OVERVIEW

The major U.S. stock indices sold off last week, resulting in the S&P 500 finally reaching a 5% drawdown from its high. For the week, the S&P 500 fell 2.21%, the Dow dropped 1.36%, and the Nasdaq declined 3.2%.

The biggest declines were concentrated in growth stocks. The Russell 3000 Growth index fell 3.38%, whereas the Russell 3000 Value index fell a smaller 0.67%.

Developed country stock markets saw declines in the 3.3% range for the week. Emerging markets did a little better but still suffered declines of around 1.5%.

Interest rates were on the move again, as the 10-year Treasury yield briefly touched the 1.54% mark during the week. Bond prices fell across the board as a result. Long-term Treasuries were down 0.97%, investment-grade corporates dropped 0.41%, high-yield (junk) bonds fell 0.31%, municipal bonds were down 0.56%, and TIPS were roughly flat to end the week.

Real estate dropped as well, falling 1.54%. However, commodities were the one shining star for the week, rising around 1.97%. Oil was up 2.78%, gold edged higher by about 0.4%, and corn prices climbed 2.8%. The U.S. dollar also strengthened by about 0.85%.

KEY CONSIDERATIONS

Keeping a Leg on Both Sides of the Fence – If we view the S&P 500 stock index as a managed portfolio, then its managers are heavily overweighting Technology. Currently, the tech sector has a market capitalization share of about 28%. If we include the stocks in the Communication Services sector, the share increases to nearly 40%.

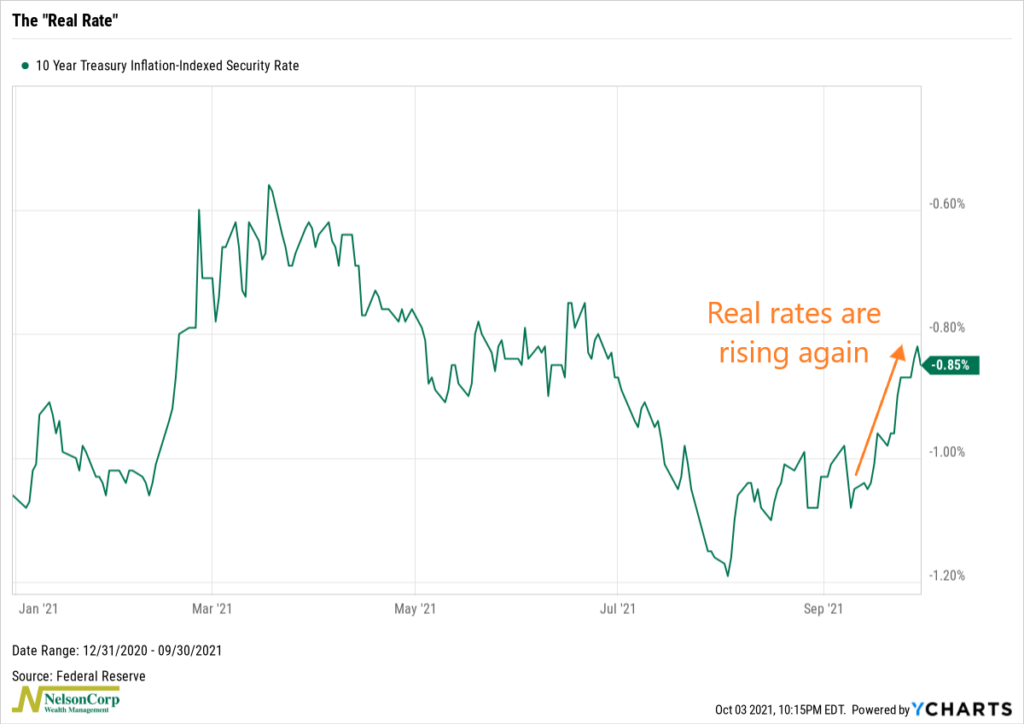

When viewed through that lens, it makes sense why the chart below has been problematic for the stock market lately.

