OVERVIEW

The major U.S. stock indices ticked lower for the second week in a row last week as corporate earnings continued to show the extent of the destruction caused by the COVID-19 pandemic.

The S&P 500 Index fell 0.21 percent, and the Nasdaq Composite dropped 0.34 percent.

International stocks did better. Developed country stocks rose 2.97 percent, and emerging market stocks rose 4.25 percent.

Long-term Treasury bond prices fell as interest rates ticked up a bit on the longer end of the yield curve.

While investment-grade corporate bonds fell 0.36 percent, high-yield bonds rallied about 0.66 percent.

The U.S. dollar weakened by a bit more than half a percent relative to other currencies.

Gold and grain prices fell on the week, but the gains in the price of oil kept the Bloomberg Commodity Index up approximately 0.78 percent for the week.

KEY CONSIDERATIONS

Testing the Waters – The global appetite for risk has slowly started to perk up recently.

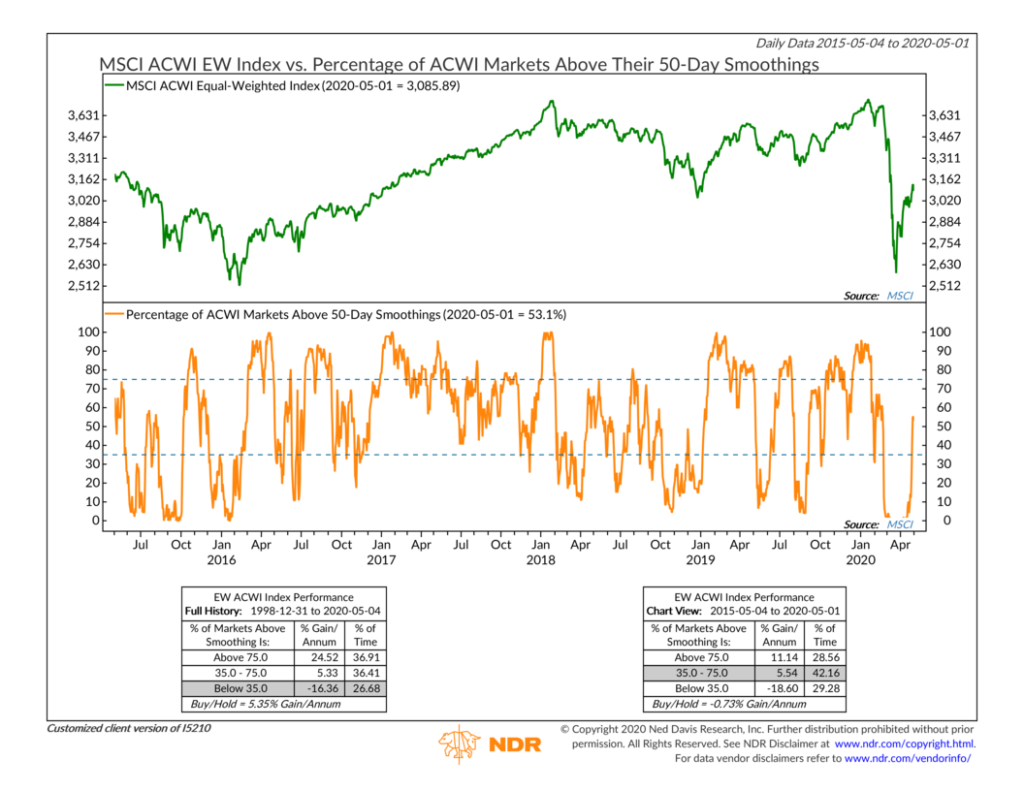

For starters, the percentage of global stocks (as measured by the MSCI ACWI Index) that are above their 50-day average price has risen to more than 50 percent, after being essentially zero for the past two months. Historically, global stocks have performed roughly on par with their long-run average return when at least 35 percent of the ACWI markets are participating in this way.

