OVERVIEW

U.S. stocks had a mixed but mild week last week. The S&P 500 dropped 0.28%, the Dow declined 0.13%, and the Nasdaq increased about 0.6%.

Growth stocks saw positive gains, to the tune of about 0.3%, whereas value stocks dipped around 0.16%. Small caps outperformed their larger counterparts, rising 1.34% versus the 0.3% decline for large caps.

Over in the bond market, the benchmark 10-year Treasury rate rose to 3.8% from the previous week’s close of about 3.7%. This led to moderate declines for most bonds. Intermediate-term Treasuries fell 0.4%, and long-term Treasuries dropped 1%. Investment-grade corporates declined around 0.7%, and high-yield (junk) bonds fell 0.88%.

Broad-based commodities were down nearly 2% for the week. This was led by a 4% decline in oil prices, as well as a 1.3% decline in gold and a 0.2% drop in corn prices. Real estate was also down about 0.9%. And the U.S. dollar strengthened nearly 0.4% against the world’s major currencies.

KEY CONSIDERATIONS

Leaky Liquidity – Last week on the blog, we highlighted a few charts showing that the U.S. economy is holding up well, despite talks of a potential recession.

This is important because the economic environment is one of the three core areas we measure when modeling stock market risk. Historically, strong readings from our economic indicators have coincided with better stock market returns.

We break down the economic environment into six sub-categories: interest rates, the yield curve, credit spreads, financial liquidity, economic activity, and inflation.

Of these, interest rates and credit spreads are both signaling a positive environment for stock market returns right now—and the economic activity and inflation components are both neutral. Nearly all the subcomponents were negative half a year ago, so this is a sign of improvement!

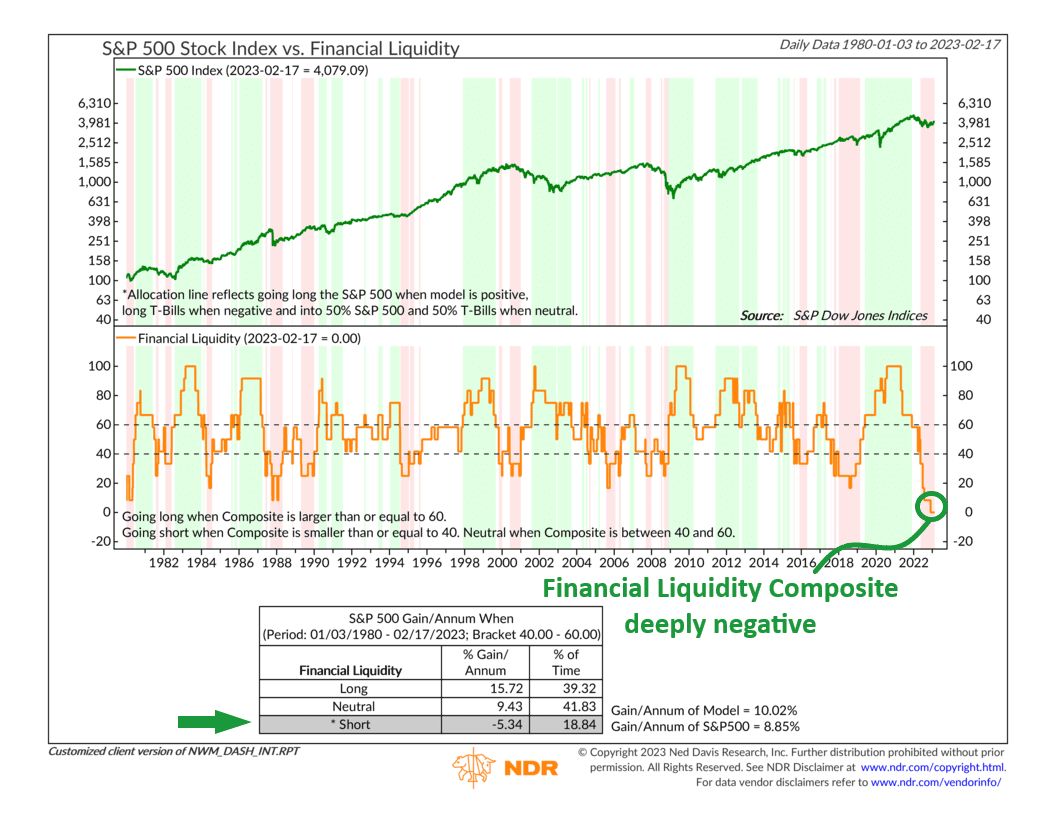

However, one low point in the model was—and still is—financial liquidity. As you can see on the composite chart below, it plummeted to record-low levels last year—and has yet to budge an inch.

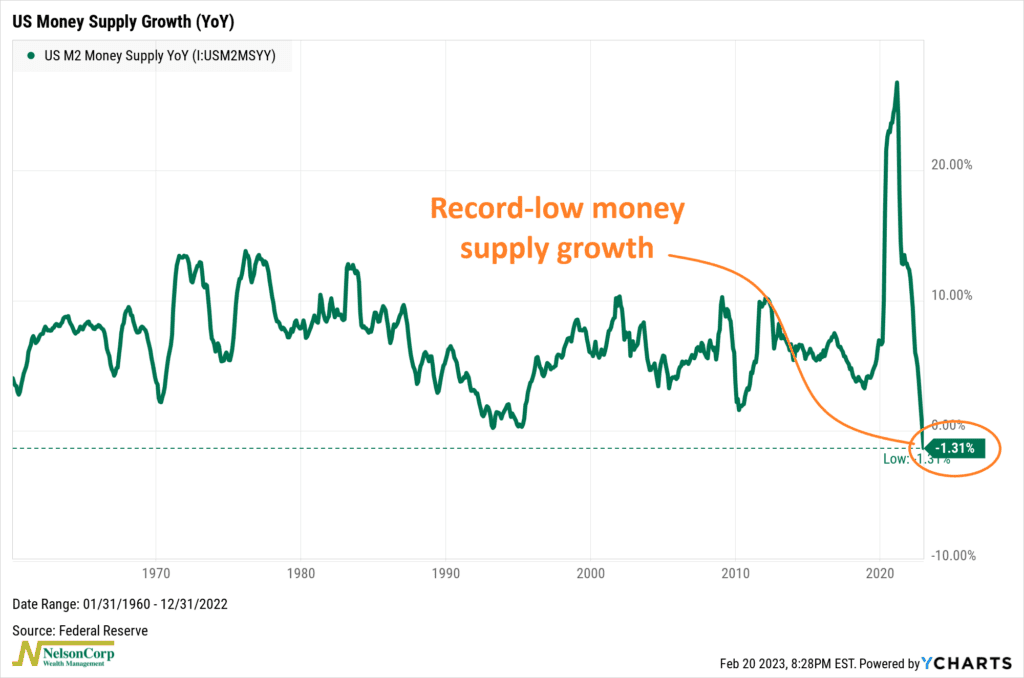

Another way we can illustrate this is via this next chart, which shows the annual growth rate in the M2 money supply. As you can see, it’s currently at record-low levels as well.

To be sure, this is all by the design of the Federal Reserve. Interest rates have been pushed higher, and liquidity has been drained from the system in order to choke off inflation. And for the most part, this has had its intended effect, as inflation is coming down (albeit slowly). But it has also had the impact of dragging asset prices down, as we saw last year.

So, the bottom line? We’ll be looking at whether some of these financial liquidity indicators can finally bottom out and turn a corner. If they can, it would go a long way toward supporting a stock market that took a beating last year. Until then, however, we should probably expect the Fed and financial liquidity to remain a problem for the stock market.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.