The Baltic Dry Index. It’s funny; despite having the word “dry” in its name, the Baltic Dry Index involves a lot of water. This is because it measures changes in the cost to ship various raw materials such as coal, iron ore, and grains across the world’s oceans. These are dry cargos—as opposed to wet ones like crude oil—so that’s where the term “dry” comes from.

The best way to think about movements in the BDI is that it goes up and down according to the demand for ships. As demand increases, the price to charter a ship rises.

This is because, in the short run, the number of ships available is fixed. (These are extremely large ships, after all). So, when the global economy is humming along and the need for raw materials increases, the price to rent a ship goes up. This makes the BDI an excellent leading indicator of economic activity because changes in the index reflect supply and demand for a lot of important raw materials used to make things.

The BDI is relevant today because of all the supply chain issues afflicting the world economy.

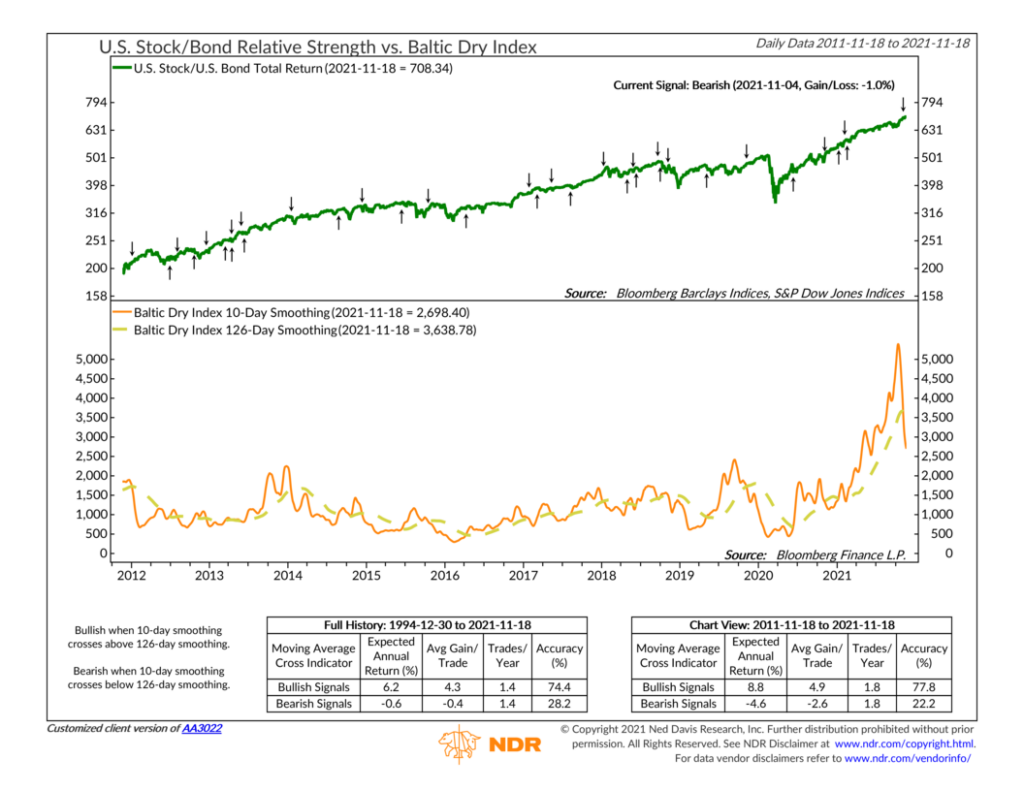

We’ve heard about the problem all year: demand is up, but supply can’t keep pace. And indeed, as the chart above shows, the 10-day average of the BDI skyrocketed this year to an unusually high level. The good news is that this has been positive for the stock market, as stock prices tend to increase when the global market is healthy and growing.

However, as the chart also reveals, the 10-day average of the BDI peaked in early October and has fallen all the way down to below its 126-day average level. This is a sign that shipping rates are finally coming down to more normal levels and might even be a sign that global growth is stalling out.

As the performance boxes at the bottom of the chart imply, this has historically been an unfavorable environment for stocks (relative to bonds), so that’s something to keep in mind for the future.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.