OVERVIEW

The U.S. stock market continued to rally last week, with the S&P 500 Index gaining 1.13%, the Dow Jones Industrial Average climbing 0.24%, and the Nasdaq Composite rising 2.09%.

Foreign stocks were also up on the week, with the MSCI EAFE Index of developed country stocks rising 1.03% and the emerging markets version of the index surging 3.49%.

The bond market was in the green last week as yields continued to drop. The 10-year Treasury yield fell to 3.5% from 3.7% the week before. Intermediate-term Treasury prices rose 1.43%, and long-term Treasuries gained 4.17%.

Commodities declined broadly, by about 0.4%, despite the 4.3% gain in oil and the 2.25% increase in gold prices. Corn, however, was down around 3.6%. And the U.S. dollar traded lower on the week by about 1.22%.

KEY CONSIDERATIONS

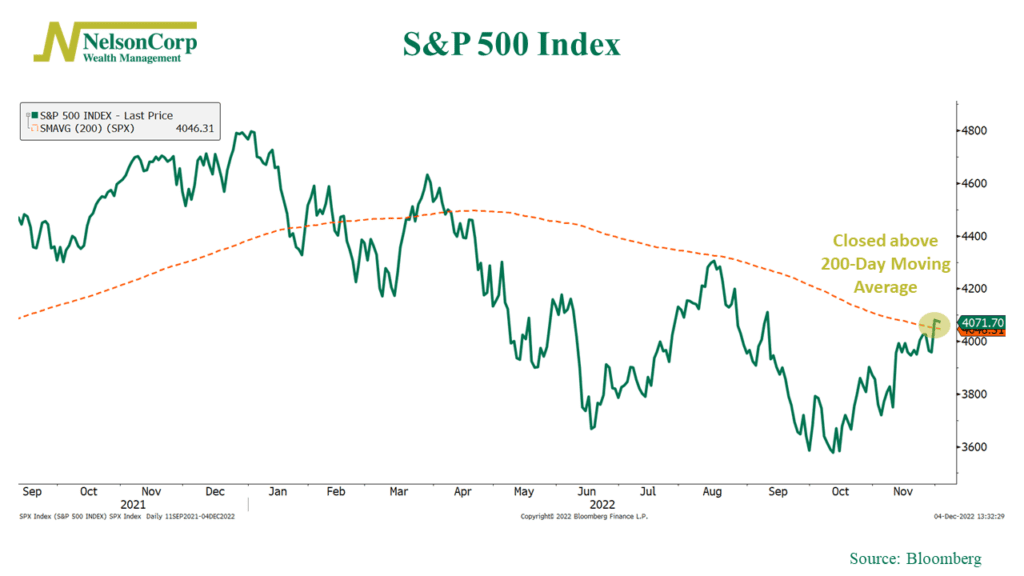

Meeting the Trendline – We can get a good look at the stock market’s long-term trend by looking at a line of its average price over the past 200 trading days.

As the orange dashed line on the chart below shows, this measure has been in a downtrend for most of the year. This is a clear indication that the stock market is in what is called a “bear market.”

However, as you can also see on the chart, the market has been rallying strongly over the past few weeks. And last week, it actually closed above its average 200-day price for the first time since April.

From a technical perspective, this is an important time for the stock market.

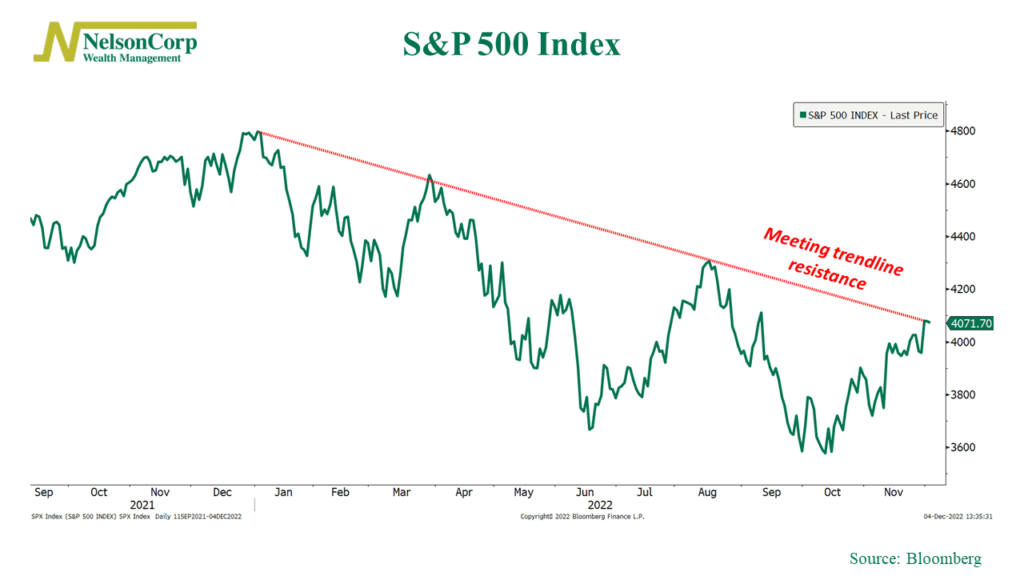

As the next chart shows, the S&P 500 Index also happens to be touching its long-term trendline resistance level.

If prices surge through these levels and go on to make higher highs (above the previous high set in August), that would be a good sign that the market is attempting to end the current bear market.

However, if prices fail to move significantly higher here or trade sideways, it would be a sign that we aren’t necessarily out of the woods yet.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.