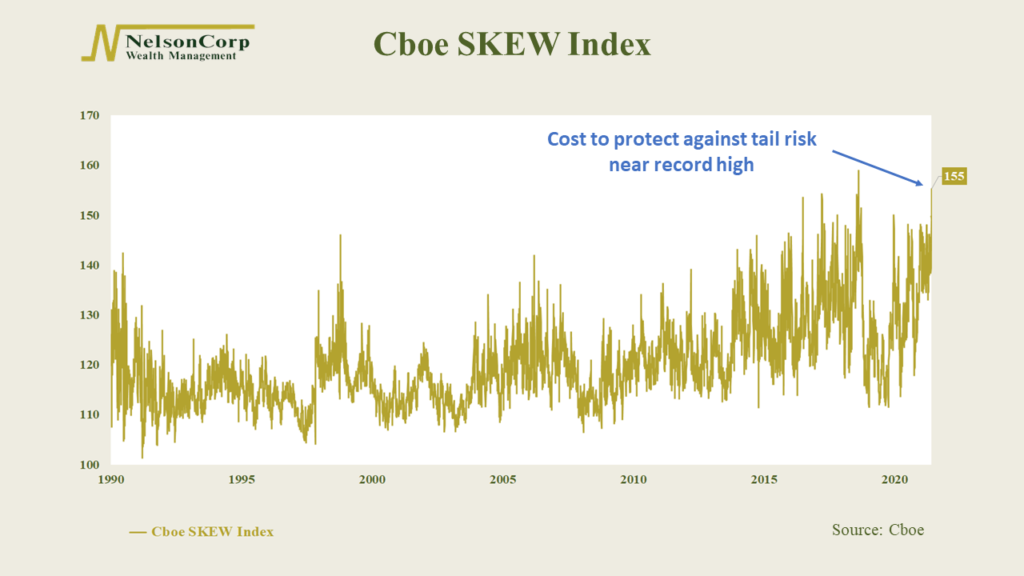

The week’s featured chart shows the Cboe SKEW Index, an option-based indicator that reflects the “cost” of protection against tail risk in the S&P 500 stock index.

Broadly speaking, tail risk refers to an event with a small probability of happening. If you remember the bell curve (or the normal distribution) from your high school statistics class, the tiny areas on the far ends of the curve are called the tails, and they aren’t supposed to occur very often.

But stock returns aren’t normal in the statistical sense. Extreme returns tend to happen more frequently in the stock market than the bell curve predicts—particularly in the left tail, where large negative returns happen more often than you’d think. Because of this, we say stocks have fat tails.

The Cboe SKEW Index attempts to measure the risk of these fat tails by calculating the prices of S&P 500 out-of-the-money options. A high SKEW index means investors are willing to pay a high premium to protect against a large drawdown in equity markets. So by bidding up the prices of these options, it’s a sign that they believe the odds of a significant market decline are relatively high.

Generally, the SKEW index ranges from 100 to 150. But recently, we saw the index hit a near-all-time-high of 155! This is a sign that investors feel nervous about the potential for a big drop in the stock market.

The good news is that, historically, when the index has reached levels this high, the significant drawdown in stocks has failed to happen; the subsequent 3-month return for the S&P 500 was about -0.1%, on average. However, the bad news is that the return was indeed negative, and equities tend to return around 7%, on average, when the SKEW index is at much lower levels than it currently is.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.