The Citigroup U.S. Economic Surprise Index is the focus of our featured indicator this week. The index—compiled by the investment bank Citigroup—tracks how economic data are coming in relative to forecasts based on Bloomberg surveys. Specifically, it evaluates the degree to which data from the past three months are beating or missing expectations. In other words, it measures surprises (hence the name). When the index is above zero, data are broadly exceeding expectations, and vice versa.

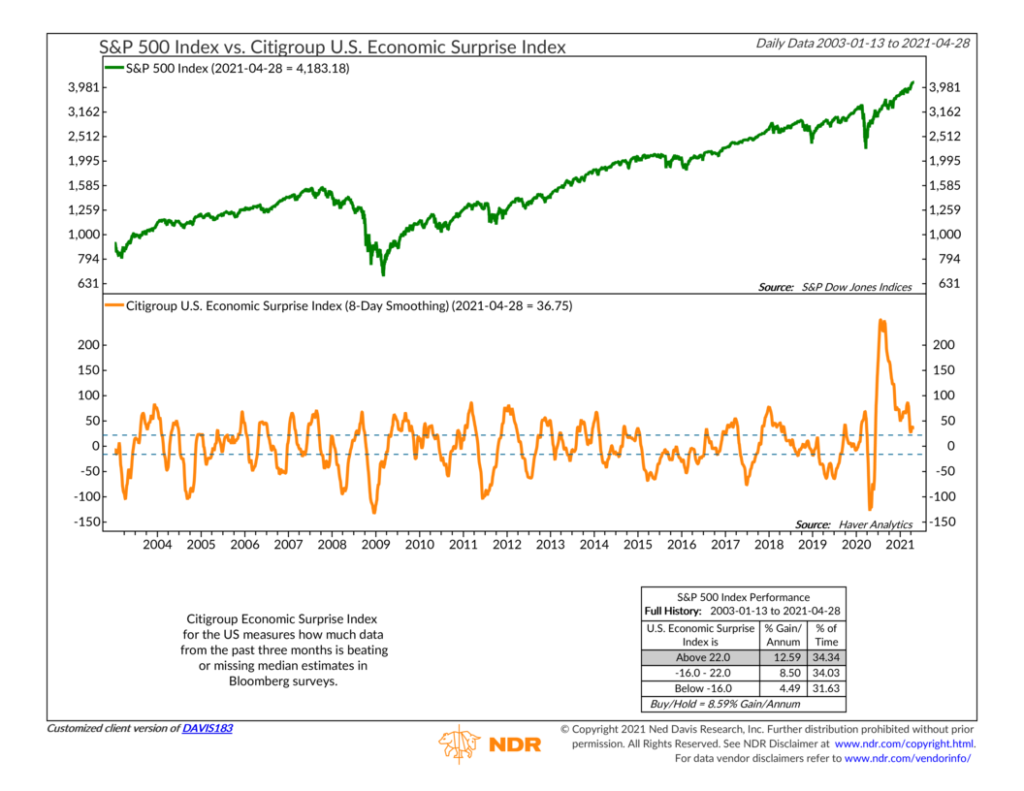

Our chart above plots the Economic Surprise Index (averaged over eight days to smooth out short-term variations) as the orange line in the bottom clip. The green line on top represents the S&P 500 index, a standard benchmark for the U.S. stock market. Historically, the S&P 500 has performed best when the Economic Surprise Index has reversed from a bottom, climbed above the lower bracket, and then rose above the upper bracket. Returns while in the top zone have been roughly 12.6% per year, on average—well above the historical buy-and-hold average of 8.6%.

This is indeed what we’ve experienced recently. When the pandemic struck last year, analysts drastically cut their expectations for the U.S. economy. But due to the unusual nature of the self-imposed economic shutdown—and after the unprecedented fiscal and monetary response—the economic data started flowing in much better than expected. In fact, the surprises have been so strong that the Economic Surprise Index has been above zero for more than ten months now. Stocks have benefited greatly from this unprecedently persistent string of better-than-expected economic news.

Alexander Pope wrote, “Blessed is the man who expects nothing, for he shall never be disappointed.” This probably explains most of that colossal surge in the Economic Surprise Index last year, as expectations for the economy dropped to essentially zero. However, the fact that the index remains in the top bullish zone today reflects the level of uncertainty that remains in the marketplace, and just how surprising this economic recovery has and continues to be.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.