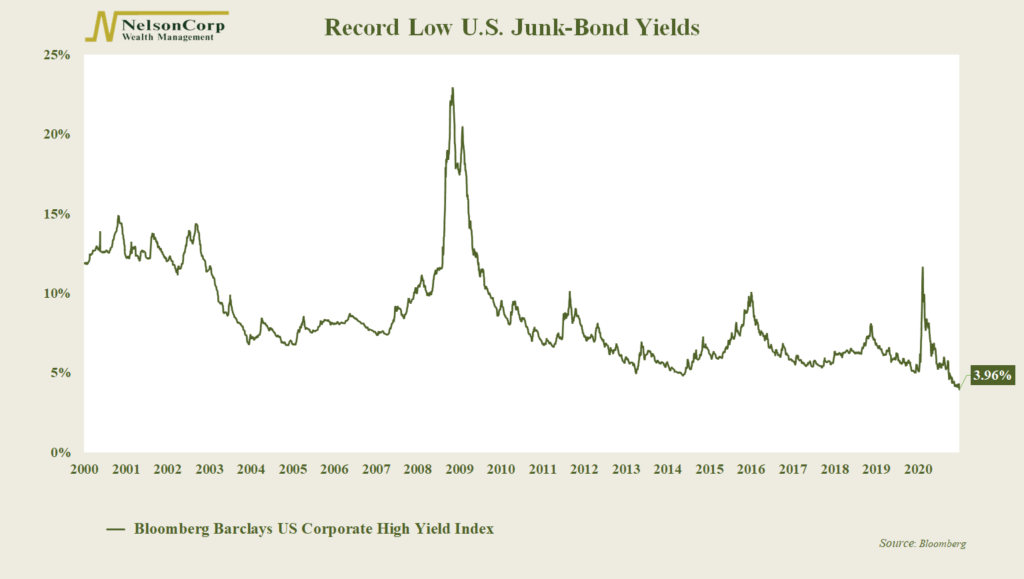

This week we look at the high-yield, or junk, bond market in the United States. This market is where companies with poor credit ratings (below the investment-grade threshold of BBB-) go to borrow money.

With cash deposits near zero, and less-risky bonds offering meager income, investors have piled into junk bonds in a big way lately.

As the chart above shows, the average yield on U.S. junk bonds dipped below 4% for the first time ever this week. This is quite astonishing, as many of these companies can now borrow at rates that governments would have been pleased to obtain just two decades ago.

These lower yields will likely encourage more speculative-grade (a polite term for junk) companies to raise more money. Indeed, January was a record month for junk-bond sales. And so far this year, volume in junk bonds is around $60 billion.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.