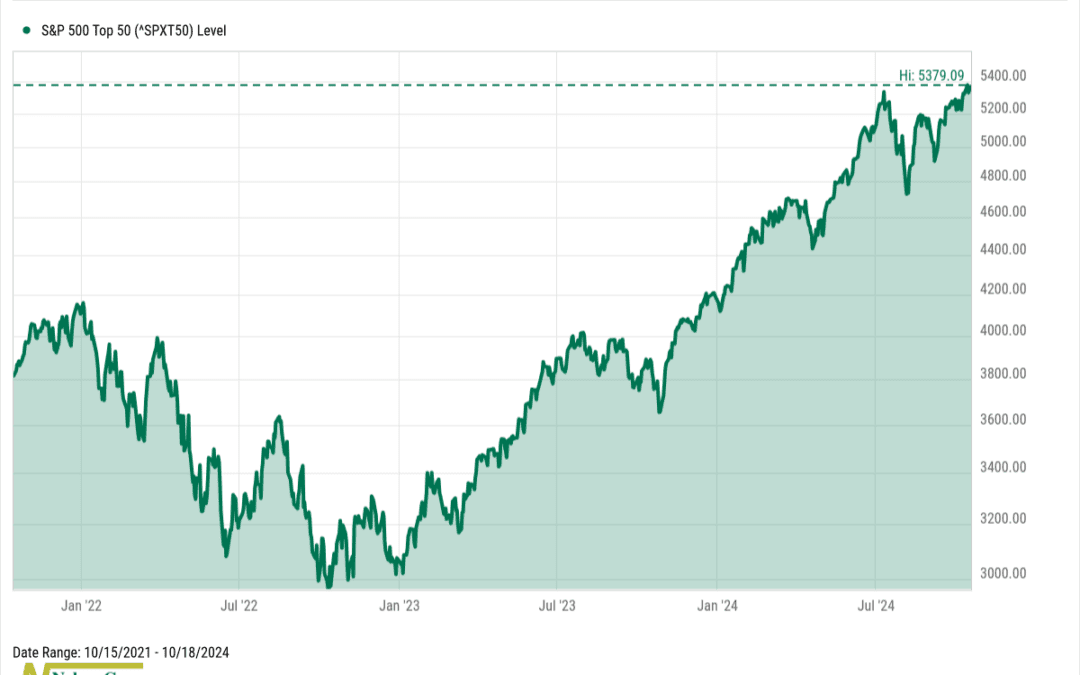

The Biggest and Best

This week’s chart shows that the biggest and best of the stock market are breaking out to all-time highs. The index, shown above, is the S&P 500 Top 50 Index. It’s a subset of the broader S&P 500 Index, focusing on the 50 largest companies by market...

