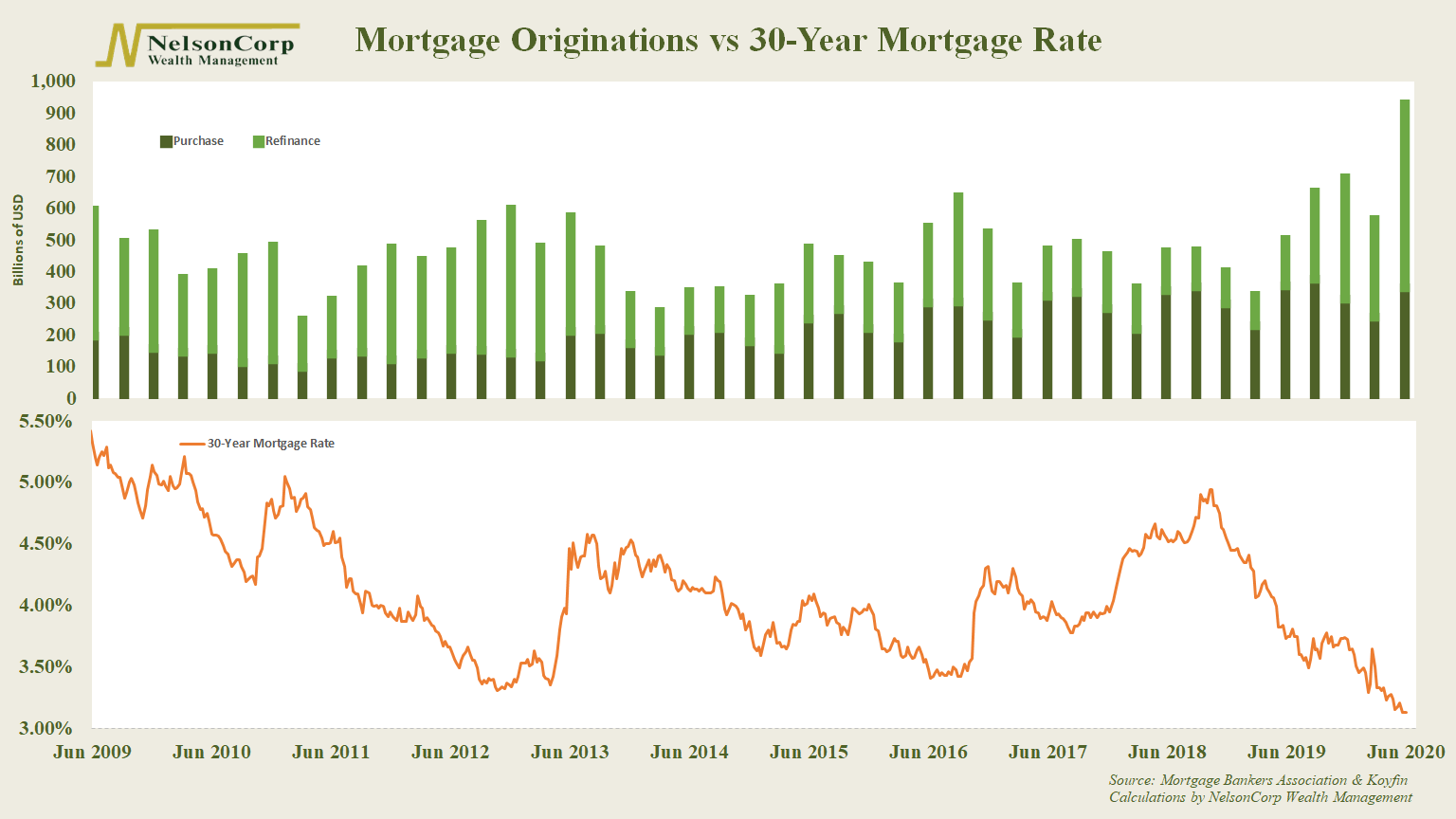

The mortgage market is on a tear in 2020. Despite a stumbling economy, lenders issued roughly $1 trillion in home loans last quarter.

As our chart of the week shows, refinancings are driving this boom. Although new home purchases were down from a year ago, refinances have climbed more than 200%.

Why is this happening?

Interest rates, mainly. The 30-year mortgage rate hit new lows multiple times this year. And at the time of this writing, mortgage rates have crept below 3%.

Whether this is good or bad depends on your perspective. Low rates are good when people want to buy or refinance a home, but those same low rates are also indicative of a sluggish economy.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.