OVERVIEW

U.S. stocks surged ahead last week, with the S&P 500 gaining 1.82%, the Dow rising 1.58%, and the Nasdaq increasing 2.18%.

Growth stocks led the way, rising 2.57% versus the 1.33% gain for value stocks. Small caps lagged, gaining just 0.39%.

Internationally, we saw developed country stocks outperform the U.S, gaining roughly 2.4%. Emerging markets also did well, rising 2.12%.

Bond yields pulled back from their recent highs and ended the week around 1.58%, down from the prior week’s close of 1.61%. Long-term Treasuries registered gains of 2.15%, investment-grade bonds rose 0.71%, high-yield (junk) bonds increased 0.15%, municipal bonds gained 0.10%, and TIPS climbed 0.61%.

Real estate had a monster week with a 3.47% gain. Commodities also did well, rising about 2% broadly. Oil rose over 3%, gold gained 0.6%, and corn fell 0.9%. The U.S. dollar weakened slightly, down about 0.28% for the week.

KEY CONSIDERATIONS

Born to Shop – If there’s one thing that I know for sure, it’s that Americans love to spend money. Happy. Sad. It doesn’t matter. Americans are reliable shoppers. You might even say we were born to shop.

So, with the holiday season just around the corner, I like to look at retail spending in the United States this time of year to get a sense of just how much people are opening their wallets.

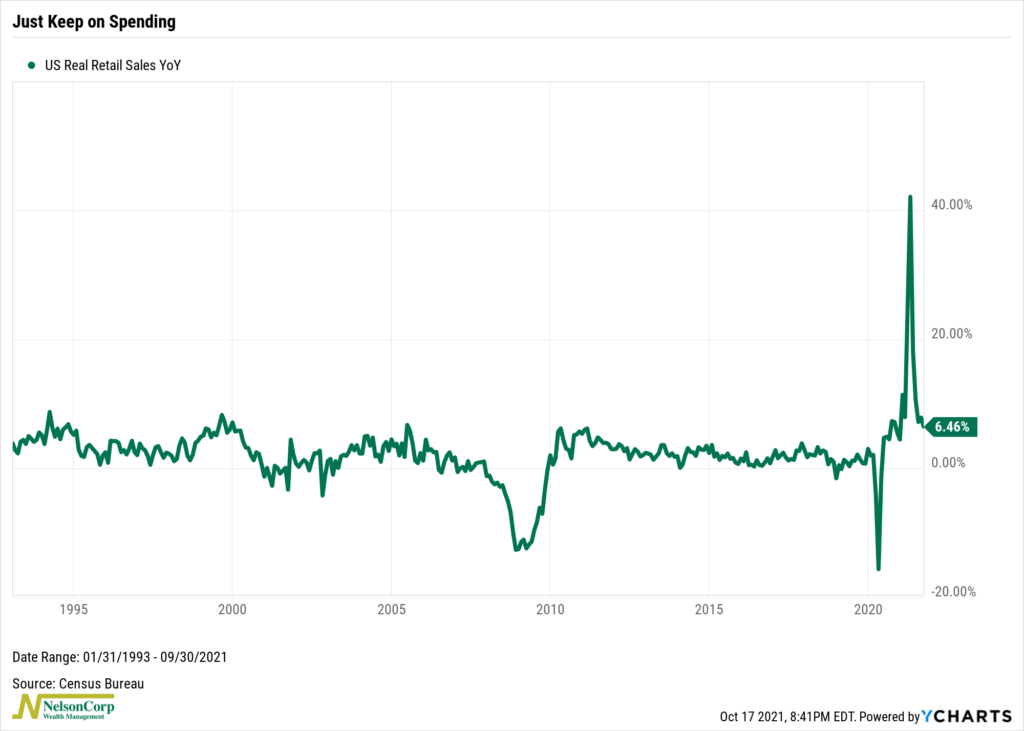

The chart below shows the year-to-year growth rate in real (inflation-adjusted) retail spending in the United States. In September, the latest reading, retail spending was up nearly 6.5% relative to a year ago.

Now, this looks small compared to the roughly 40% growth rate we saw in May (the big spike on the graph). However, that was mostly due to being compared to a low point during the pandemic last year—the so-called base effect. The 6.5% growth rate is still higher than in any other economic expansion since 1968. More so, the discretionary spending component is up 15% on a year-to-year basis, off its peak but still showing significant strength. So, the message is clear: American consumers just keep on spending.

Why? Because shopping feels good, of course. Medical research has found that shopping can trigger the release of dopamine in the brain. This neurotransmitter makes you feel happy or satisfied, and it gets released when we experience new, challenging, or exciting things. For many people, shopping is all those things.

But here’s where it gets tricky. If we look at consumer sentiment surveys—what you might call the “happy meters”—the message is less cheerful. Consumer confidence is down, based on both current conditions and expectations. It’s been knocked down to near its lowest level since December 2001. And on a year-to-year basis, consumer sentiment has fallen 12.7%, something consistent with slowing economic growth. So, there could be some downside risk lurking here in the consumer sentiment data. But then again, it’s usually best not to bet against the American consumer.

As for the stock market, it seemed to like the better-than-expected retail sales numbers last week. After this recent bout of weakness, the S&P 500 turned the corner and shot back above its 50-day moving average to end the week.

As for our models, they still see things as mostly bullish, with both the price action of the stock market and the underlying economic environment holding up well.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.