Rolling Returns Radar

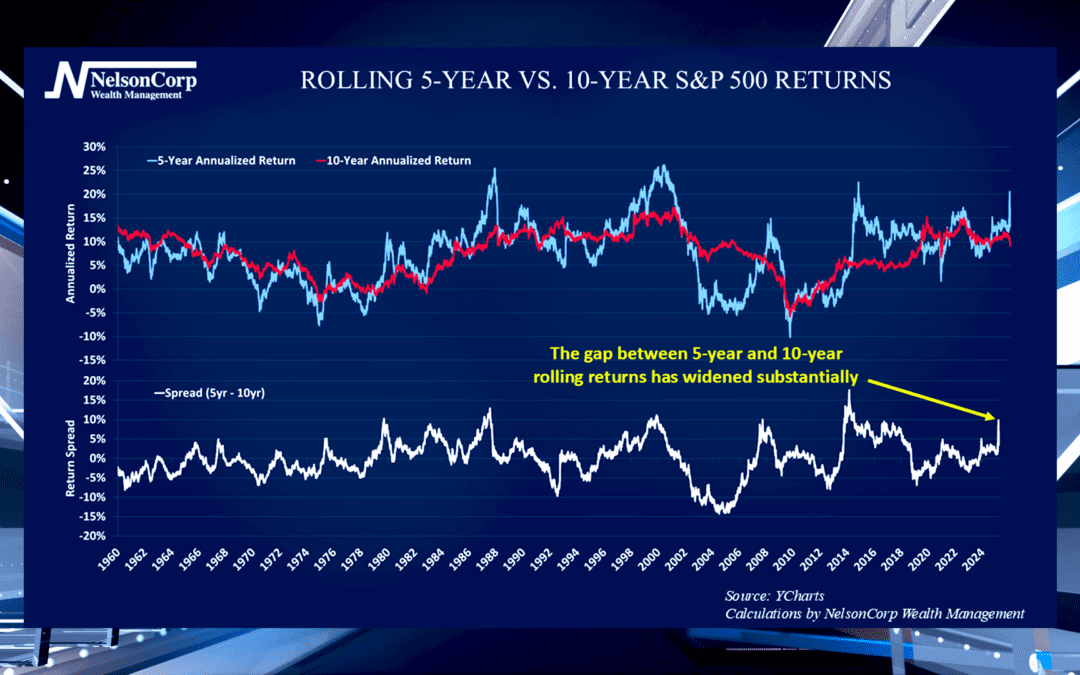

The stock market has performed well the last few years, but this year’s off to a rough start. Nate Kreinbrink joins us to discuss how a slower stretch after a strong run is normal for the markets.

The stock market has performed well the last few years, but this year’s off to a rough start. Nate Kreinbrink joins us to discuss how a slower stretch after a strong run is normal for the markets.

