Take It Slow

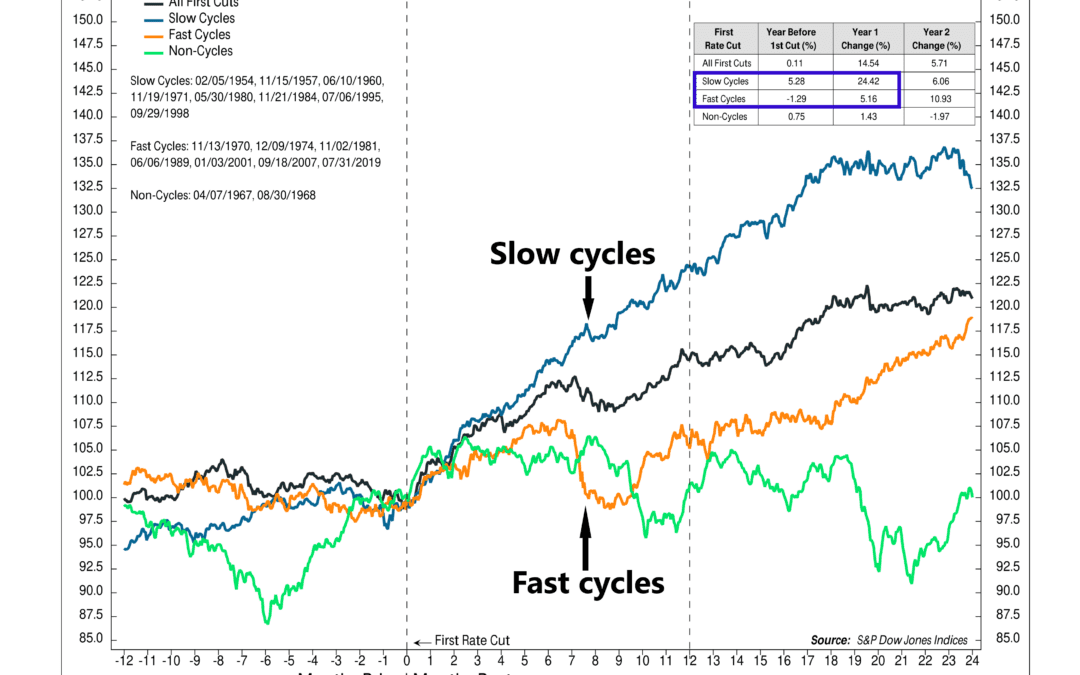

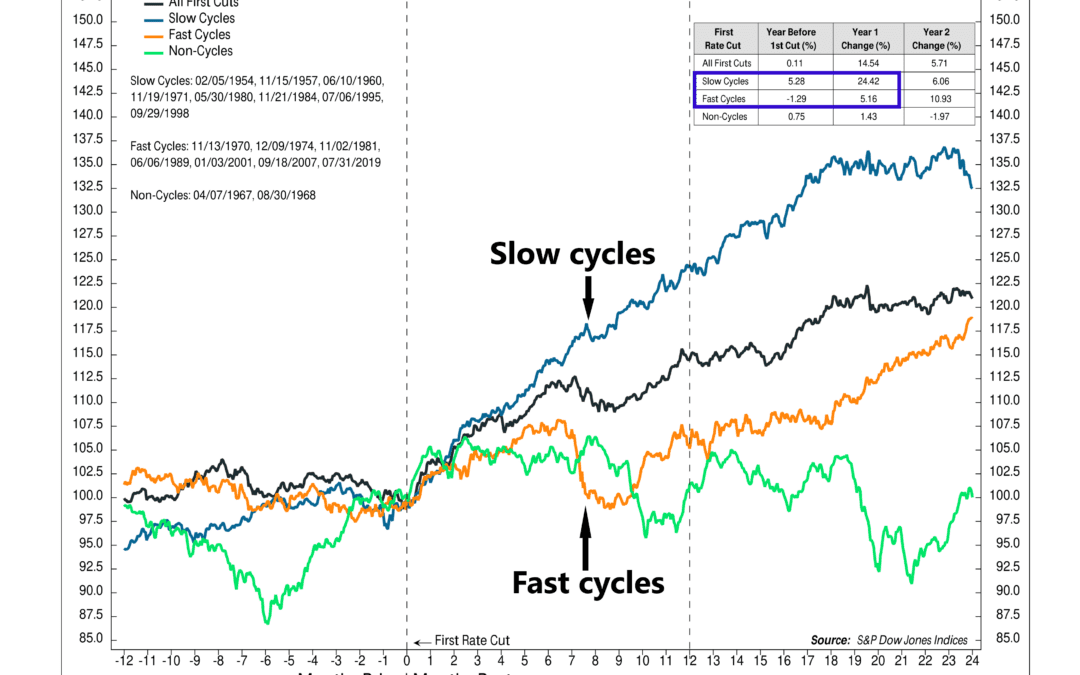

Stocks continued to hit new all-time highs last week. In this week’s commentary, we discuss some of the factors driving the market higher, including why a “slower” Fed is a better Fed when it comes to its rate-cutting ambitions.

