Above target inflation and widespread supply and labor shortages are things the U.S. economy hasn’t experienced in quite some time. The good news for workers, however, is that companies have raised wages at an exceptional rate in recent months, hoping to attract more workers.

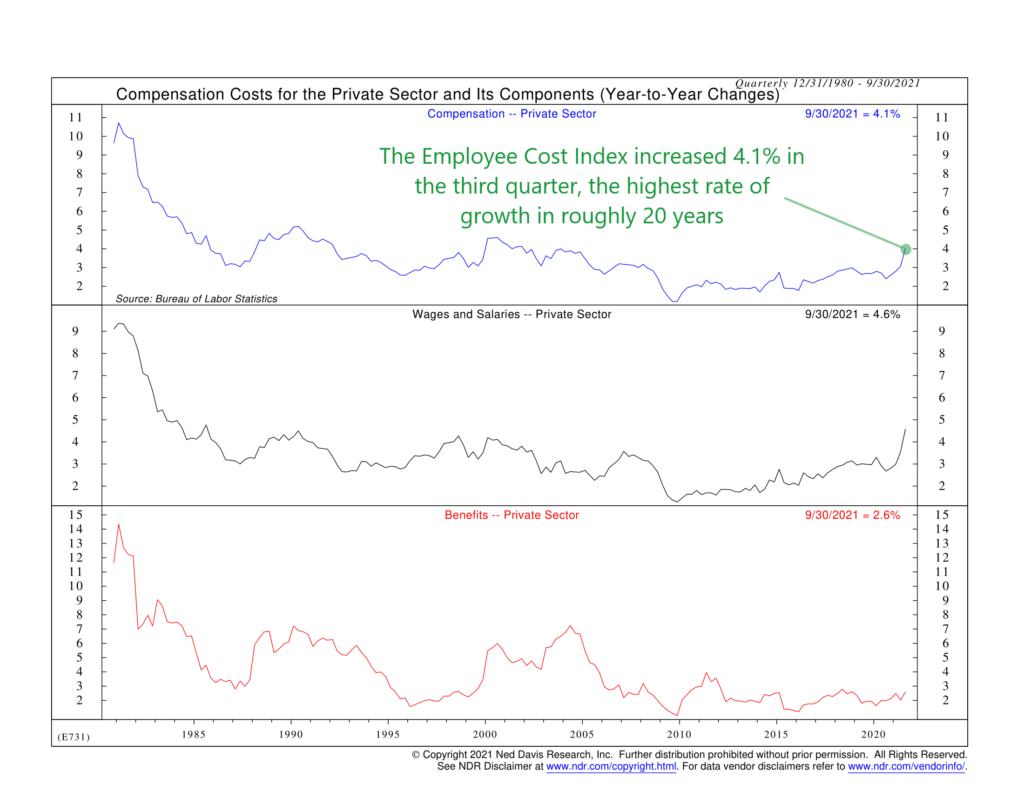

Our featured chart above shows how much the employment cost index—a broad gauge of wages and benefits—has risen on a year-to-year percentage basis in the most recent quarter. Total compensation—shown as the blue line in the top clip—rose 4.1% in the third quarter from a year ago. That was the highest rate of growth in nearly 20 years.

Total compensation can be further broken down into two major categories: wages & salaries and benefits. Wages and salaries—the black line in the middle clip—rose 4.6% last quarter from a year ago. That’s the biggest gain in wages since the 1980s. In contrast, if you look at benefits at the bottom of the chart (red line), you can see that they have been rising at a slower pace of about 2.5%—on par with the average rate for the past 10+ years. So, most of the recent gains have come from higher salaries and wages and less so from better benefits.

For the average worker, getting a raise of more than 4% over the past year is good news. The less-great news, however, is that inflation (not shown here) is rising just as fast—if not faster. So, in real (inflation-adjusted) terms, these raises will have less of an effect on overall purchasing power for the average consumer.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.