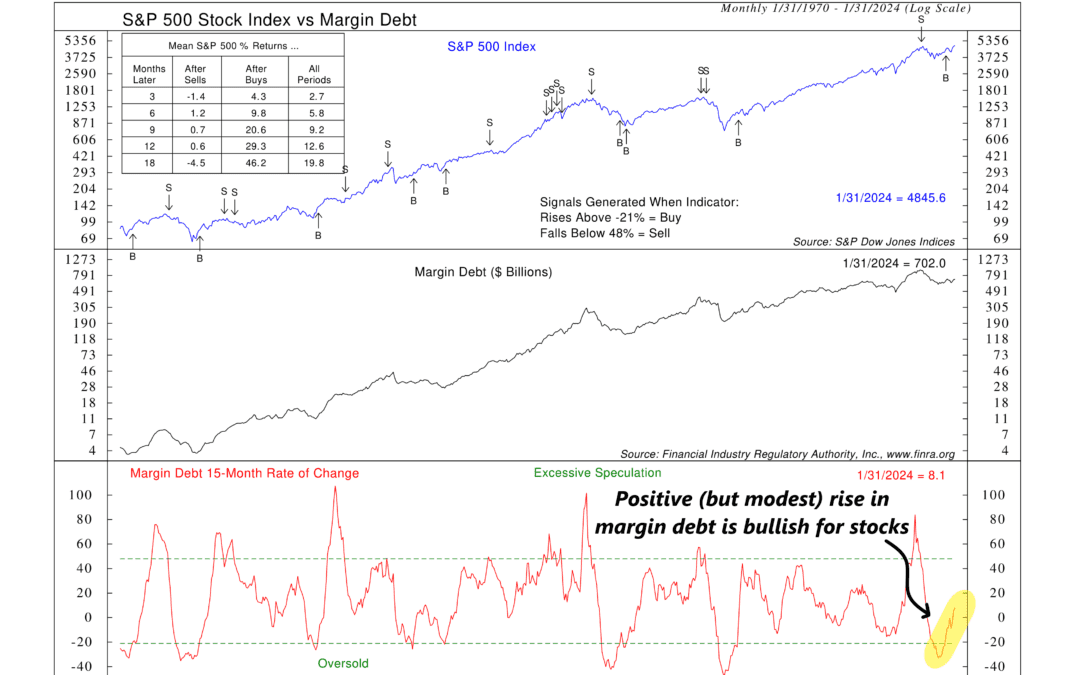

The focus of this week’s indicator is margin debt. What is margin debt? In simple terms, it’s money that an investor borrows to purchase stocks. Think of it like a credit card for the stock market. It allows investors to amplify their returns, but there’s...