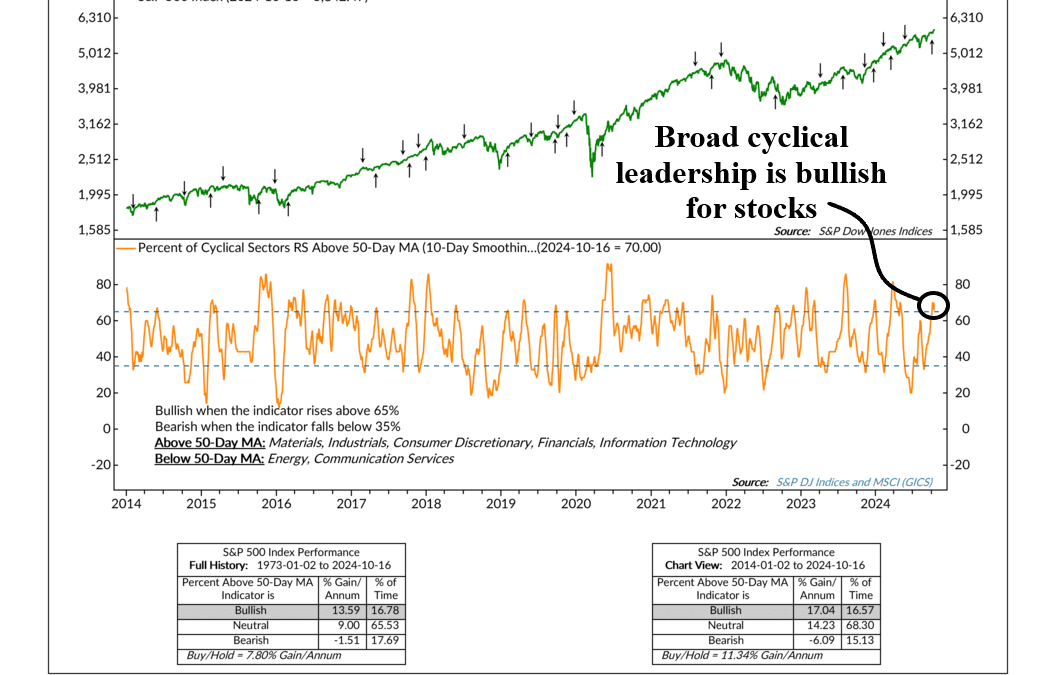

Cyclical Leadership

This week’s indicator is all about the cyclical sectors. What are the cyclical sectors? Well, as their name implies, they’re sectors that are in sync with the economic cycle. When the economy grows, these sectors do well. But when the economy contracts, they...

Financial Focus – October 16th, 2024

In this week’s “Financial Focus,” Nate Kreinbrink and Andy Fergurson discuss the recent October 15th tax deadline and the common misconceptions surrounding tax extensions. They explain that while an extension grants more time to file, taxes owed must still be paid by April 15th to avoid interest and penalties.

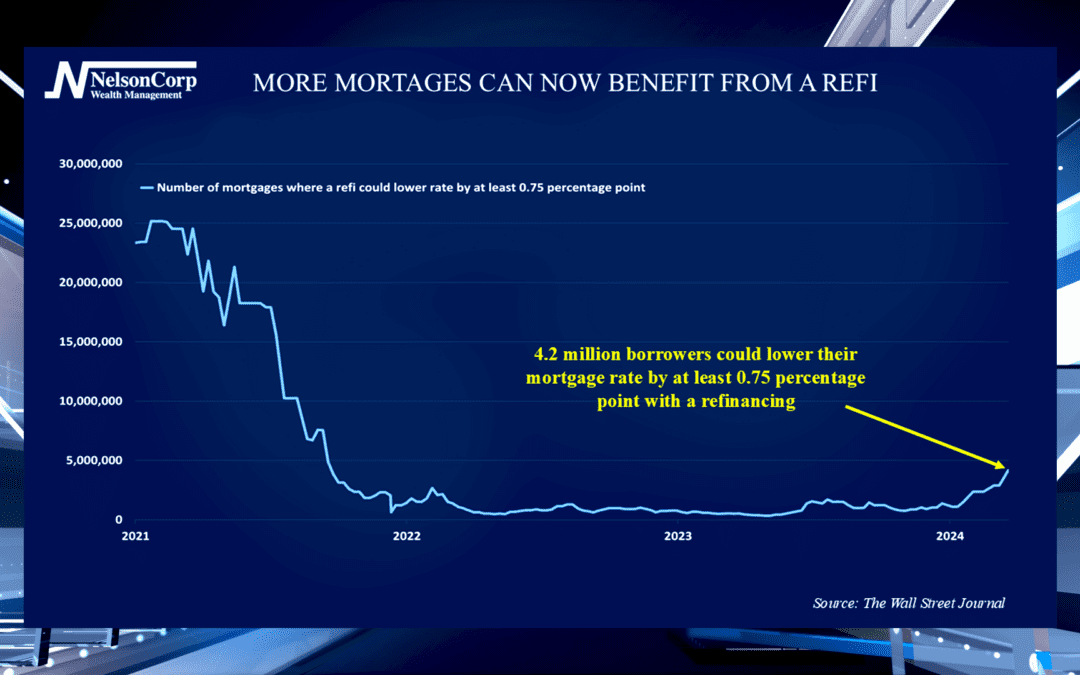

Refi Revival

With the Federal Reserve reducing interest rates, the lower mortgage rates have translated into positive activity for the housing market. James Nelson shares factors homeowners should consider when deciding if the time is right to refinance.

