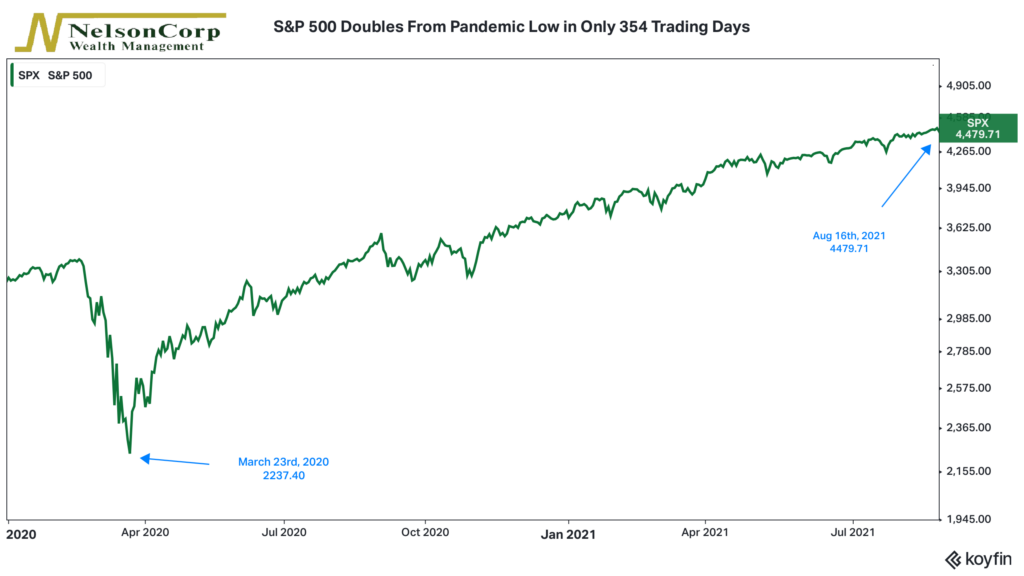

Well, that was fast. On Monday, the S&P 500 stock index officially doubled in price from the pandemic low it touched on March 23, 2020. It took stocks only 354 trading days to get there, making it the fastest bull market doubling from a bottom in the post-WWII era.

A 100% gain in such a short amount of time is pretty astonishing. On average, it usually takes a bull market more like 1,000 trading days to reach that milestone.

Of course, the dates have been cherry-picked here to show returns from the very bottom of the sell-off. Stocks are up 100% only if you compare them to the level they reached after falling roughly 34%.

But still, if you’re an investor, this is welcome news, as it means your stock investments recovered a lot quicker this time around compared to past bear markets—something that is very important if you’re a retiree taking periodic withdrawals from your account.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.