Financial Focus – March 19th, 2025

With tax season flying by, Nate Kreinbrink and Andy Fergurson remind listeners to double-check their paycheck withholdings before it’s too late. They also share tips on missing tax documents and how smart income planning can help you avoid surprises next April.

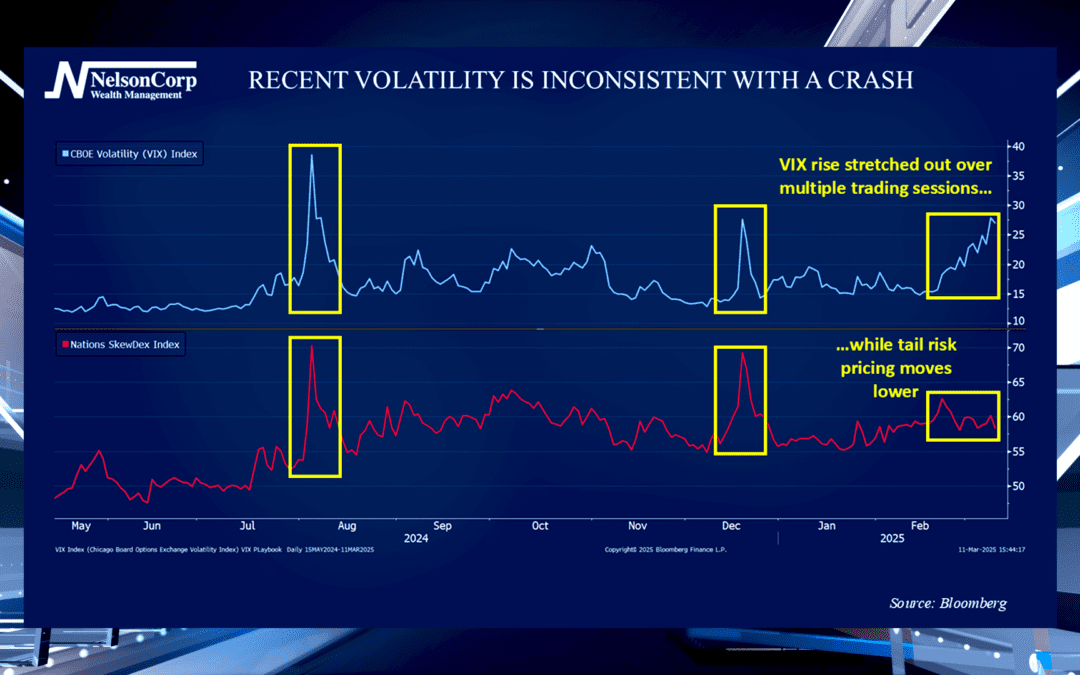

Volatility Watch

Market volatility has been rising and investors are rightfully concerned. David Nelson joins us to share two indexes Wall Street uses to gauge fear in the market and advises viewers to be cautious moving forward.

Financial Focus – March 12th, 2025

In this week’s episode of Financial Focus, Nate Kreinbrink discusses market updates and the complexities of retirement planning, emphasizing the importance of having a solid financial strategy. He highlights key retirement considerations, such as pension options, healthcare coverage, and investment allocations, while encouraging listeners to seek guidance to navigate the process smoothly.