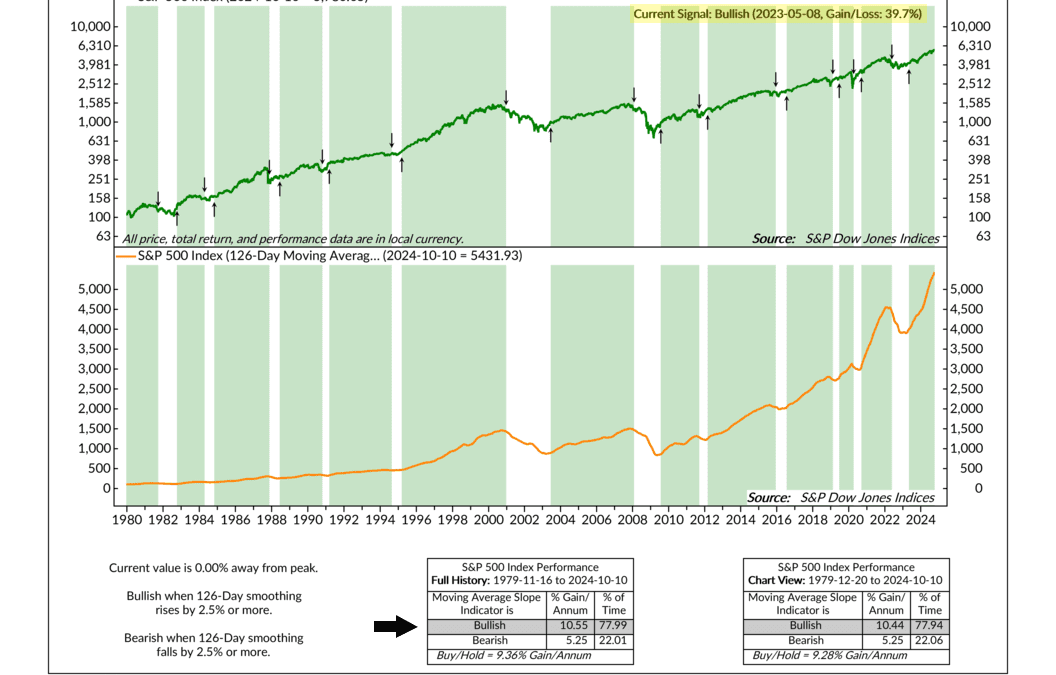

Follow Trendlines, not Headlines

In a world filled with distracting headlines, the secret to smart investing is to Follow Trendlines, Not Headlines. Dive into this week’s commentary to discover what you should really be paying attention to in your investment strategy.

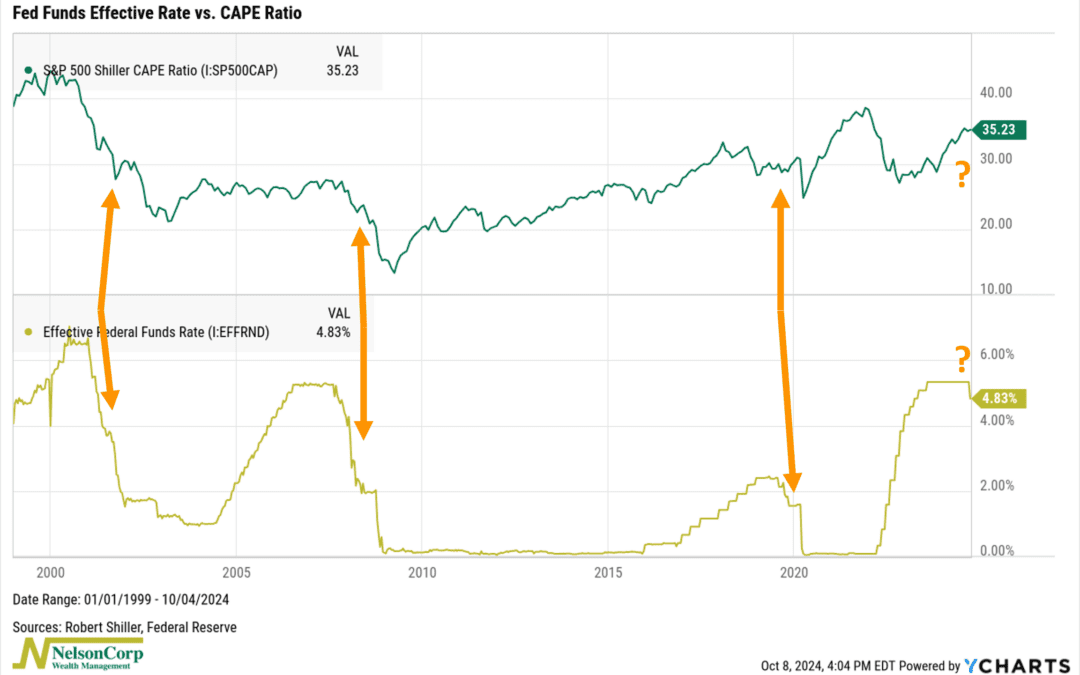

The Fed/CAPE Connection

This week’s chart highlights a key connection between the Fed Funds Rate and stock market valuations, as measured by the CAPE ratio. But first, some definitions. The Fed Funds Rate is controlled by the Federal Reserve and influences all other interest rates....

