Most of the time, we focus on U.S. market indicators. That’s where most investors spend their attention, and for good reason—U.S. markets dominate global headlines. But strong signals can show up in places people aren’t watching as closely. And when they do, it’s often worth paying attention to.

This week, we’re turning to Europe, where a rare and historically strong signal just showed up.

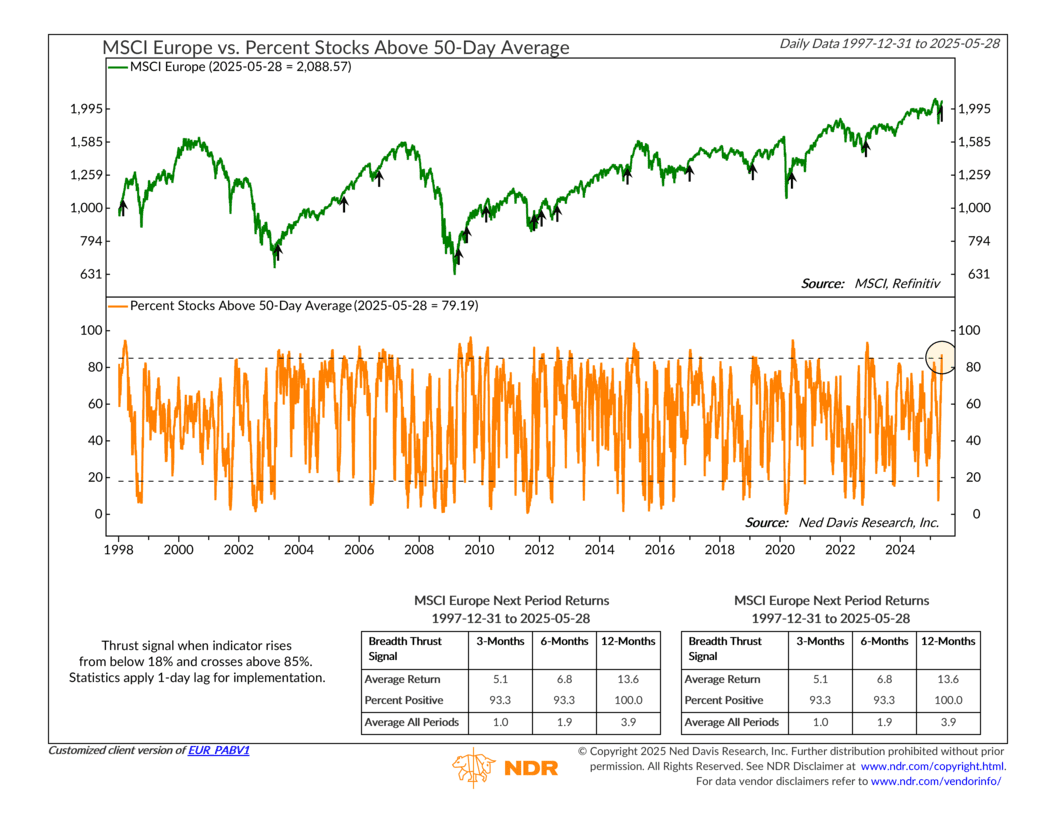

The chart above tracks the MSCI Europe Index (top panel) and the percentage of European stocks trading above their 50-day moving average (bottom panel). That lower line gives us a quick sense of how broad the strength is across the market. Recently, that number jumped over 85%.

This matters because of what came before. Just a few weeks ago, that same percentage was below 18%. When the indicator moves from under 18% to over 85%, it triggers what’s known as a “breadth thrust”—a sharp shift from weakness to strength across a wide range of stocks.

It’s only happened 15 times since 1997. But when it has, the results have been consistently positive. On average, the MSCI Europe Index returned 5.1% over the following 3 months, 6.8% over 6 months, and 13.6% over the next year. In most of those cases—93% to 100% of the time—returns were positive.

You can see those signals marked by arrows on the top panel. They tend to come after markets have gone through a tough stretch, when investor sentiment is still cautious but conditions are starting to improve.

These kinds of signals don’t appear often. But when they do, they’re worth noting.

The bottom line? Right now, European stocks are showing broad strength—something we haven’t seen in a while, and something that has often led to solid gains in the past.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The MSCI Europe Index is a free float-adjusted market-capitalization-weighted index designed to measure the performance of large- and mid-cap stocks across developed European markets.