Disclosure: Indices mentioned are unmanaged, do not incur fees, and cannot be invested in.

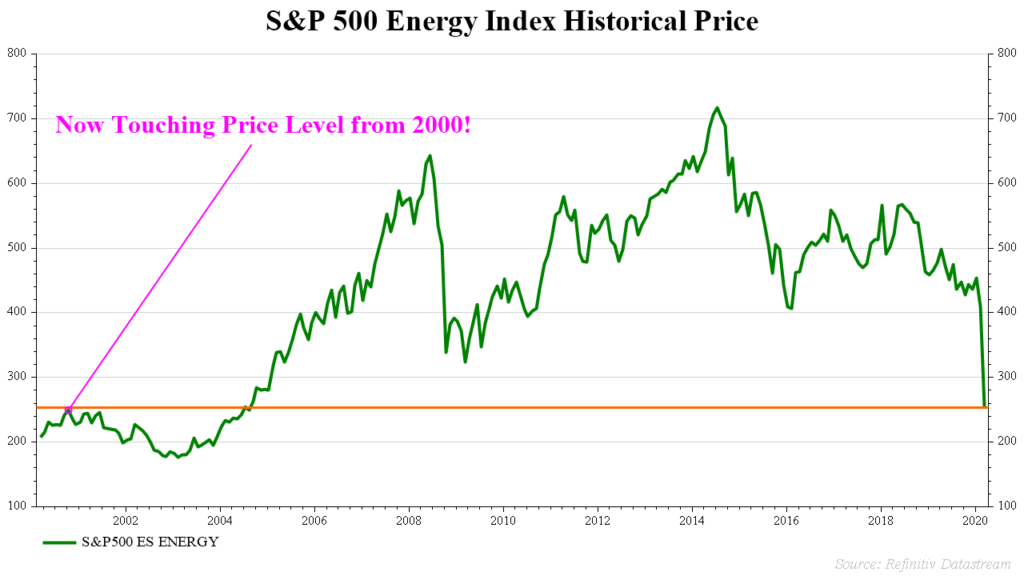

This week the energy sector of the S&P 500 stock index reached price levels last seen 20 years ago.

These are not little companies, but big, blue chip, household names that have fallen, in some cases, 90% from their peaks!

They are a cautionary tale that embodies the expression, “Don’t try to catch a falling knife!”

You can think about a 90% drop like this. At one point, the stock had fallen 50% and you have thought that was a great time to buy.

After buying down 50%, the stock fell another 50% for a total peak-to-trough decline of 75%.

If you liked it down 50%, you love it down 75%, so you double down and buy more.

From there, the stock falls another 60% to land at its total decline of 90%.