Stocks continued to hit new all-time highs last week. In this week’s commentary, we discuss some of the factors driving the market higher, including why a “slower” Fed is a better Fed when it comes to its rate-cutting ambitions.

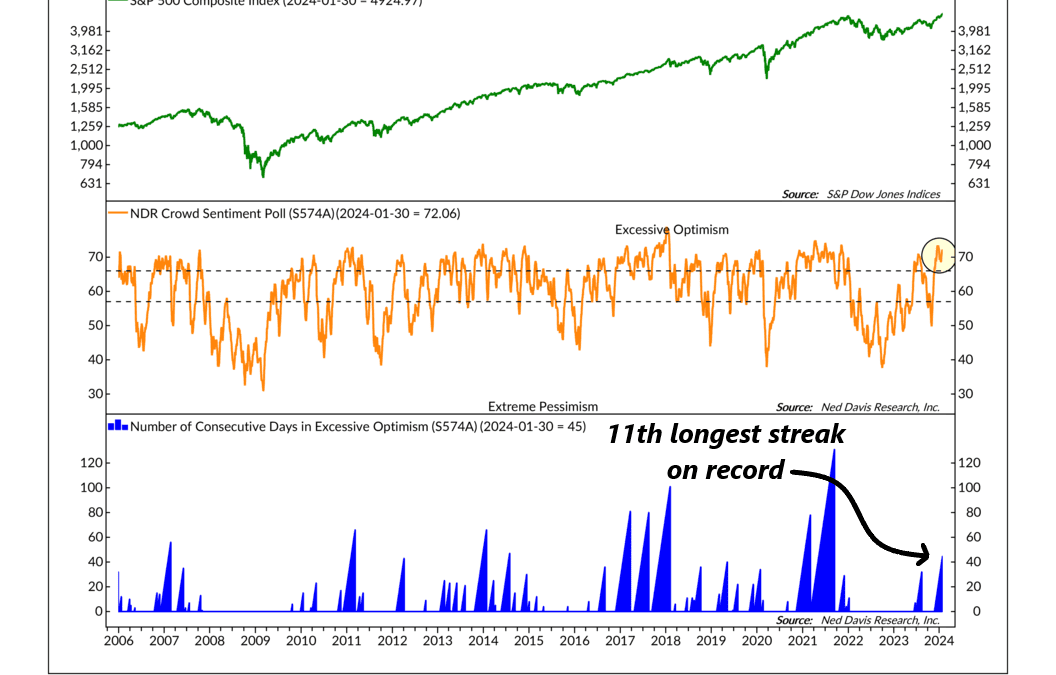

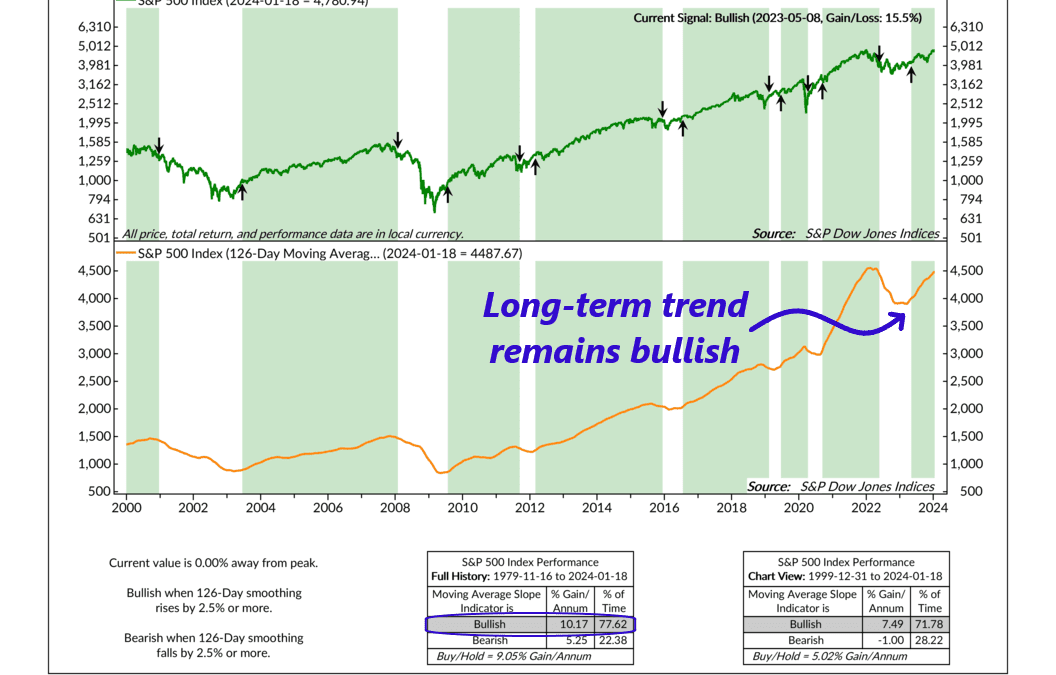

Investors have been on an optimistic streak lately. In this week’s discussion, we take a look at how all this positivity might influence the long-term health of the ongoing bull market.