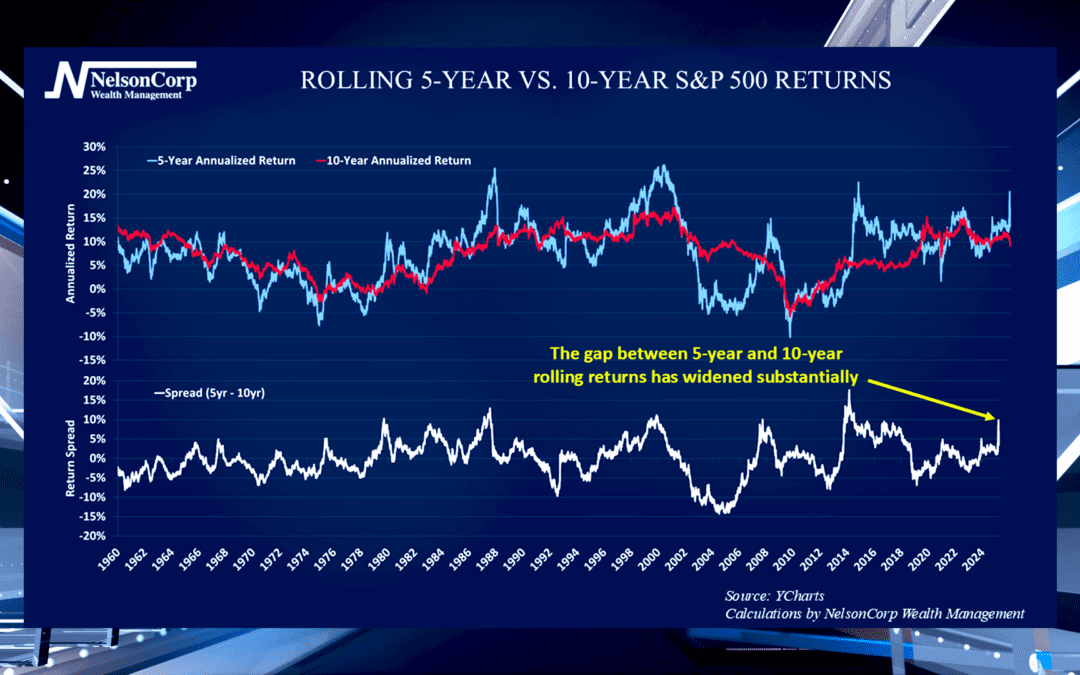

First quarter did not start 2025 off on solid footing. David Nelson is here to share historical data on how years have traditionally finished after bumpy beginnings.

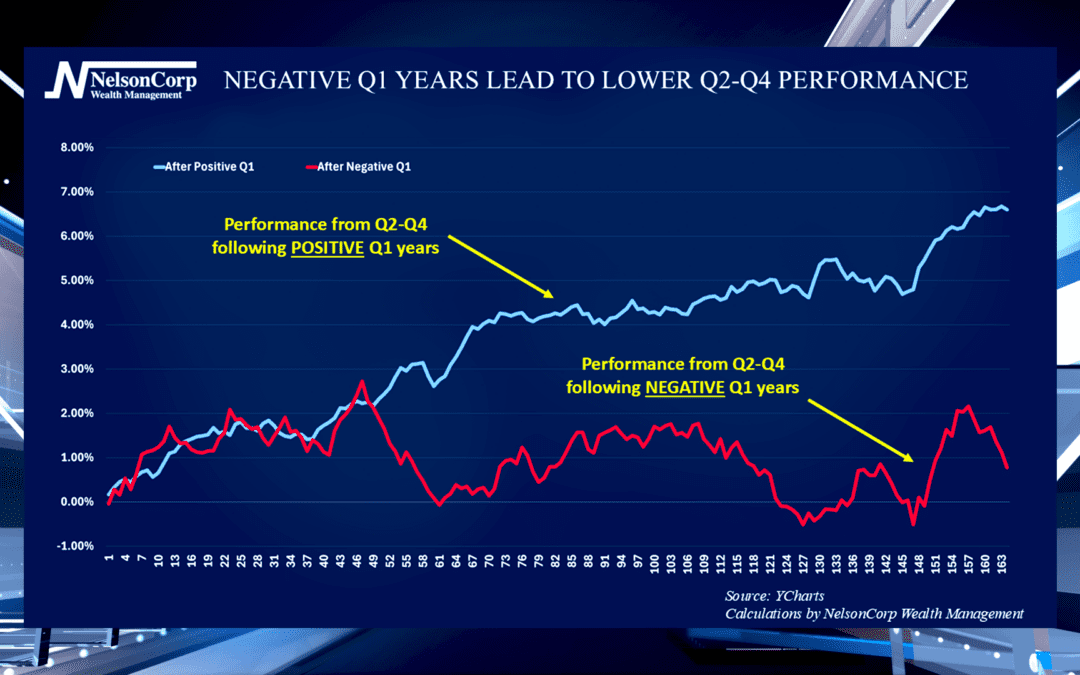

We have seen considerable movement in the markets lately—especially in currencies and interest rates. David Nelson joins us to discuss data showing a rare event… the U.S. dollar appearing to lose appeal with global investors.

