We’ve recently talked about this idea of participation—or lack thereof—in the stock market. One way to measure participation is to look at a stock index and calculate what percentage of the individual stocks are performing well. When this number is high, we say participation is good and vice versa.

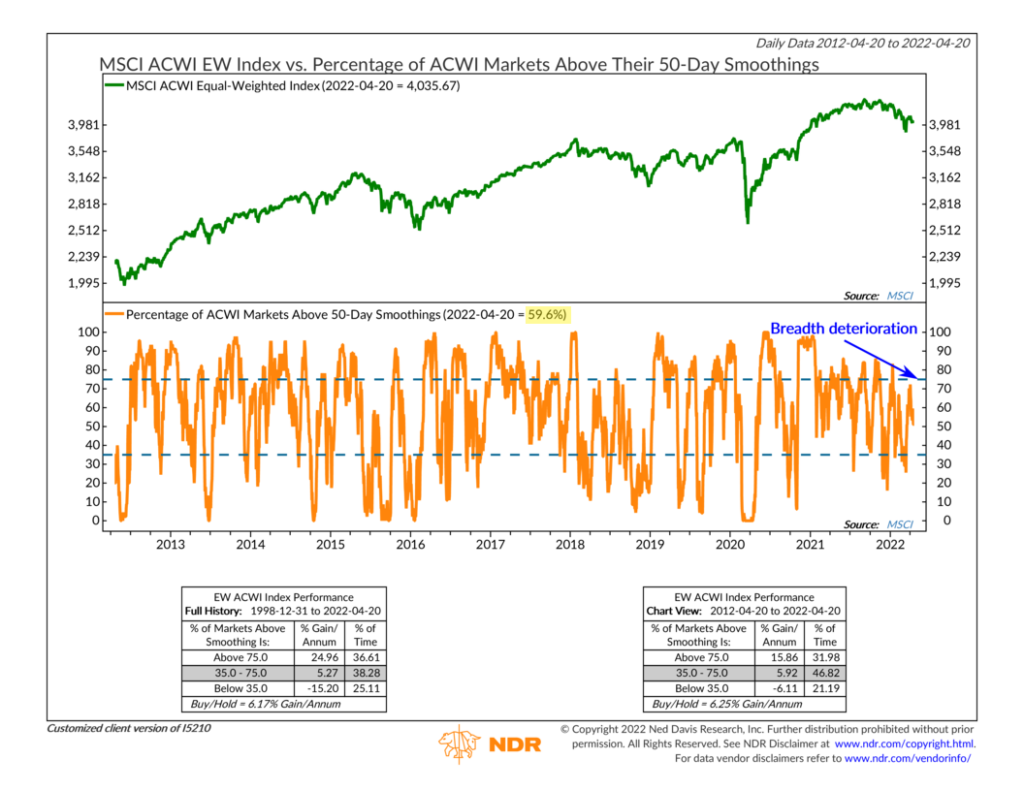

As an example, our indicator on the chart above uses an equal-weighted version of the MSCI All-Country World Index to calculate global stock market participation. This index is made up of many different stock market indexes from around the world, so it’s a good proxy for global stock returns.

The orange line on the bottom clip of the chart represents the percentage of those global stock markets trading above their average 50-day price level. Fifty days is about 2-3 months of trading, so if a market index is trading above that level, it’s a sign that it’s at least in a short-term uptrend.

If a high percentage (at least 75%) of those markets in the overall index are in short-term uptrends, then it’s a positive signal for global stock prices. But, if that number drops to below 35%, it produces a negative signal.

Historically, the MSCI ACWI Index has had double-digit returns when this indicator has been above 75% (the upper dashed line). And when participation has fallen below 35% (the lower dashed line), returns have actually been negative. Between 35% and 75%, returns have been neutral, in line with the buy-and-hold average of roughly 6%.

Looking at recent history, we can see that this indicator is currently hovering around the 50%-60% participation level, smack dab in the middle of the neutral zone. A year ago, breadth or participation based on this indicator was consistently over 90%.

This recent breadth deterioration is weighing heavily on global stock prices. And with fewer global stock markets in short-term uptrends, it will be harder for the overall index to generate returns much higher than the historical average.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.