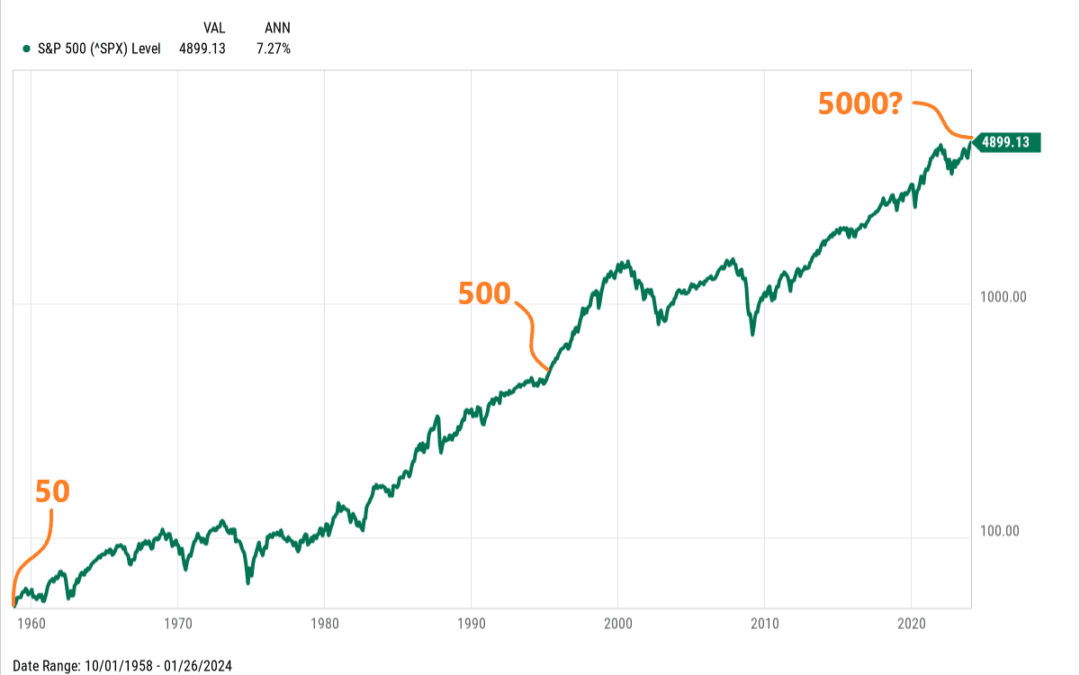

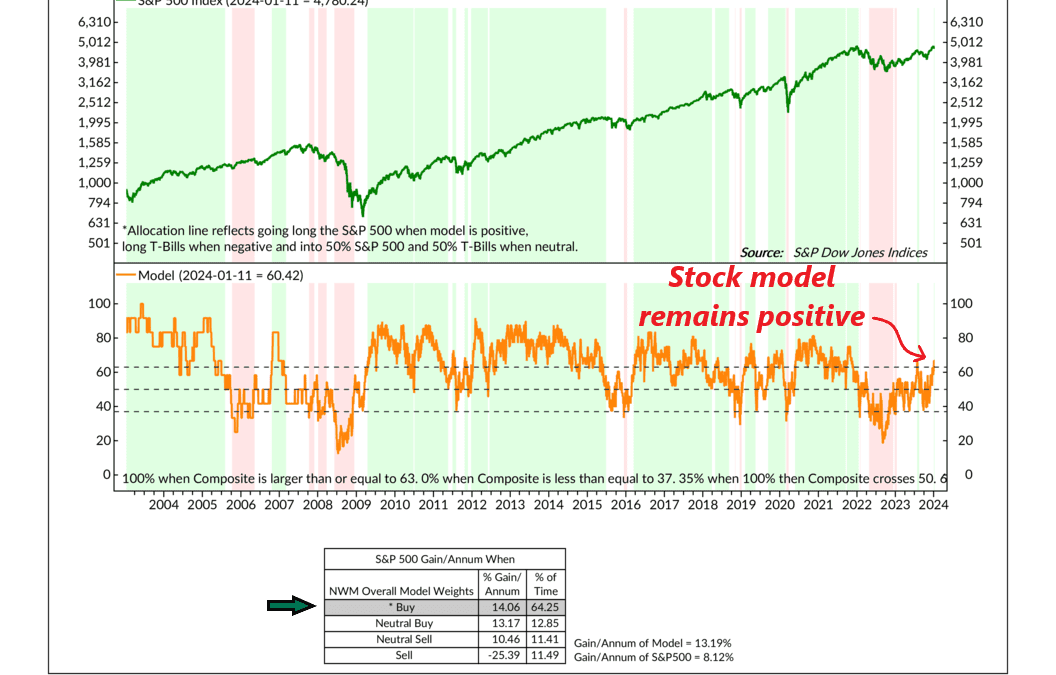

For investors, the price movement of the stock market is often the star of the show. But in the week’s commentary, we discuss the “supporting cast” and how these indicators can help one better manage risk.

Navigating the stock market often feels like a delicate balancing act. In this week’s discussion, we examine the evidence from various indicators to figure out which way the investment scales are tipping.

