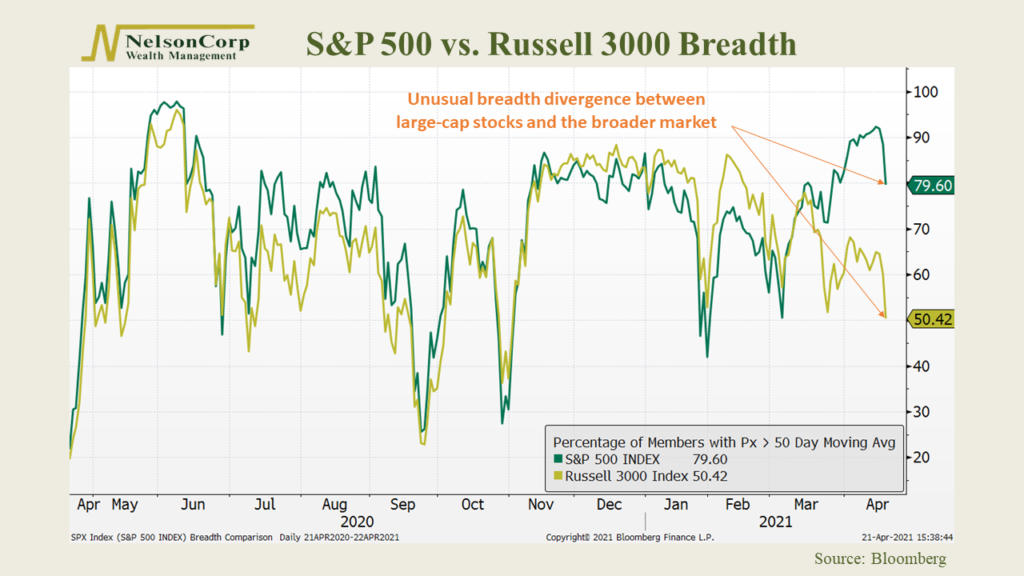

This week’s featured chart looks at stock market breadth in the United States. Specifically, we focus on two major U.S stock indices. You may already be familiar with the first, the S&P 500, representing the 500 largest stocks by market capitalization in the U.S. The other is the Russell 3000, a commonly used benchmark for the entire U.S. stock market.

The breadth for each index is determined by calculating the percentage of the stocks in the index currently trading above their 50-day moving averages—the higher the number, the better the breadth. Said differently, if more of the stocks within the index are rallying in price, it means the breadth of the index is strong.

As the chart above shows, the breadth of these two stock indices has moved in lockstep together in the past. When the breadth of the S&P 500 (large-cap stocks) has been high, so has the Russell 3000’s (the broad market).

This year, however, things have changed. After a small but meaningful divergence in favor of the broad market’s breadth versus large-caps earlier this year, we are now seeing large-cap breadth outpace that of the overall market. As of this writing, about 80% of the stocks in the S&P 500 are considered to be in uptrends, versus just 50% in the Russell 3000.

This chart is a good reminder that even if a market-cap weighted index is rising in price, it doesn’t necessarily mean the majority of stocks within the index are participating. Because it’s weighted by market cap, a few very large stocks can push the index higher all by themselves.

Right now, we see a lot more participation within the large-cap-focused S&P 500 index, and a lesser amount if you include all the stocks in the Russell 3000. Another reason to always know what you own.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.