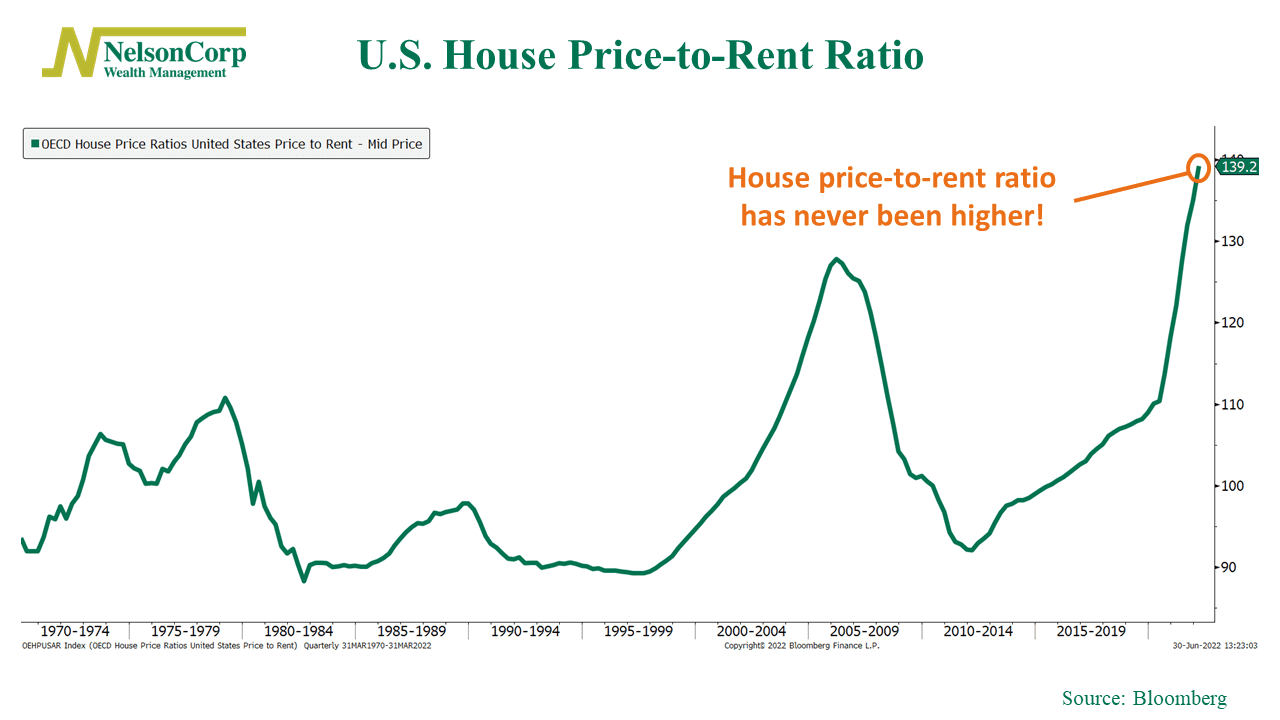

This week’s featured chart shows a reason why we probably won’t see inflation come crashing down any time soon.

The chart, shown above, shows the ratio between home prices and rents. When it’s rising, it means home prices are growing faster than rents; when it is falling, it means rents are rising faster than home prices.

As you can see, it’s up quite a bit. As the kids say nowadays, it’s gone to the moon! The current reading of about 140 puts it at a record high. Compared to pre-pandemic levels, it’s up roughly 30%.

This all means that we should expect rents to rise soon to catch up with home price appreciation levels. This is because, historically, home price appreciation leads to rent inflation by a lag of about 18 months or so.

But this also means we should expect to see continued pressure on Consumer Price Index (CPI) inflation in the coming months as well.

Why? Because rents are not directly calculated in the CPI inflation numbers. Instead, the government uses a number called Owner’s Equivalent Rent (OER). This isn’t a real price number; rather, it’s a survey-based number that the Bureau of Labor Statistics calculates by asking people how much they would rent their home for today. And because people are slow to adjust this number upwards, it tends to lag home price levels as well.

This is significant because the OER makes up the majority of the shelter component of the CPI, and the shelter component makes up roughly 1/3rd of the overall CPI number. Currently, OER is running around 5%, and this is expected to rise in the coming months.

So, bottom line, there’s going to be continued upward pressure on the CPI because rents need to go up to stay in line with overall home price appreciation levels.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.