This week’s indicator focuses on the National Financial Conditions Index (NFCI) produced by the Chicago Federal Reserve. There are several “financial conditions” indexes out there, but the NFCI version includes a number of financial indicators (over 100) covering a broad array of financial markets going back to 1973. It gets updated weekly, so the NFCI provides a timely view of U.S. financial conditions based on money markets, debt and equity markets, and the traditional and “shadow” banking systems. For this reason, it’s sometimes referred to as a real-time monitor of financial stability.

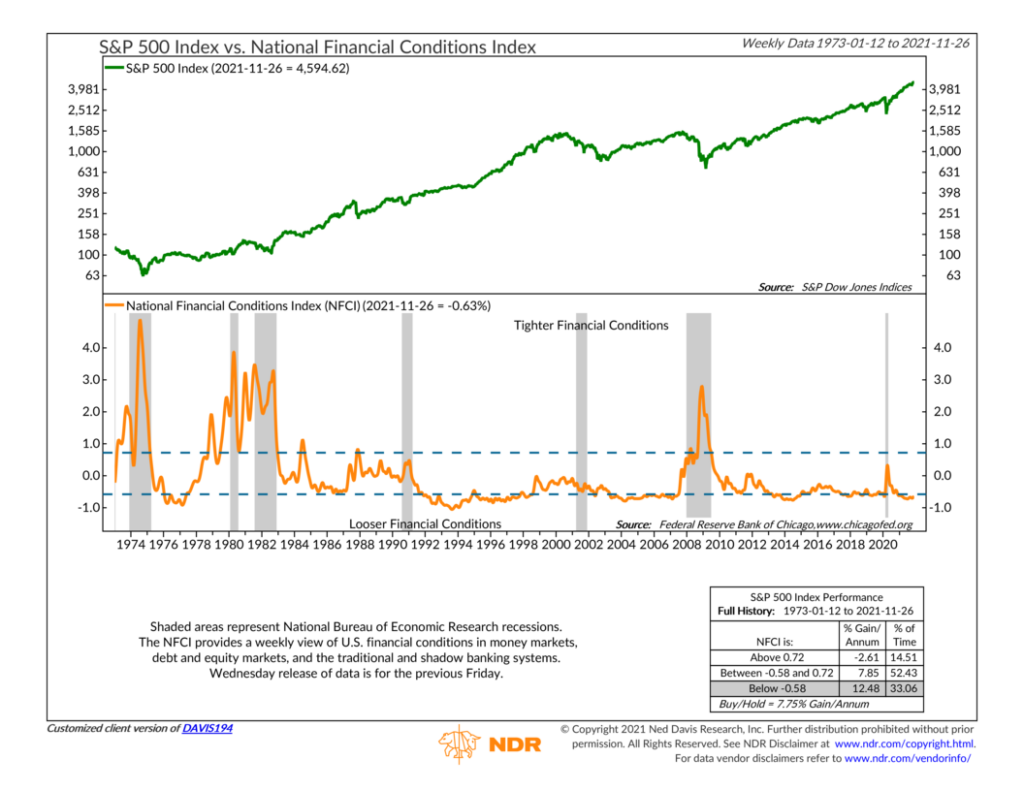

So how do we interpret it? Well, the NFCI is constructed to have an average value of zero, so whenever it is positive or well above zero, that tends to be a sign of stress in financial markets. More specifically, we’ve found that readings above 0.72 have been associated with tighter financial conditions, which have historically been a drag on the stock market. However, we’ve also found that when the index is below -0.58, it’s been a sign of looser financial conditions; historically, stocks have gone on to outperform in this type of environment.

What mostly stands out when looking at the history of the NFCI on the chart above is just how loose or easy financial conditions have been over the past 30 years or so compared to prior history. Of course, we had a huge spike during the Financial Crisis in 2008 and then another notable jump in March 2020. But the Fed has acted in a determined way to keep rates and financial conditions loose for the most part, which has helped boost the broader stock market.

Overall, though, this indicator is useful because it taps into that old adage about bankers in general: they give you an umbrella when the sun is shining but take it away once it starts to rain. In other words, when the economy is growing and things look cheery, bankers make loans more freely. But when the cloud of a recession looms, bankers tighten their belts and make fewer loans. This makes the National Financial Conditions Index something worth paying attention to as investors.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.