In this week’s commentary, we highlight a “financial triumvirate” that has formed in our main stock market model and discuss why the market’s fate depends on its strength.

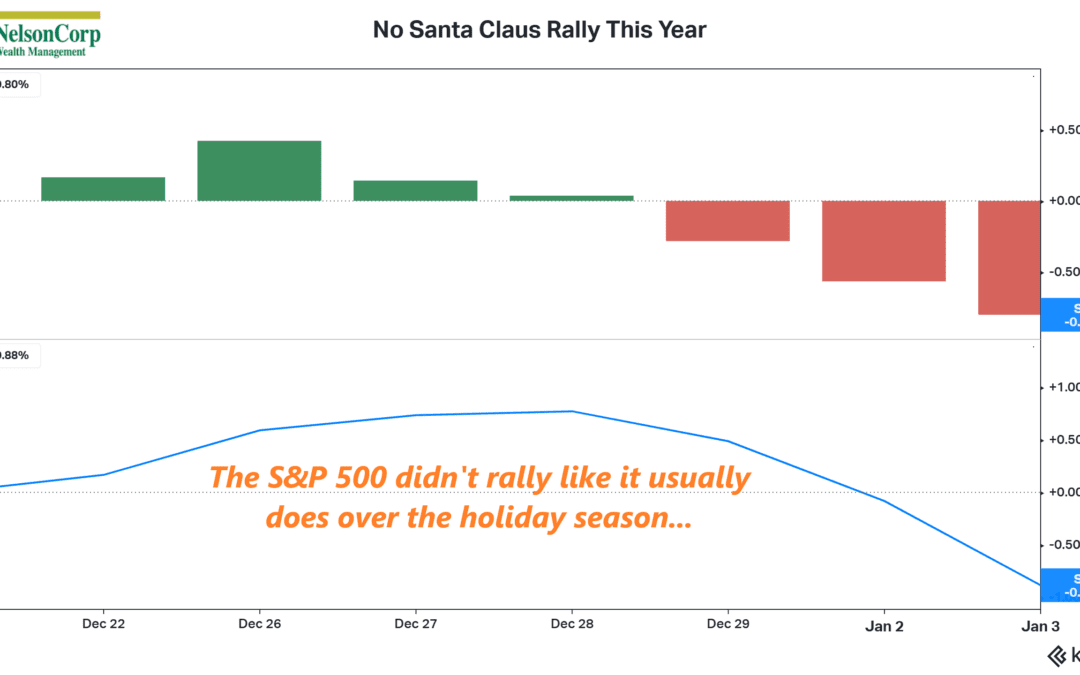

Santa didn’t visit Wall Street this holiday season. In this week’s commentary, we discuss what a failed “Santa Claus Rally” means for stocks and whether investors can end up with more than just a lump of coal this year.