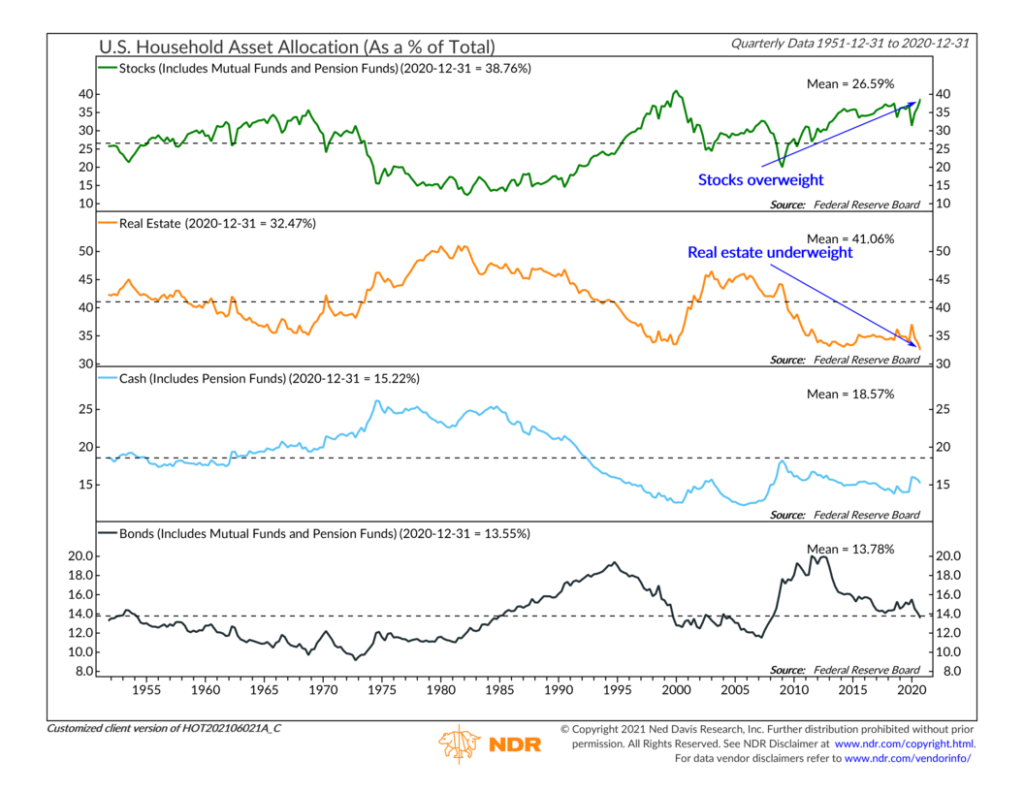

This week’s featured chart looks at how American households are slicing up their economic pie or total wealth. Using data from the Federal Reserve, we break down the overall wealth of American households into four major categories: stocks, real estate, cash, and bonds. The chart above shows how much (as a percentage of the total) households have allocated to each asset class over time and the mean or historical average for each.

A couple of things stand out. For one, compared to the average since 1950, stocks are the only asset class in which households are “overweight” (meaning above the long-term average). The current allocation to stocks is nearly 39% versus the historical average of about 27%. This is just below the peak of 41% reached during the dot-com boom in 2000, which is concerning in and of itself.

Bonds are right in line with their historical average, and cash is just slightly below average. So, the other surprising thing that stands out is that most of the increase to stocks came at the expense of real estate, which is now at a historically low level. In the past, households have had most of their wealth tied up in the equity in their homes, with an average allocation of about 41%. But now, they have only about 32% allocated to real estate. Not only is that low compared to the historical average, but it’s also oddly low relative to the stock allocation. The only other time households had more of their wealth locked up in stocks than in their homes was, once again, at the peak of the dot-com boom in 2000.

Now, this type of chart shouldn’t be viewed as a short-term timing tool. It’s more useful for looking at trends at a very high level, allowing one to monitor risk on a long-term time frame. If you believe that these excesses are bound to revert to their long-run averages, then this chart could play an important role in making long-term asset allocation decisions.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.