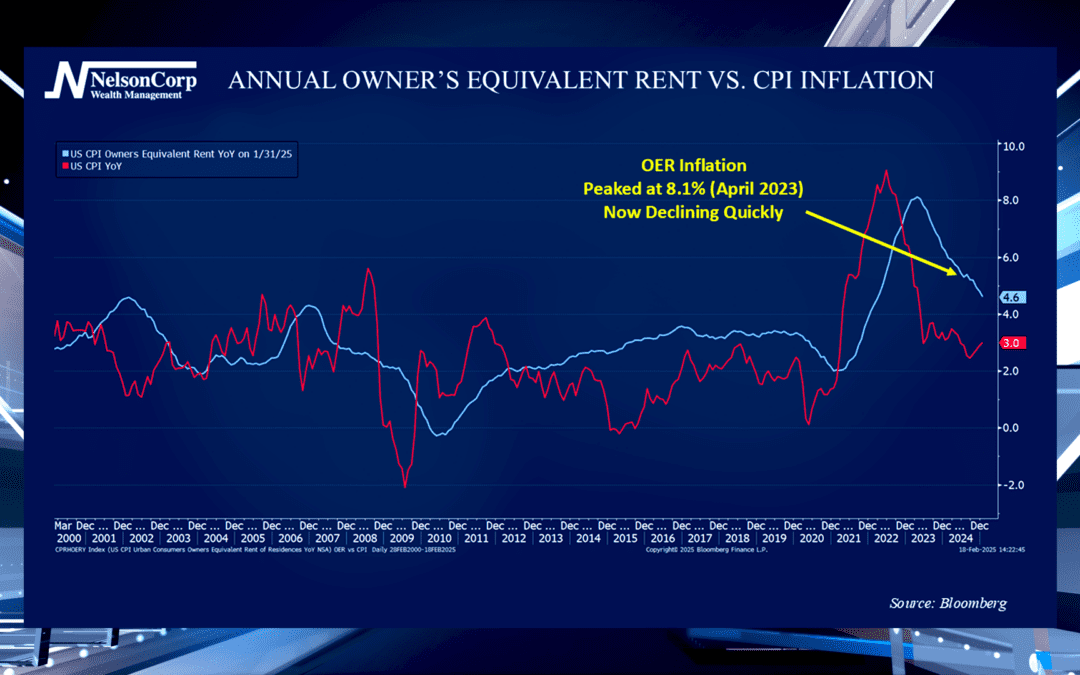

Housing Inflation

James Nelson talks with us about housing inflation and the owner’s equivalent annual rent. Learn more about what this means for inflation and the housing market moving forwards.

Financial Focus – March 5th, 2025

In this week’s episode of Financial Focus, David Nelson joins Gary Determan to discuss market swings, the impact of tariffs on farmers, and the broader economic outlook. He talks about the shift to a more defensive investment approach and shares insights on how global trade changes are affecting businesses and consumers.

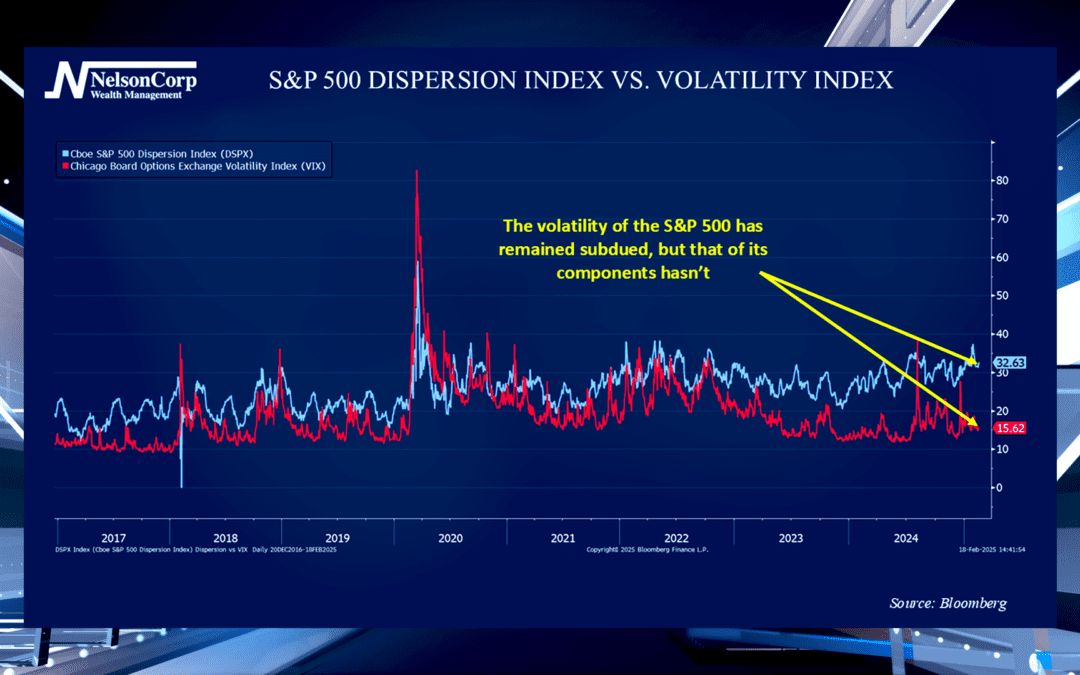

Go Your Own Way

Lately, the stock market seems stable, but some investors are noticing more turbulence under the surface. David Nelson is here to share what has historically occurred when the indexes appear calm while individual stocks are volatile and advises viewers to proceed with caution.

Financial Focus – February 26th, 2025

This week’s Financial Focus, hosted by Nate Kreinbrink and Mike VanZuiden, covers the complexities of Medicare enrollment and the importance of reviewing options regularly. They emphasize understanding enrollment periods, making informed decisions, and seeking professional guidance to navigate Medicare effectively.

