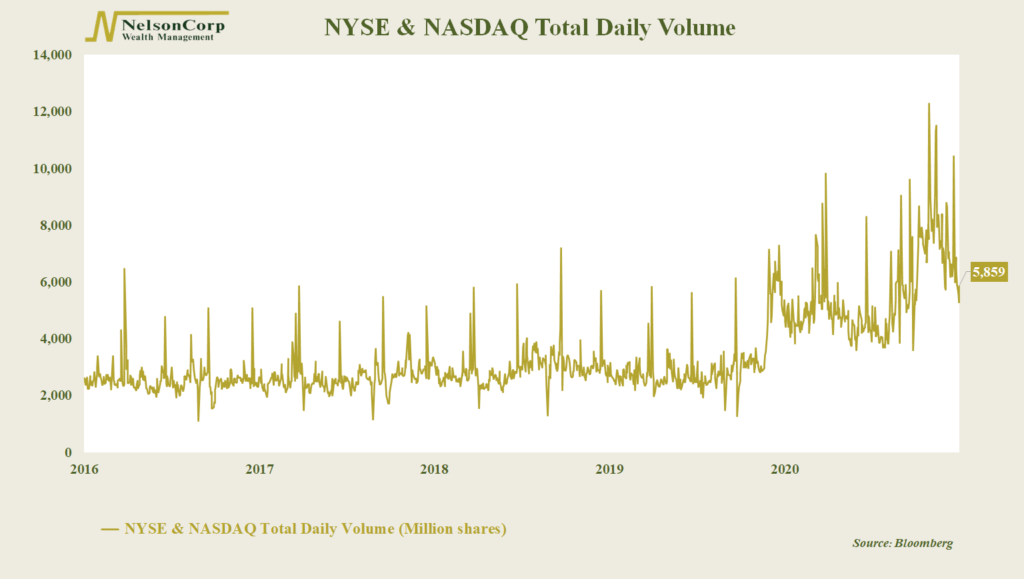

For this week’s Chart of the Week, we look at the daily volume of shares traded on the two major U.S. stock market exchanges: the New York Stock Exchange (NYSE) and the NASDAQ stock exchange. Whenever a share of stock gets bought and sold on one of these exchanges, it gets counted towards the daily volume. The chart above simply adds up these daily volume transactions and plots them as a line over the past five years.

As you can see, from 2016 to the end of February 2020, the average daily volume of shares traded on these two exchanges was about 2.7 billion. On various occasions, volume would spike as high as 6 billion or more, but this was just temporary, and it would quickly fall back to its historical average.

Things changed in March 2020. The pandemic-induced stock market sell-off saw daily trading volumes surge to more than 7 billion a day. Things cooled off a bit as the market started to recover after that. There was an even bigger surge to nearly 10 billion shares traded a day in the summer, then volumes fell from there, and they continued to drop into the Fall.

And then, with daily trading volumes still high relative to their pre-crisis levels, they went into rocket-emoji mode. Daily trading volumes started surging again in November, eventually hitting a peak of more than 12 billion a day in late January of this year.

Since then, however, we’ve seen daily trading volumes cool off quite a bit. At the end of March, daily trading volumes were hovering around 5.8 billion a day—still more than double the pre-crisis average, but far below where they were just a few months ago.

Going forward, it will be interesting to see if daily trading volumes continue to fall and eventually reach more normal levels, or if the combination of an improving economy, more government stimulus, and high levels of household savings will lead to another resurgence in stock market activity.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.