You may or may not have heard the news this week: Moody’s—the credit rating agency—downgraded the United States’ credit rating from its highest level, Aaa, to Aa1. The usual culprits were to blame: rising fiscal deficits, growing national debt, and increasing interest costs.

But the question is—should investors be worried?

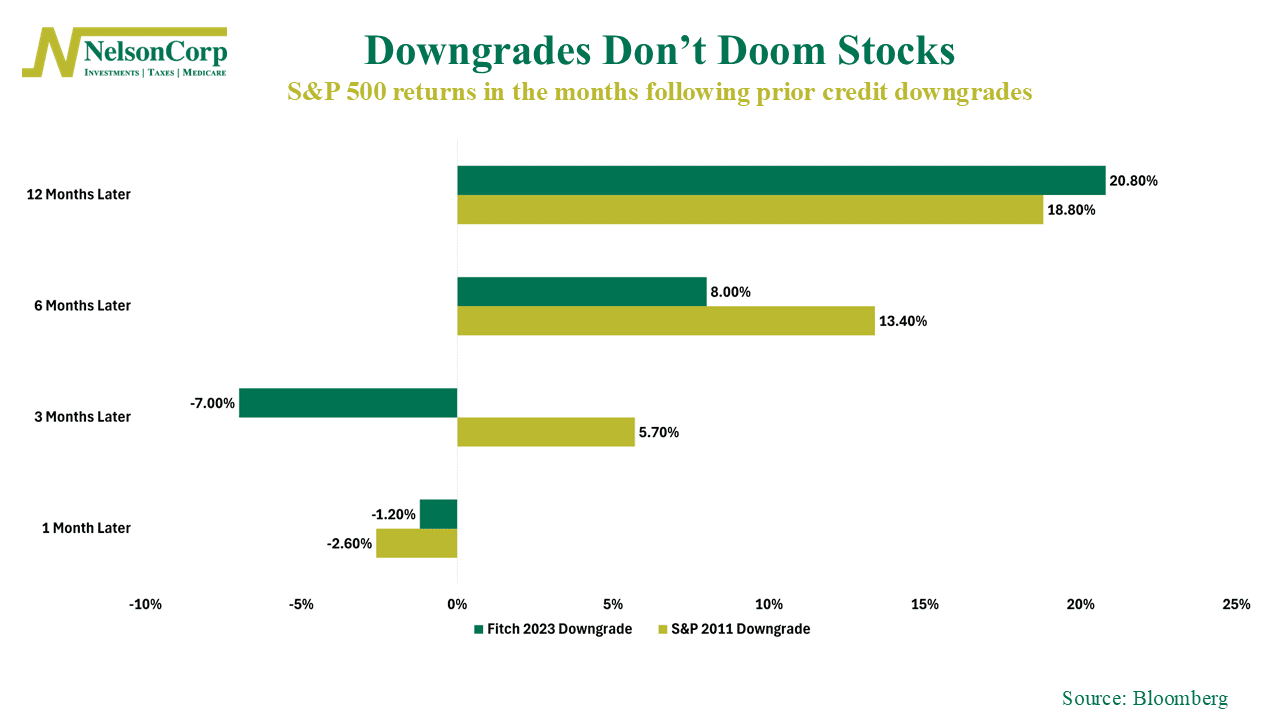

According to this week’s chart, history says probably not. After the 2011 S&P downgrade and the 2023 Fitch downgrade, stocks did slide in the first month or two following the announcement. But the impact didn’t last. Six and twelve months later, the S&P 500 was up—by a substantial margin.

The bottom line? Rising debt levels and long-term fiscal sustainability are real issues. But based on the historical record, credit downgrades have mostly been non-events for markets. They haven’t told us much about where stock prices are headed.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.