This week, the Commerce Department announced that real GDP fell at a seasonally adjusted annual rate of 0.9% in the second quarter. This followed a 1.6% decline in the first quarter. Taken together, that’s two consecutive quarters of declining real GDP, which is the technical definition of a recession.

However, it won’t be an official recession until the Dating Committee of the National Bureau of Economic Research says so, and they look at many more economic indicators than just GDP—many of which aren’t in recession territory now.

So maybe we aren’t in a recession? Perhaps this is just a mild slowdown or a “growth recession?”

But, for argument’s sake, let’s say we are in a recession. What does that mean for the stock market going forward?

That’s where the potential good news comes in. The stock market is a forward-looking indicator, unlike many economic gauges—like GDP—which are lagging indicators. This means that by the time an official recession is declared, it is likely that the stock market has already bottomed and is on an upswing.

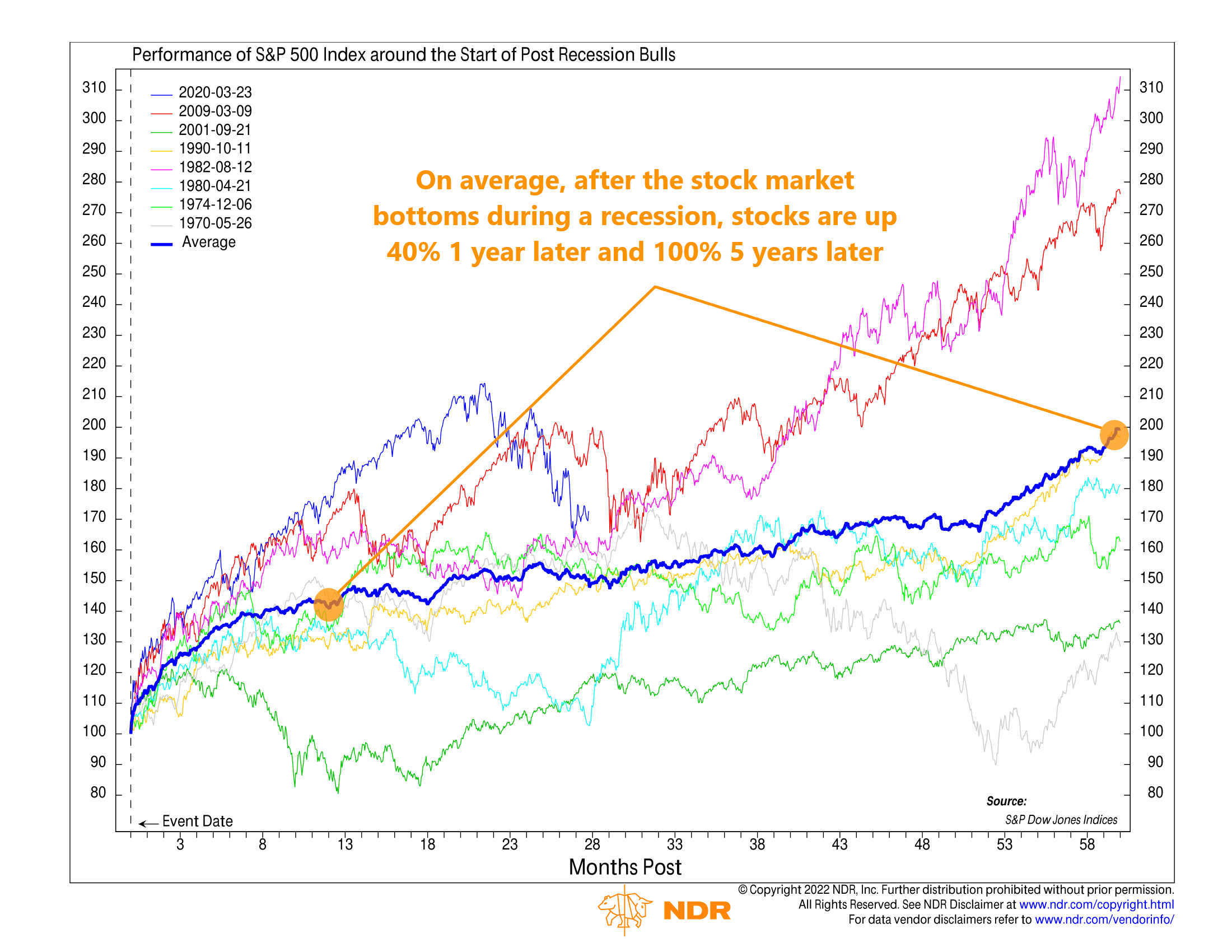

We illustrate this dynamic in our chart above, which shows the stock market’s performance after the start of economic recessions. Each colored line represents a different period in history when the stock market bottomed during a recession. And the bold blue line shows the average of all those post-recession stock market rallies.

It’s that bold blue line—representing the average—that we want to focus on here. As you can see, the stock market has gone up 40%, on average, in the year after it bottoms during a recession. And looking five years out, the market is up roughly 100% or double after a bottom.

So, the key takeaway is that even though we know that recessionary periods are bad for stocks, the silver lining is that stocks are already down quite a bit. And since the stock market tends to bottom well before an official recession is declared, we want to be on the lookout for signs that the stock market is bottoming—because historically, returns can be pretty substantial in the months and years after a stock market bottoms during a recession.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.