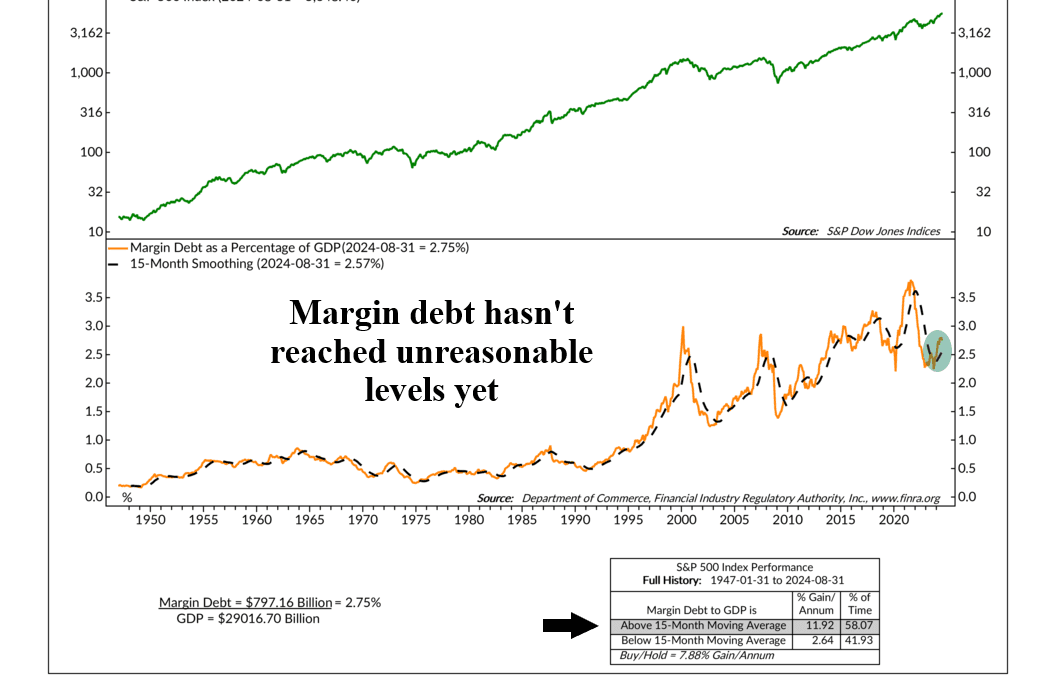

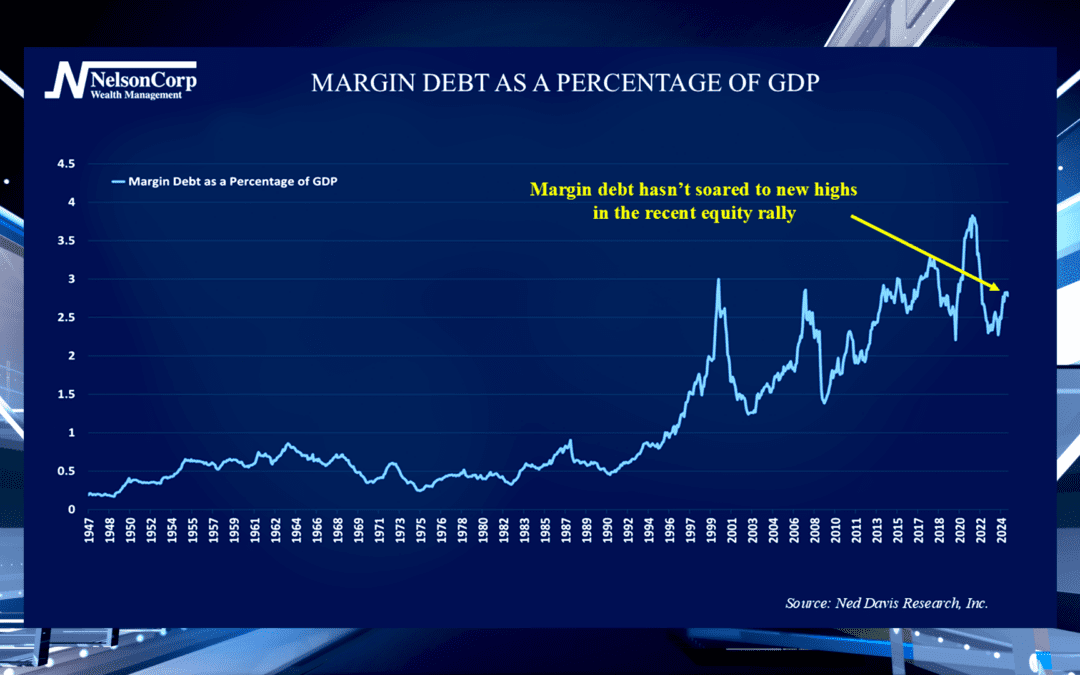

Leverage Limits

This week’s indicator is all about leverage in the stock market, or what is commonly referred to as margin debt. What is margin debt? In simple terms, it’s a measure of how much money investors are borrowing to buy stocks. When they do this, it’s called buying...

Financial Focus – October 9th, 2024

In this week’s Financial Focus, Nate Kreinbrink highlights the importance of updating beneficiary designations for retirement accounts and life insurance policies. He also covers recent changes requiring beneficiaries to withdraw inherited funds within 10 years, starting in 2025.

Margin Meter

