One of the more interesting developments this year is the strength in international stocks. For a long time, they’ve trailed the U.S., often by a wide margin. When it came to international diversification, many investors asked themselves: why bother?

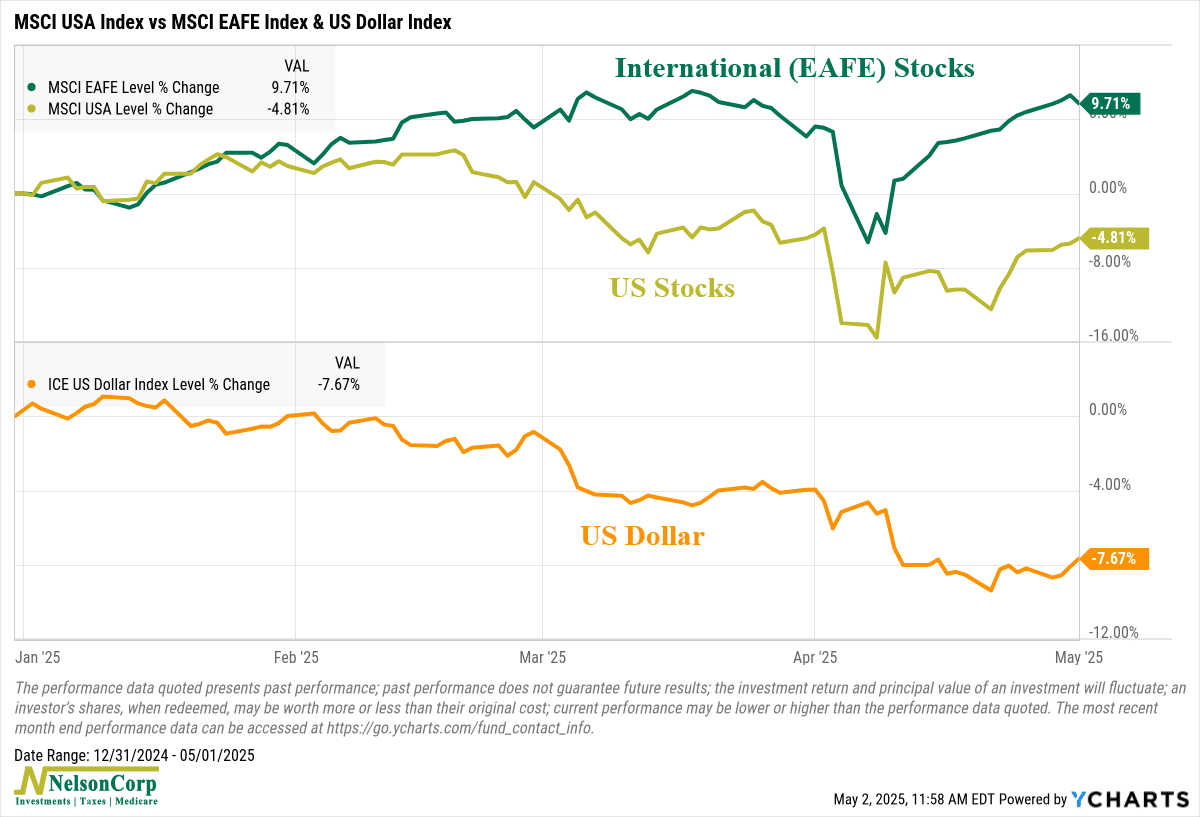

But recently, international stocks have started to hold their own. Developed-market stocks, shown by the green line, have climbed nearly 10% since the start of the year. U.S. stocks, in gold, remain down about 5%.

A big reason for the shift is the dollar. The orange line tracks the ICE U.S. Dollar Index, which has fallen more than 7% year-to-date. A weaker dollar tends to support international returns because your investments in those countries will get more bang for the buck in terms of earnings and dividends.

For investors, it’s a development worth noting. International stocks have struggled for years, but momentum has started to shift. If current trends continue, we think they could play a more meaningful role in portfolio strategy going forward.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The MSCI EAFE Index is a market-capitalization-weighted index that tracks large- and mid-cap stocks in developed markets outside the U.S. and Canada, including Europe, Australasia, and the Far East.

The MSCI USA Index is a market-capitalization-weighted index designed to measure the performance of large- and mid-cap segments of the U.S. equity market.

The ICE U.S. Dollar Index measures the value of the U.S. dollar relative to a basket of six major world currencies, providing a general indication of the dollar’s strength or weakness.