by NelsonCorp Wealth Management | Feb 15, 2024 | Indicator Insights

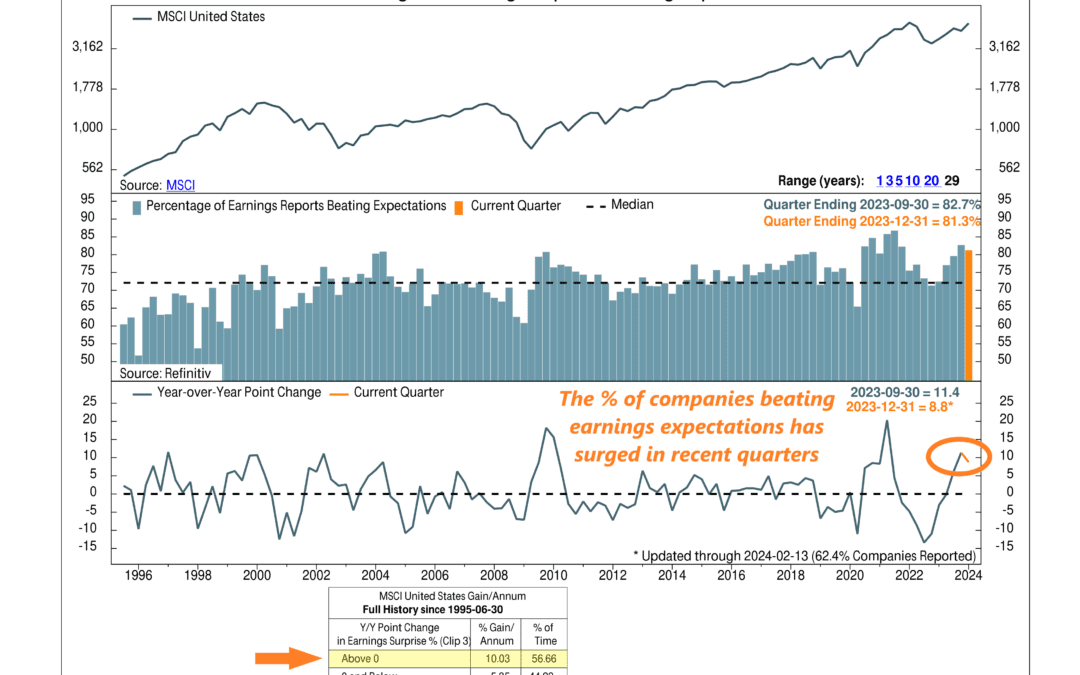

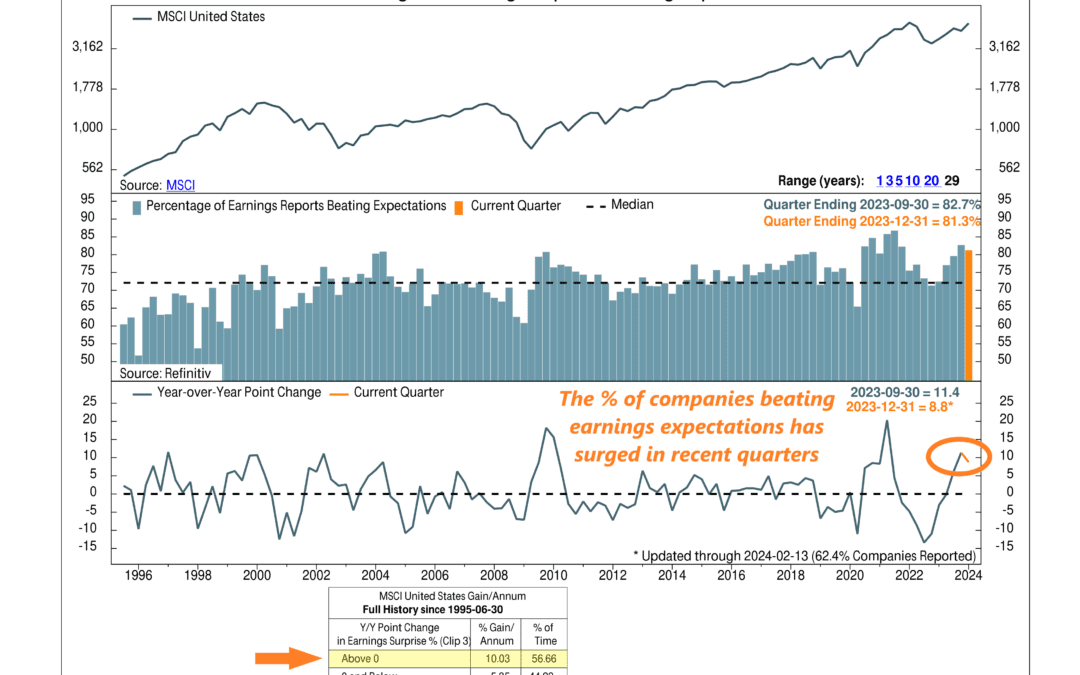

This week’s indicator looks at the percentage of U.S. companies beating earnings expectations—or what is commonly called the “beat rate” on Wall Street. The key insight of the indicator is that when more companies beat earnings expectations in a quarter, it...

