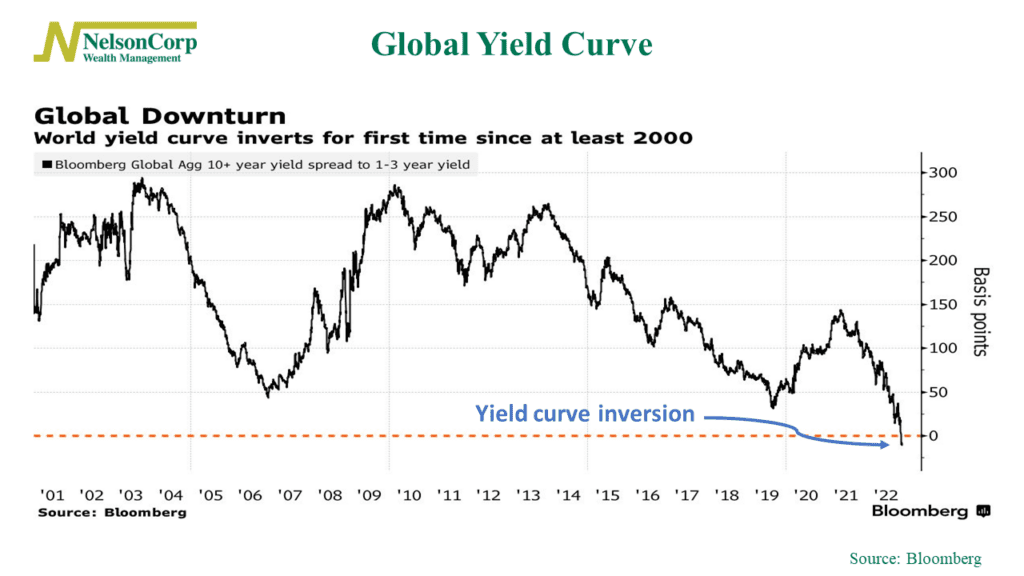

We’ve talked some this year about the U.S. yield curve and how its inversion is signaling that a recession could be right around the corner.

But it’s not just a U.S. problem. Global bonds joined the party this week. The chart above shows that the average yield on sovereign bonds maturing in 10 years has fallen below that of bonds maturing in one-to-three years. This is the first time the worldwide yield curve has inverted in at least two decades.

Why did this happen? Mostly because yield curves tend to invert when investors’ pessimism toward the economy grows. As investors switch their money to longer-term bonds, it drives the prices of those bonds up and their yields down. Plus, policymakers around the world are raising short-term interest to tame rising consumer prices, which also drives the yield curve further into negative territory.

The takeaway? Investors aren’t too excited about the strength of the worldwide economy right now. Some European countries—like Germany—may already be in a recession, and some strategists predict that the U.S. could likely enter one by the middle of next year.

The questions for financial assets are how severe will a potential recession be? How much would it affect corporate earnings? And just how aggressive will the world’s central banks be in raising rates to combat inflation? These are the issues that investors will be grappling with going into next year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.