This week, I want to focus on what is called a “credit spread” indicator.

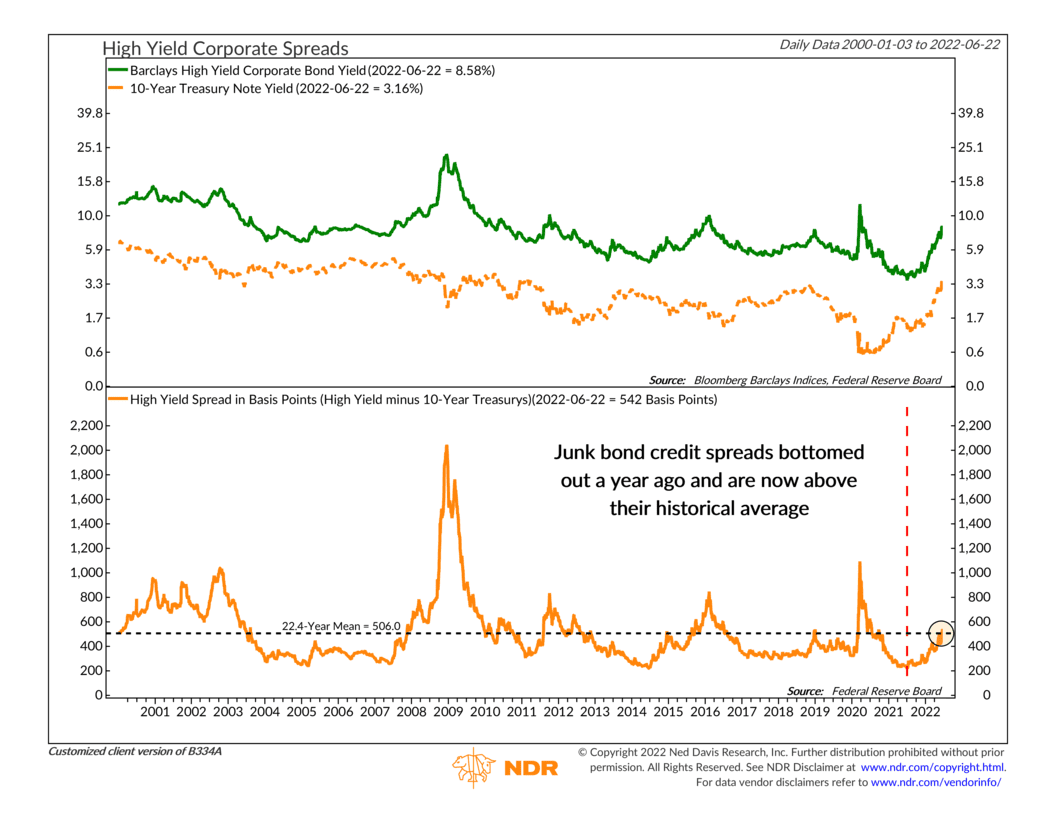

We highlighted the specific indicator above about a year ago. It measures high-yield (junk bond) credit spreads. In particular, it evaluates the distance between a safe asset—in this case, a U.S. Treasury note, shown as the orange dashed line on the top clip—and a riskier asset like a lower-quality corporate bond with the same maturity (green line, top clip).

A year ago, the spread or difference between junk bonds and Treasury notes (orange line, bottom clip) was around 230 basis points (2.3 percentage points). That was a historically low spread, and as we warned at the time of that writing, it didn’t leave much room for error for the market going forward.

Why? Because historically, stock returns tend to suffer the most when credit spreads are low and rising. This happens because investors sell off the bonds with the most credit risk when the economic outlook starts to sour—and then stocks tend to follow suit shortly after. With credit spreads so low, investors were underestimating the risk in the market—and risks are always lurking.

Indeed, credit spreads have widened since our writing a year ago. They’ve gone from a low of roughly 230 basis points to approximately 540 basis points. This is just north of the historical average of roughly 500 basis points. It appears investors have woken up.

We have found, however, that the best stock returns occur after this credit spread indicator peaks and comes down, especially after it’s climbed above the 500-basis point average.

The bond market tends to lead the stock market, so we’ll be looking for clues from indicators such as this to help telegraph where stocks are headed next.

Now that junk bond credit spreads are above their historical average, we’ll look for a peak in the spread. Once the spread trades lower than where it was a month ago, it will trigger a buy signal for the stock market.

Until that occurs, though, we should expect negative to neutral price action from the overall stock market.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.