by NelsonCorp Wealth Management | Feb 8, 2024 | Indicator Insights

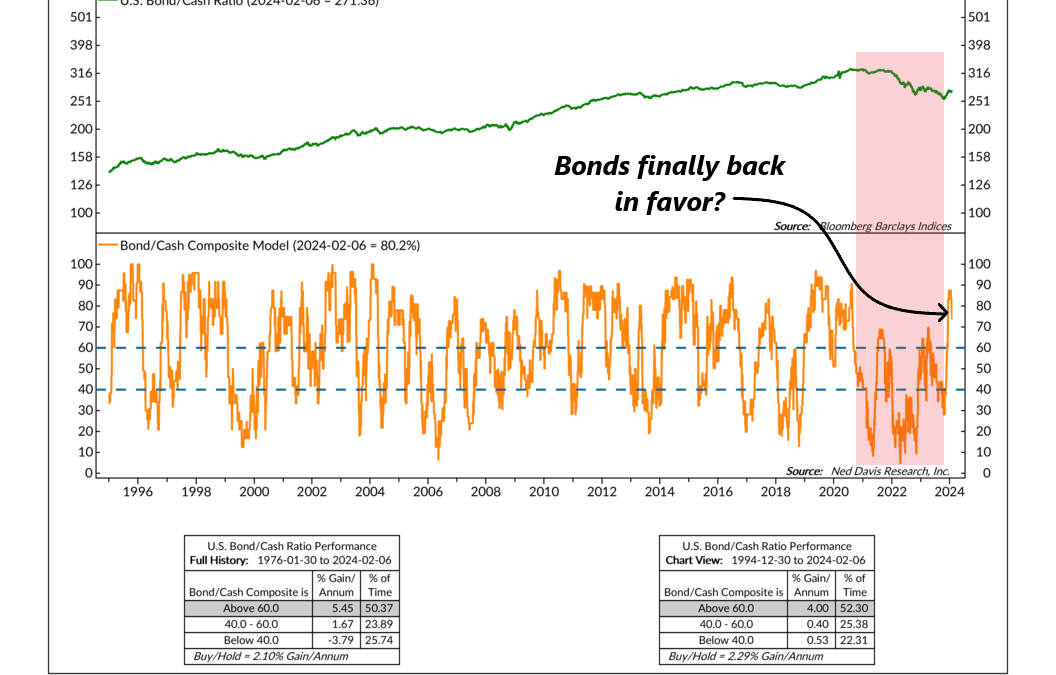

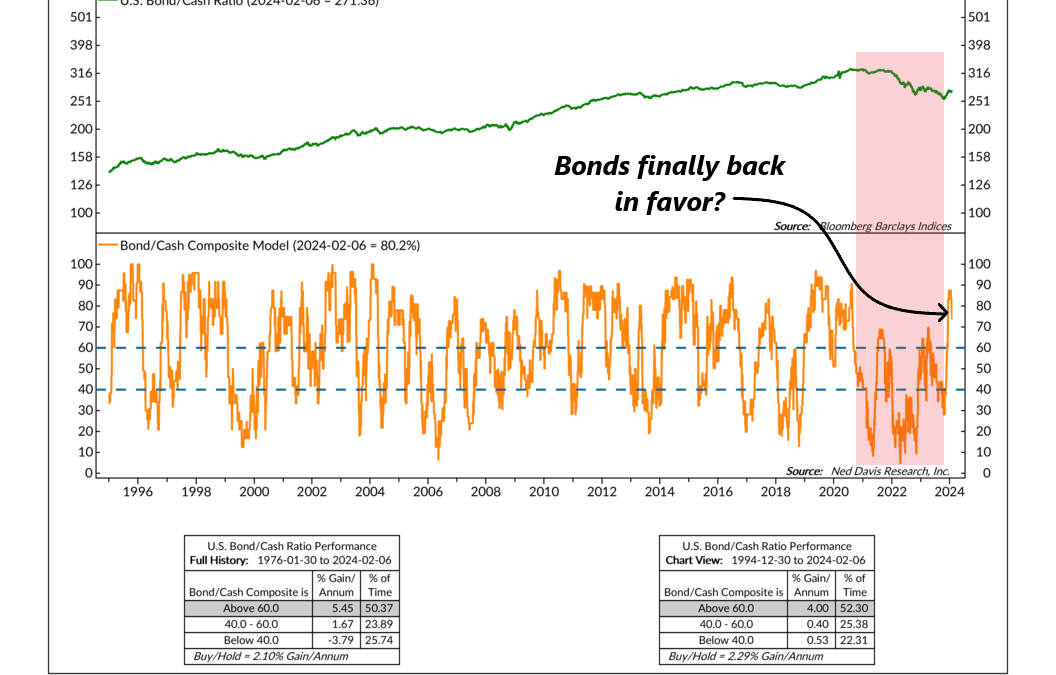

Bonds have had a rough time the past few years. The Fed started raising cash rates in 2021 to tackle inflation, and bond returns suffered severely. But, according to this week’s featured indicator, things are starting to look up for bonds. The indicator is...