We occasionally hear experts refer to leverage when discussing markets. David Nelson walks us through what that means and what investors should take away from margin debt trends.

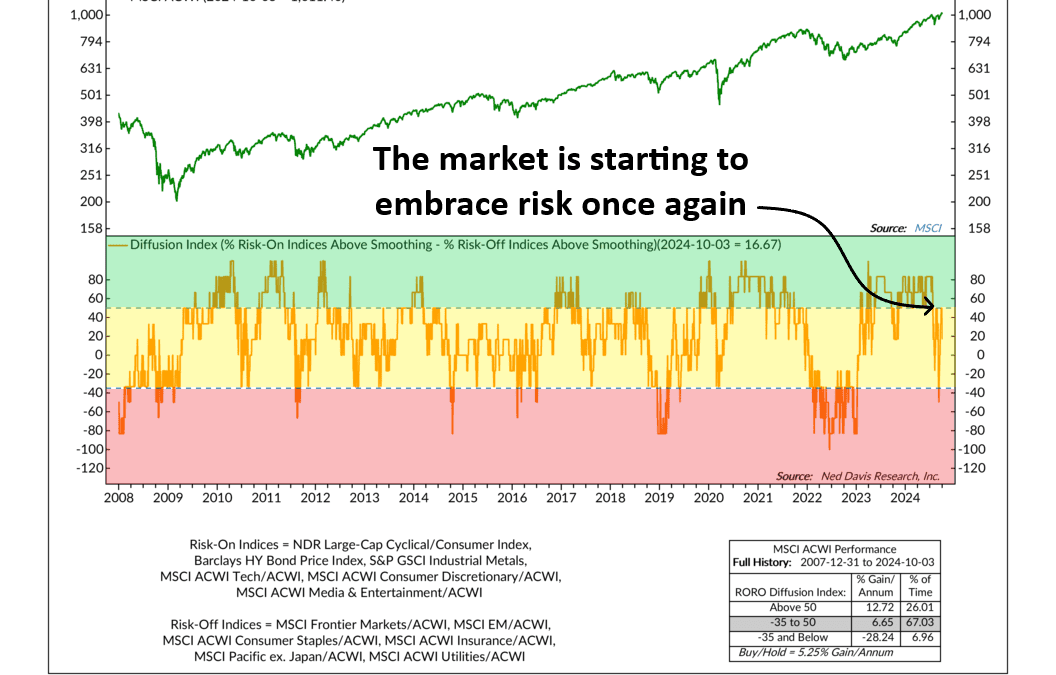

Take a Chance on Me

The market’s been tapping into its inner ABBA lately, suggesting now might be the time to “take a chance” on stocks again. In this week’s commentary, we dive into the key Risk-On/Risk-Off Diffusion Index and explore why investors are starting to move to a more upbeat market tune.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, CA, CO, CT, FL, GA, HI, IA, ID, IL, IN, LA, MA, ME, MI, MN, MO, MT, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.