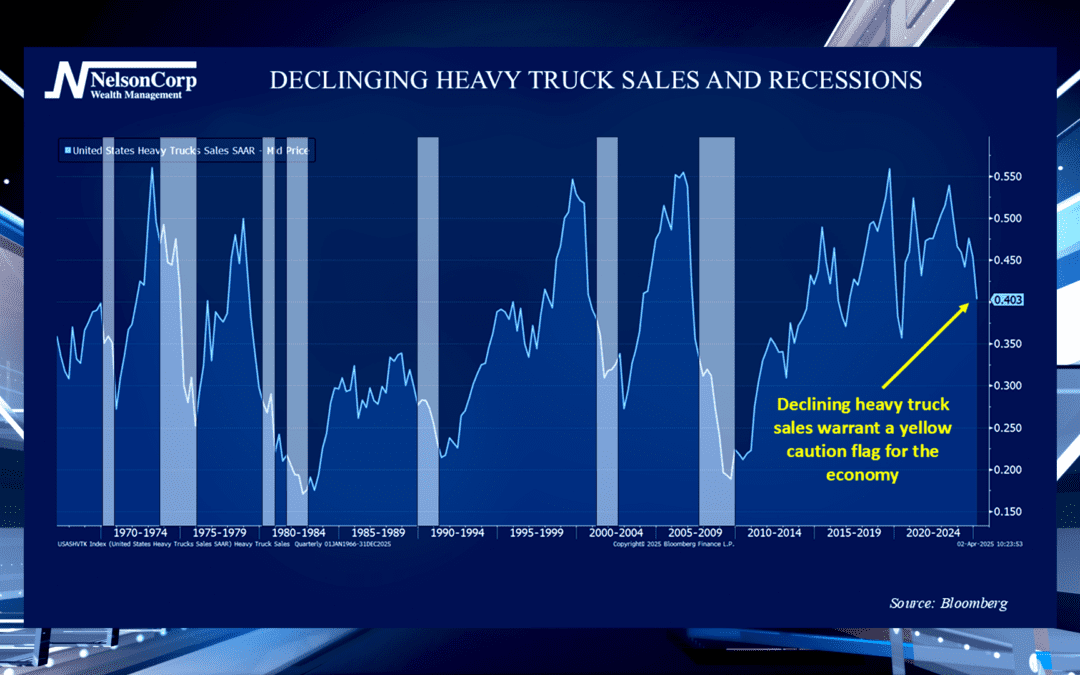

The sales volume of heavy weight trucks is a leading economic indicator. John Nelson is here to explain why and what heavy truck sales reveals about the broader economy.

