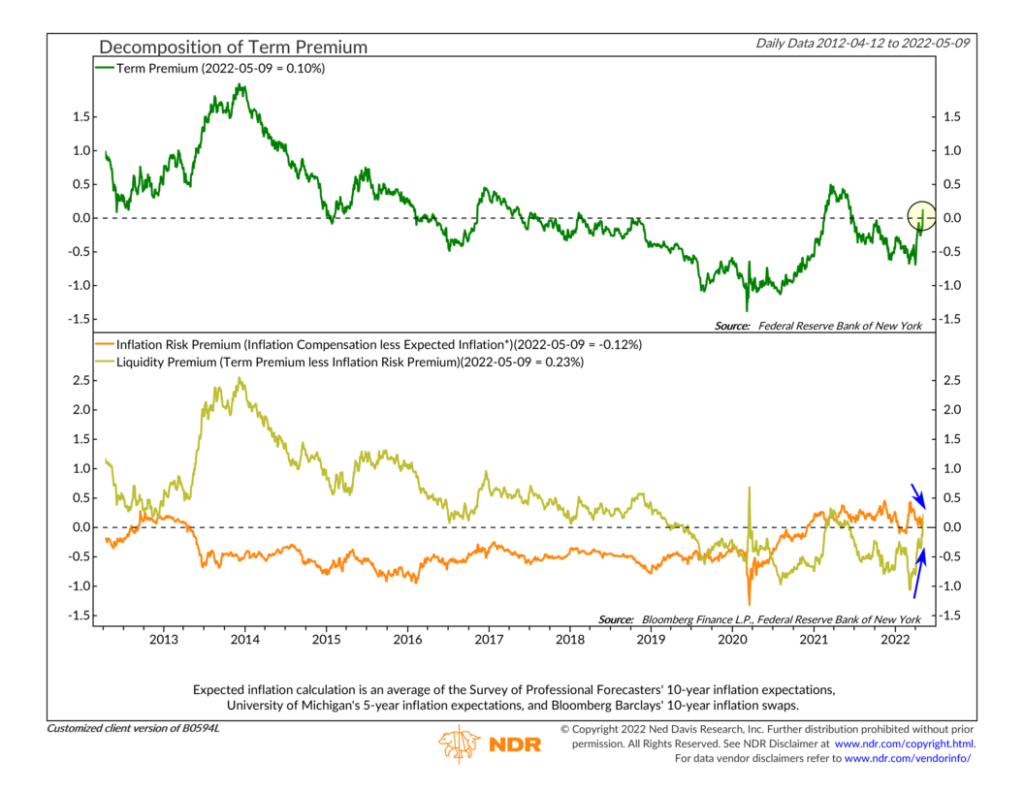

This week’s chart looks at what is called the “term premium” on U.S. government bonds. A term premium is the extra return bond buyers demand to hold a long-term bond instead of a series of short-term bonds. All else equal, term premiums on longer-term bonds will be higher when investors are more risk-averse. So, essentially, term premiums can be thought of as a measure of uncertainty.

As the top half of the chart shows, the term premium on a 10-year U.S. government bond (green line) has once again risen about zero percent. Currently, it’s about 0.10%, compared to its recent low of -0.70% at the beginning of April.

What has driven this recent surge in the term premium? To figure this out, the bottom half of the chart decomposes the term premium into two components: the inflation risk premium and the liquidity premium.

The inflation risk premium (orange line) is the extra compensation bondholders demand for inflation that might come in higher than what is already expected by the market. This measure surged above zero when the pandemic hit in 2020 for the first time since 2013. In recent months, however, it has started to drift lower and is now just a tad below zero.

This leaves us with the liquidity premium (gold line). This is the additional compensation demanded for holding a bond when it cannot be easily converted to cash at fair market value. In other words, it’s a measure of how easily a bond can be sold, and it tends to rise when liquidity dries up, usually in times of market stress. As the chart shows, the liquidity premium has surged in recent months and is currently about 0.23%.

According to the Fed’s May 2022 Financial Stability Report, low liquidity is indeed a problem right now. Low market liquidity, the report stated, likely contributed to large fluctuations in financial asset prices in recent months. More so, metrics that measure market depth suggest notable deterioration in Treasury market liquidity.

What does this mean for investors? Well, all of this is concerning because, as the report warns, further increases in Treasury yields could put further downward pressure on stock market valuations. In other words, we may not be out of the woods yet.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.