Most of the major companies in the U.S.—particularly the ones in the manufacturing business—employ people called purchasing managers. These managers are vital to a company’s success because it’s their job to predict and purchase the types and amounts of raw materials the company needs to produce a finished product.

So, it follows that because of their proximity to the real-time economic performance of their companies, a purchasing manager’s opinion about the state of business is valuable information to have.

For this reason, the Institute of Supply Management (ISM) produces two reports every month—one for manufacturing and the other for services—and compiles the responses to questions asked of purchasing managers in hundreds of U.S. companies. The replies are formed into something called a diffusion index, which simply measures the proportion of replies that are either positive or negative. A reading above 50 for both the manufacturing and services report can be interpreted as stronger economic growth prospects. In contrast, a reading below 50 can be seen as a slowdown or contraction in economic expectations.

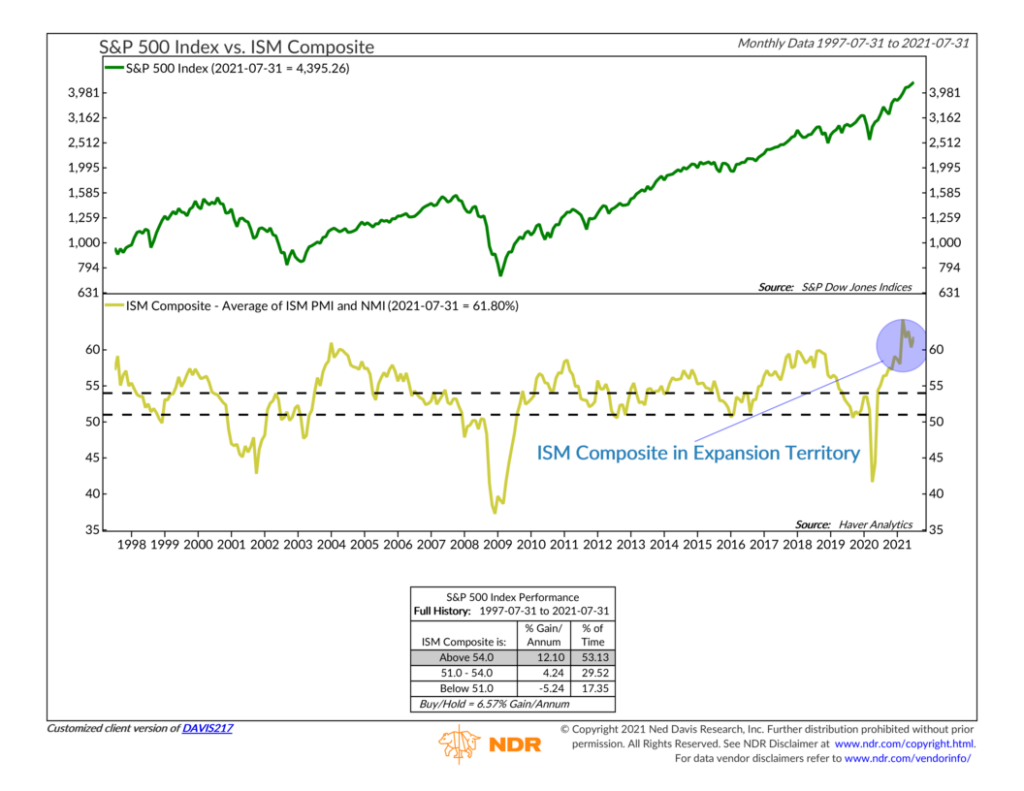

Our indicator above simply takes the two ISM reports—manufacturing and services—and averages them together to get the ISM Composite (gold line). Historically, when this composite has been greater than a reading of 54, the S&P 500 stock index (green line) has performed strongly—returning about 12% per year, on average. However, when the composite’s reading has fallen below 51, stocks have typically lost money on an annualized basis.

Since June 2020, the ISM Composite has been above the upper dashed line, indicating expansion in the manufacturing and services sectors of the economy. Sure enough, stocks have done exceptionally well during this same period—further entrenching the idea that listening to what purchasing managers are saying can potentially give an investor a slight edge in managing their stock market exposure risk.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.