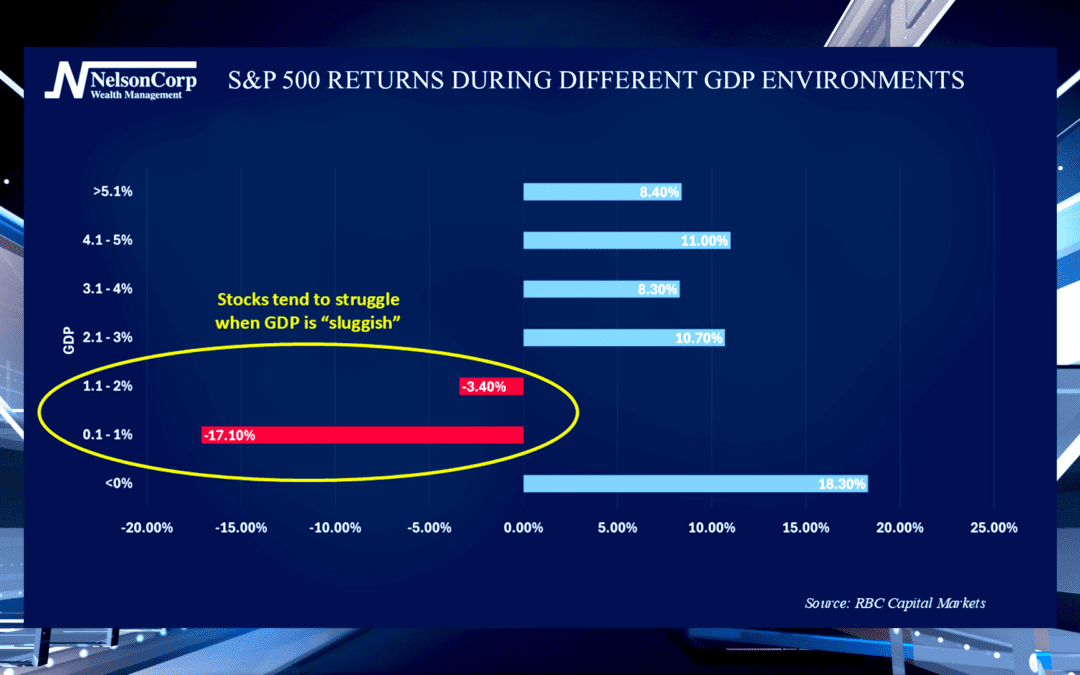

We often hear about GDP when experts are discussing the state of the economy. David Nelson joins us to share how important the Gross Domestic Product variable is and how it relates to stock market returns.

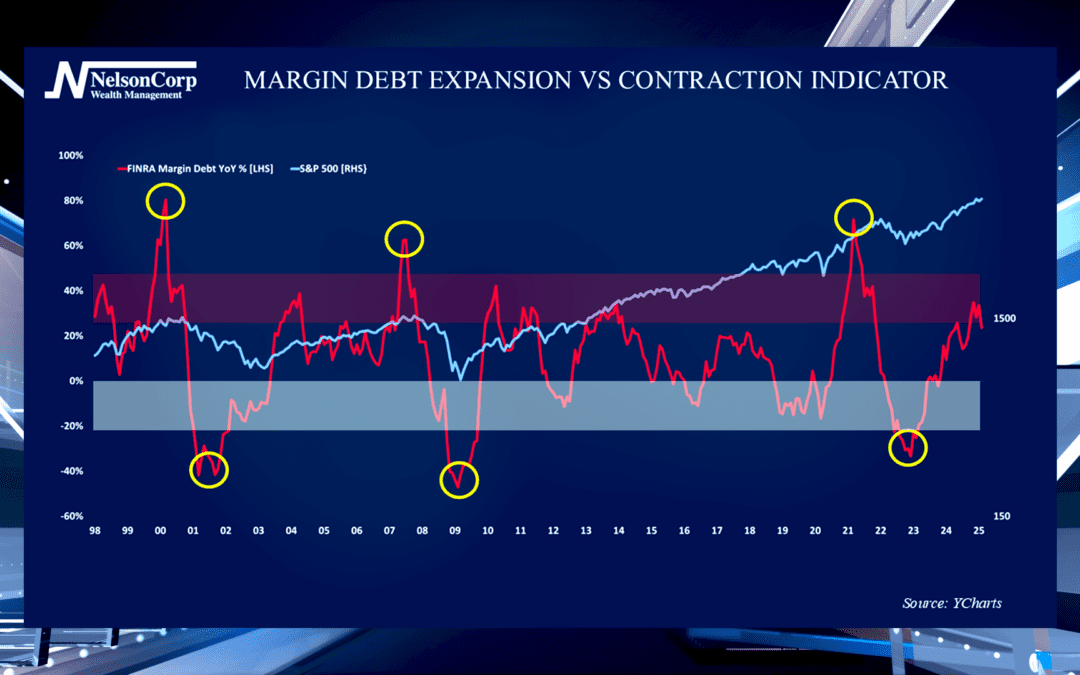

Margin debt is the amount of money investors borrow to buy stocks. David Nelson explains the historical trend of margin debt and why investors should continue to be cautious.