This chart shows the benchmark 10-year Treasury yield adjusted for inflation, also known as the “real rate.” It has gone from -1.05% to -0.85%, a rise of 20 basis points in a matter of a few weeks.

When real interest rates are rising, it creates a challenging environment for growth stocks, as they are expected to generate earnings further out in the future. Tech stocks are mostly growth stocks. And historically, growth stocks have struggled to digest interest rate increases that have been led by sharp increases in real interest rates.

In the longer run, though, we think it’s likely that growth stocks will continue to benefit from historically low interest rates and a slower economic growth environment.

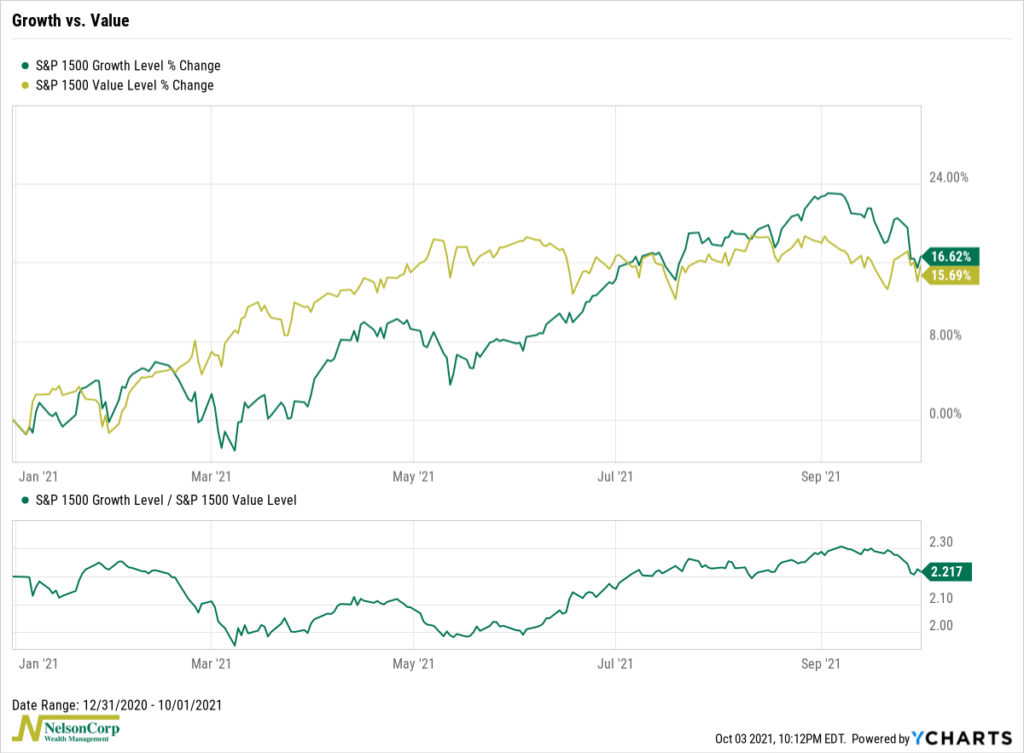

In the shorter term, however, we could continue to see the back-and-forth battle between growth and value that we’ve witnessed all year, as shown in the chart below.

In the top clip, we have the S&P 1500 Growth index as the green line and the S&P 1500 Value index as the gold line. They’re both up about 16% this year.

But if you look at the relative strength line in the bottom clip, you can see how the two have taken turns outperforming each other all year. When the line was rising, growth was outperforming; falling, and value was doing better.

It’s for this reason that we’ve preferred to take a diversified approach to this bull market. At the portfolio level, we have exposure to both growth and value sectors. We think this makes sense for the current environment, as we’ve seen that the market tends to regularly let outperforming sectors underperform for a while as the underperforming ones get a turn to outperform.

A diversified approach is probably the best route to take in this sort of situation, especially with the way real interest rates have moved this year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.