It used to be taught in finance class that nominal interest rates can’t go lower than zero, at least theoretically, because people can always just hold cash.

However, in recent history, several economies around the world have seen the rates on their government debt do just that—go negative!

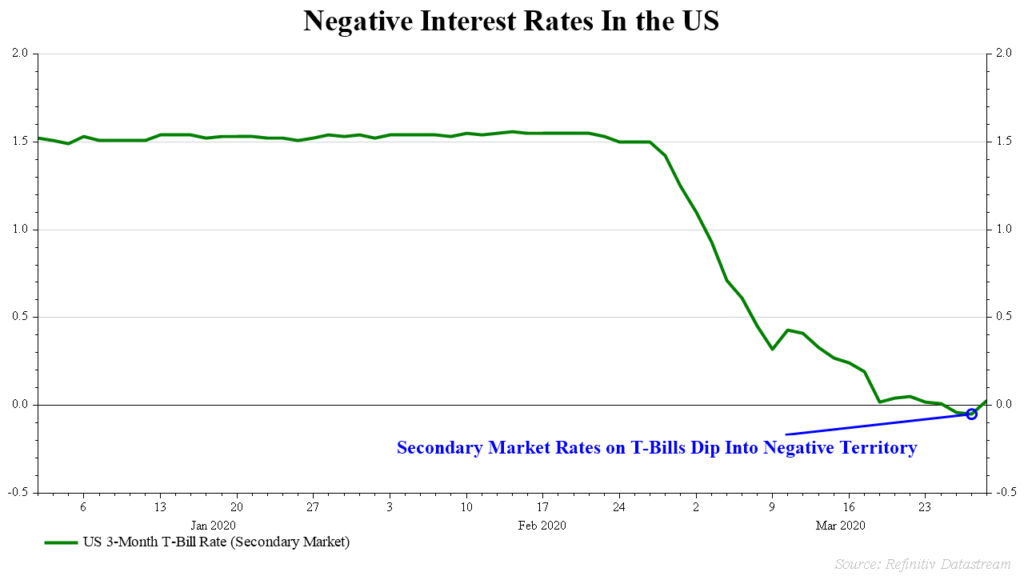

And it has now happened in the United States. The above chart shows the 3-month U.S. Treasury Bill rate. Last week, this rate fell into negative territory. The 1-month Treasury Bill rate also went negative.

Imagine that; you’d have to pay the government in order to lend them money in this type of environment.

Of course, when inflation is accounted for, negative real interest rates are nothing new. But we aren’t really hardwired to think in inflation-adjusted terms.

Ben Bernanke, the former Chairman of the Federal Reserve, has pointed out that we are experiencing a global savings glut. In other words, there is a lot of cash being saved out there.

In times of stress, when demand for safety is high and expected inflation is low or even negative, investors are willing to pay for security. Or maybe they are seeking to profit if rates go even more negative. Whatever the case, negative interest rates have become a reality.