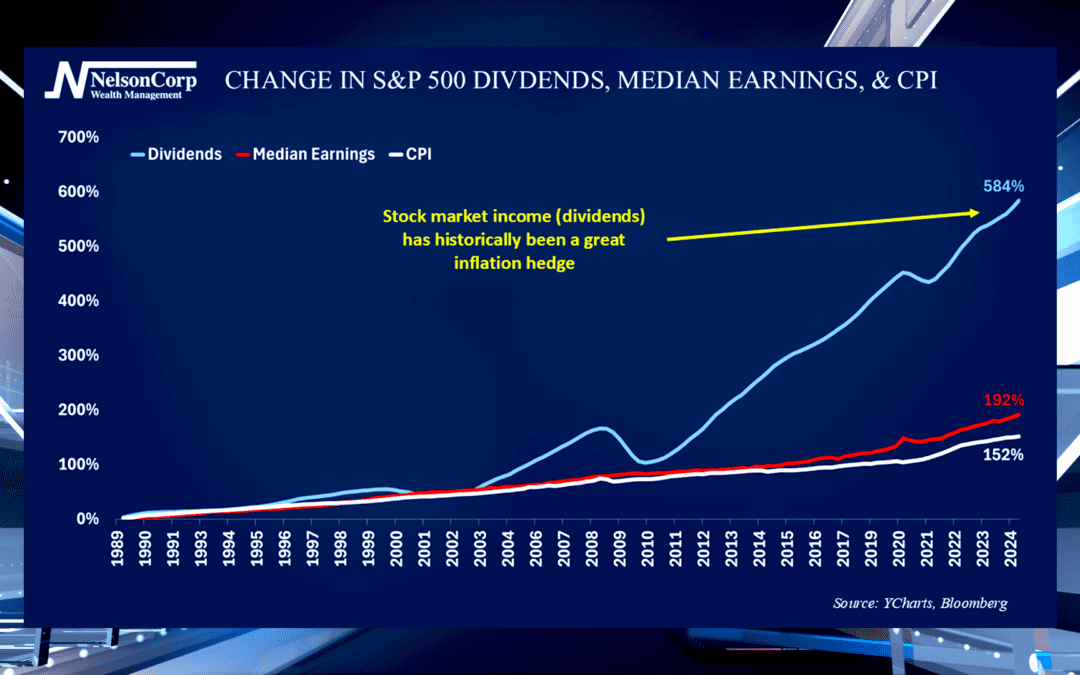

Inflation Hedge

With inflation still a major concern, investors want to know how to protect their purchasing power. David Nelson joins us to explain why investors should not ignore their assets income potential.

Financial Focus – February 19th, 2025

Tax season is in full swing, and as the paperwork piles up, it’s a good time to stay organized and plan ahead for next year. Tune in as Nate and Andy break down the latest tax tips, the importance of preparation, and why kindness goes a long way during this busy season.

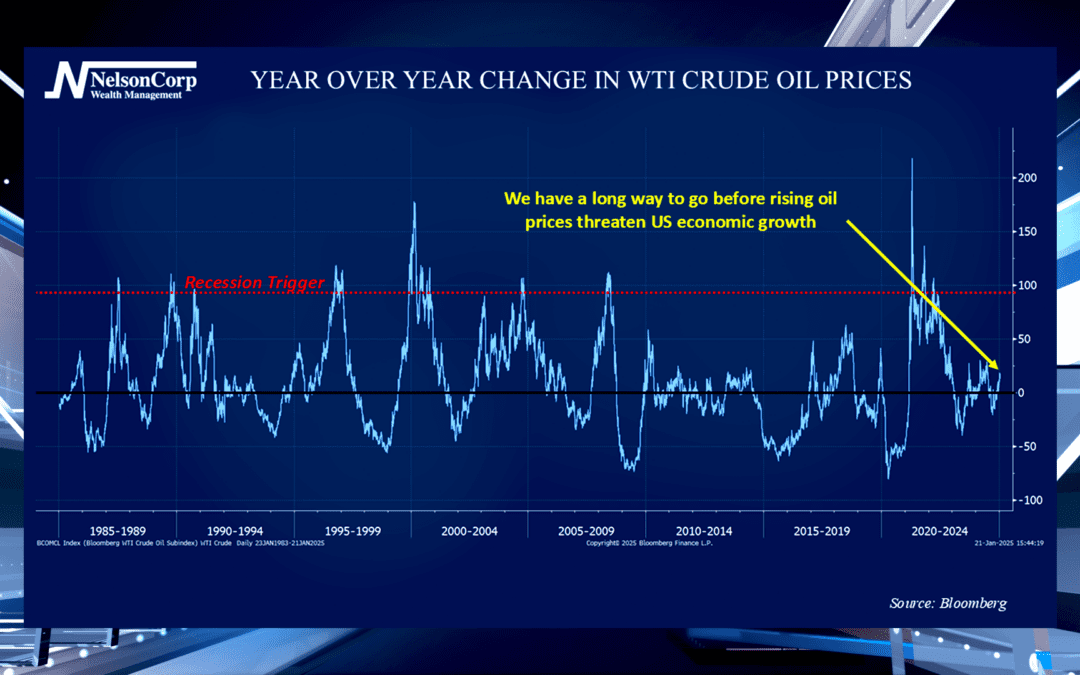

Cover You in Oil

When oil prices rise, they often capture people’s attention because of the impact they have on the economy as a whole. John Nelson is here to share crude oil data and explain why investors are smart to monitor this indicator in the long term.

Watch – 4 Your Money on CBS Local 4 every Tuesday at 6:10 a.m. and again at 6:10 p.m.

Watch – 4 Your Money on FOX 18 every Tuesday at 8:10 a.m.

Listen to – Financial Focus on KROS FM 105.9 and AM 1340 every Wednesday at 9 a.m. and Market Update from NelsonCorp Wealth Management every weekday at 12:10 p.m.