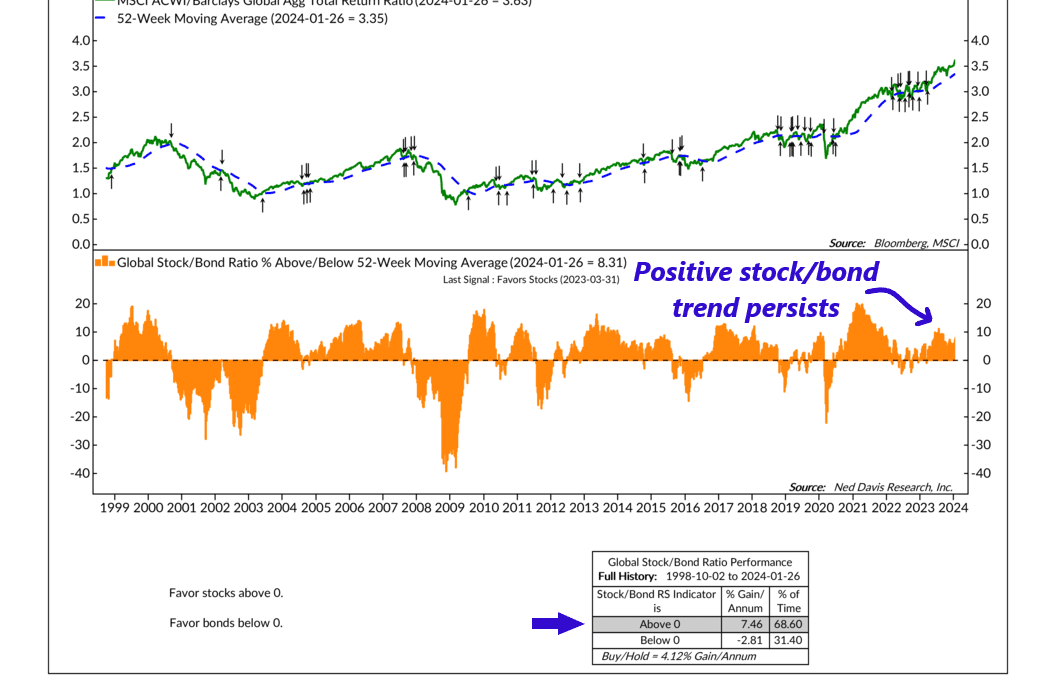

by NelsonCorp Wealth Management | Feb 1, 2024 | Indicator Insights

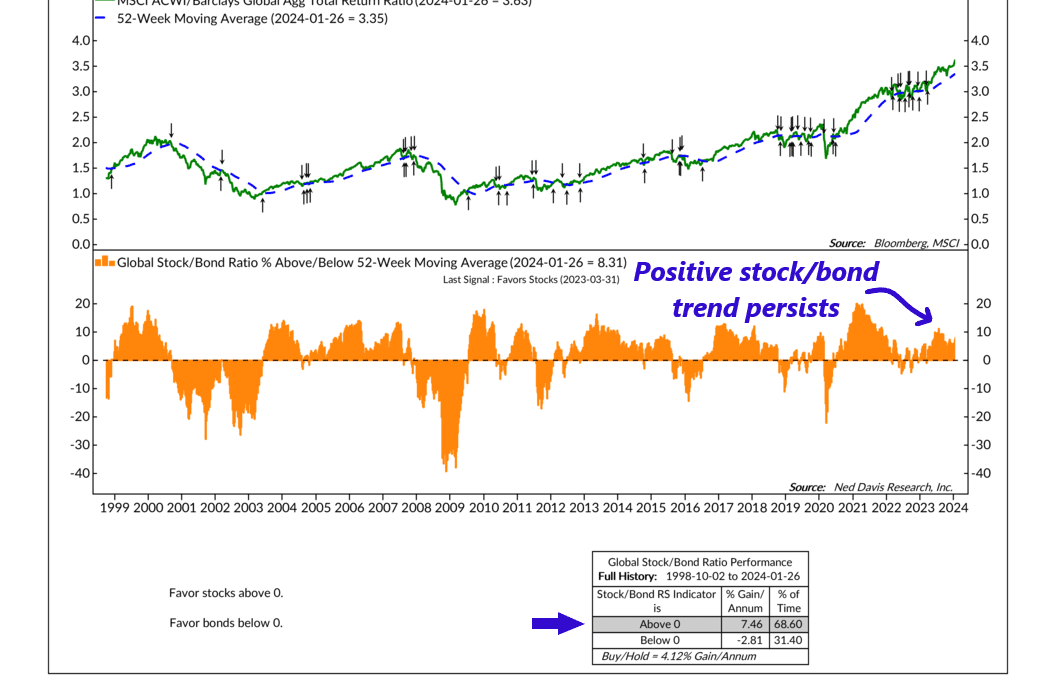

For this week’s indicator, we’re going to look at a technical concept called relative strength. What is relative strength? In simple terms, it measures how well one investment or asset is doing compared to another. It’s typically calculated by dividing...