Much of this increased risk appetite is coming from the strong relative performance of the Information Technology sector. The ratio of this sector to the global stock index is well above its 200-day average price. Since this ratio has a reasonably high correlation with the global stock index itself, its outperformance is a sign of increased risk-taking.

Also, stronger performance in the global Utilities sector is typically a sign of decreased risk-taking, as evidenced by its negative correlation to the global stock index. However, the ratio of the global Utilities sector to the global stock index has fallen below its 200-day average price, a sign that investors are less keen on playing it safe as they recently were.

Nonetheless, despite these improvements, the global appetite for risk has just barely entered a “neutral” state. High-yield bond prices, which are generally a proxy for risk-taking, have improved nicely from their lows but remain well below their 200-day average price. Oil, of course, has been slaughtered this year. And long-term Treasury bonds, the archetypal “risk-off” asset with a negative correlation to global stocks, continue to outperform strongly this year.

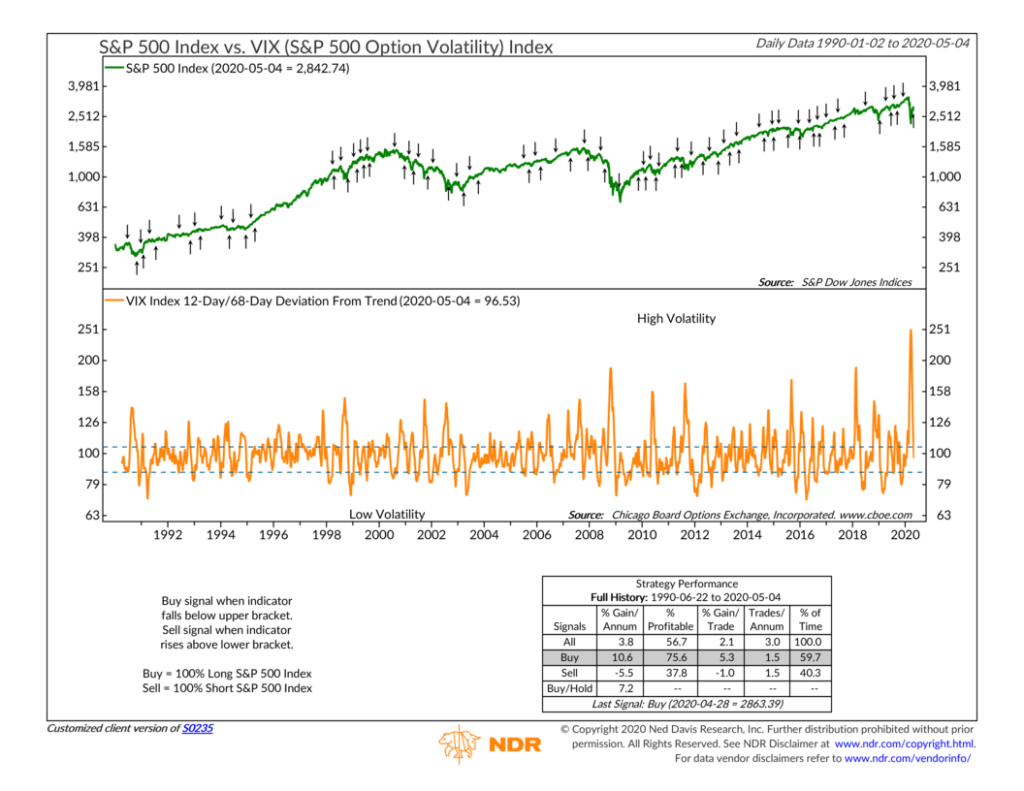

As for the United States, volatility remains elevated relative to historical standards. However, the VIX index, a measure of implied volatility in the S&P 500 Index, has come down quite a bit since its highs reached earlier in the crisis. And recently, we saw its shorter-term (12-day) average price fall enough relative to its longer-term (68-day) average price to trigger a bullish signal for stocks.

All in all, there are some reasons to put more risk on the table. But the weight of the evidence suggests a cautious approach.

When uncertainty runs high, dipping your toe into the water sometimes makes more sense than performing a full-on cannonball.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.