OVERVIEW

The S&P 500 index closed out the last week of the year at new all-time highs, rising about 1.4% for the week. The Dow Jones Industrial Average followed close behind, climbing 1.35% for the week. And the Nasdaq Composite brought up the rear, gaining 0.65%.

Internationally, developed country stocks gained around 1% for the week, while emerging market stocks rose nearly 3%.

Bond prices rose across the board, as the yield on the 10-year Treasury note fell to 0.92% from last week’s close of 0.93%. High-yield and investment-grade bonds rose about 0.29% and 0.25%, respectively.

The U.S. dollar fell 0.45%, which helped boost commodity prices. Gold, oil, and corn had moderate gains for the week.

And lastly, real estate had a decent weekly gain of about 1.2%.

KEY CONSIDERATIONS

Big-Time Moves – 2020 was a year of big-time moves in the stock market. During that turbulent time in March, the S&P 500 index had its third-worst daily decline (-11.98%) on record occur just days apart from its ninth-best daily gain (+9.38%).

In fact, during a stretch of trading that started in March, the S&P 500 had a daily move up or down of 1% or more on 24 of the 25 trading days.

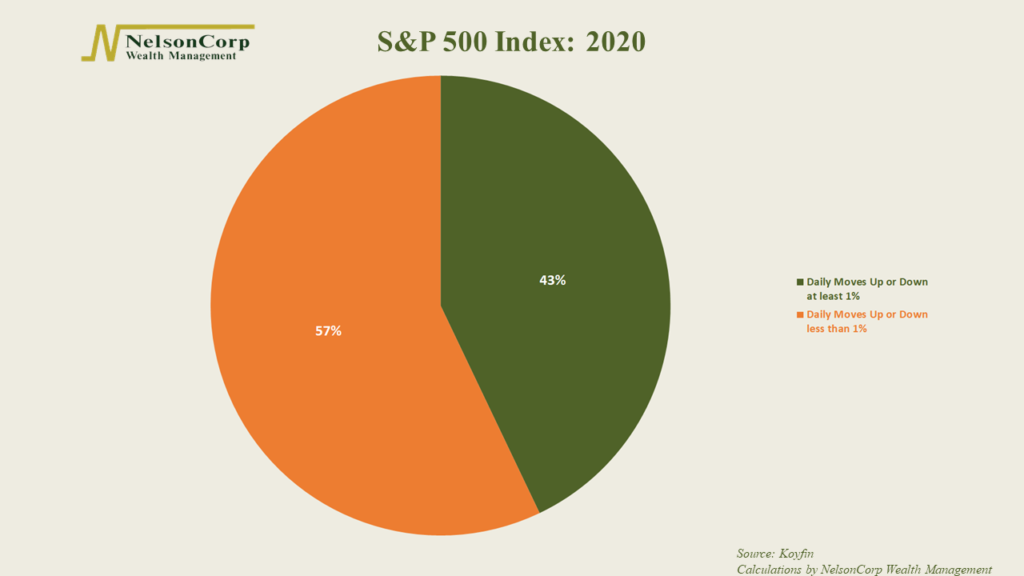

As for the year as a whole, we find that the S&P 500 had a daily move up or down of 1% or more on 43% of its trading days.

By comparison, for the whole history of the S&P 500 (1928 – 2020), it has only had these sorts of moves about 24% of the time.

So, by this measure, the stock market was nearly 80% more volatile this year than average!

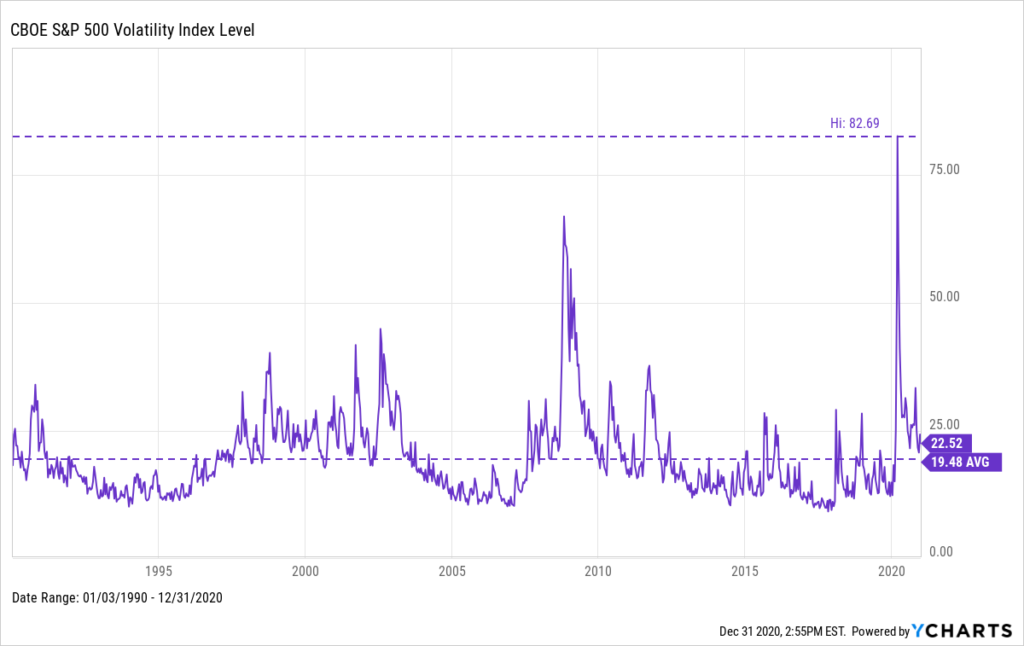

But there are other ways of measuring volatility in the stock market. The CBOE S&P 500 Volatility Index is one of them. Sometimes referred to as the “Fear Index,” it earned its name in March when it skyrocketed to an all-time high of 82.69.

It has since come down from those lofty levels. The average reading for the year was about 29. It ended the year a bit over 22.

Interestingly enough, the long-run average since 1990 has been about 19.5, so it is still elevated compared to “normal” times.

Nonetheless, the trend in volatility is going in the right direction, which–bar any unforeseen setbacks–is historically bullish for stock returns.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.