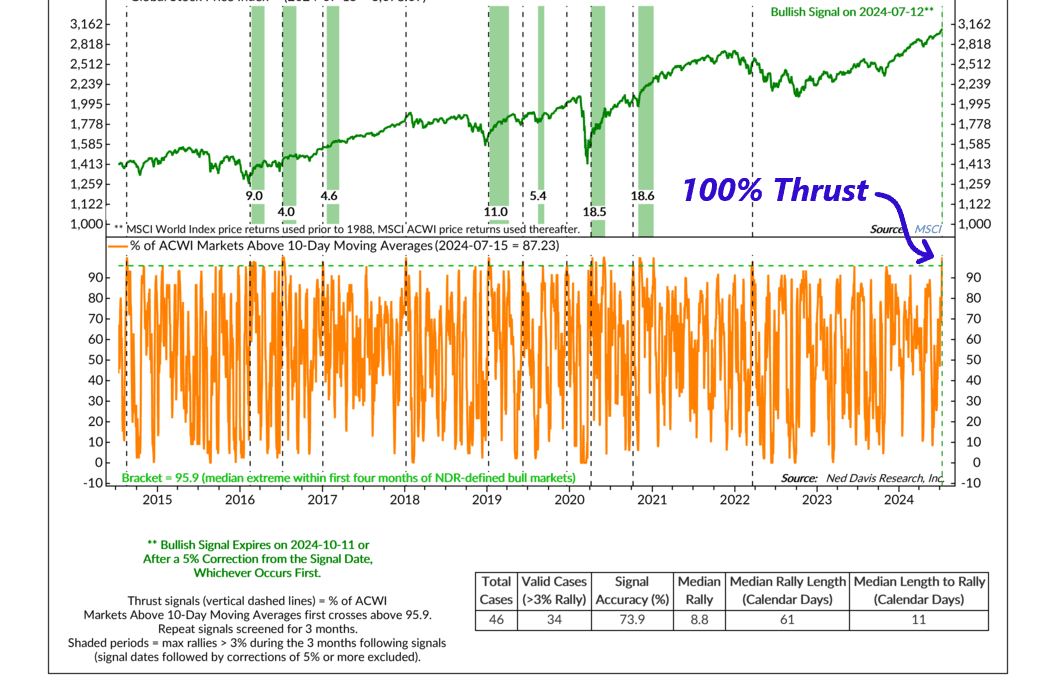

by NelsonCorp Wealth Management | Jul 18, 2024 | Indicator Insights

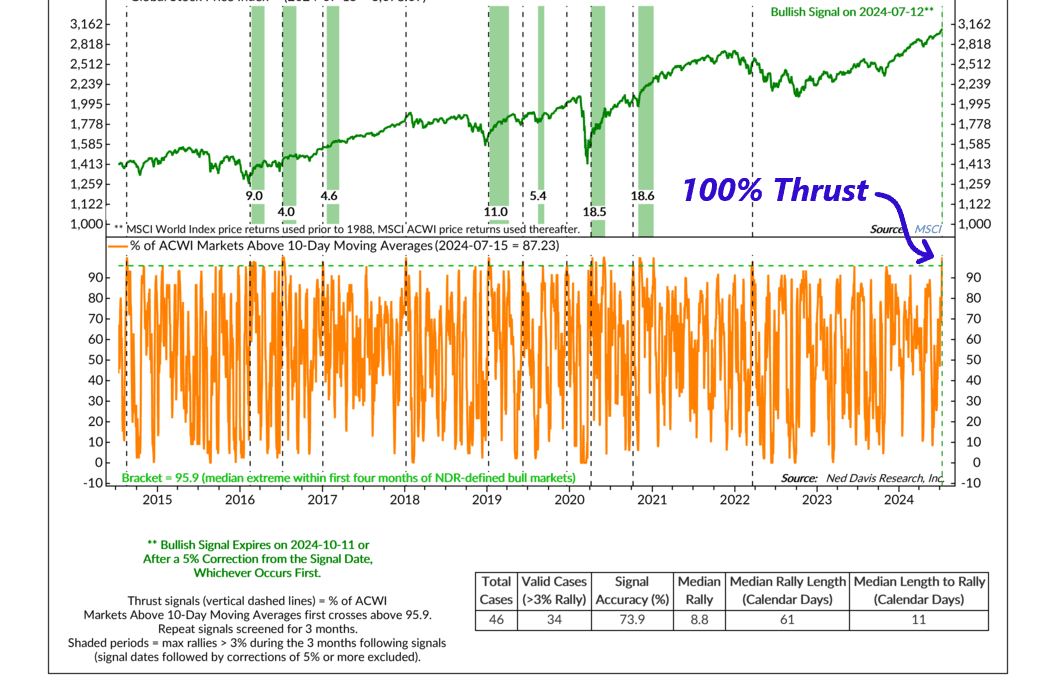

After nearly 2 ½ years, we finally experienced a global breadth thrust last week. What’s a global breadth thrust? Well, it basically means a whole bunch of stocks around the world moved significantly higher at the same time—and in a relatively short period of...

by NelsonCorp Wealth Management | Jul 11, 2024 | Indicator Insights

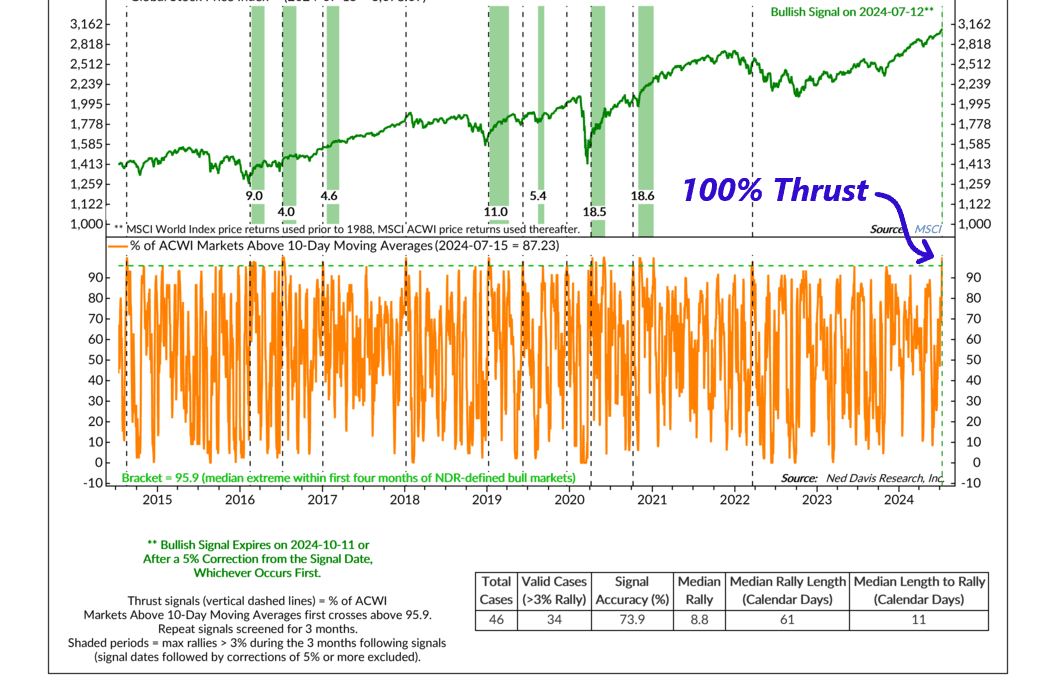

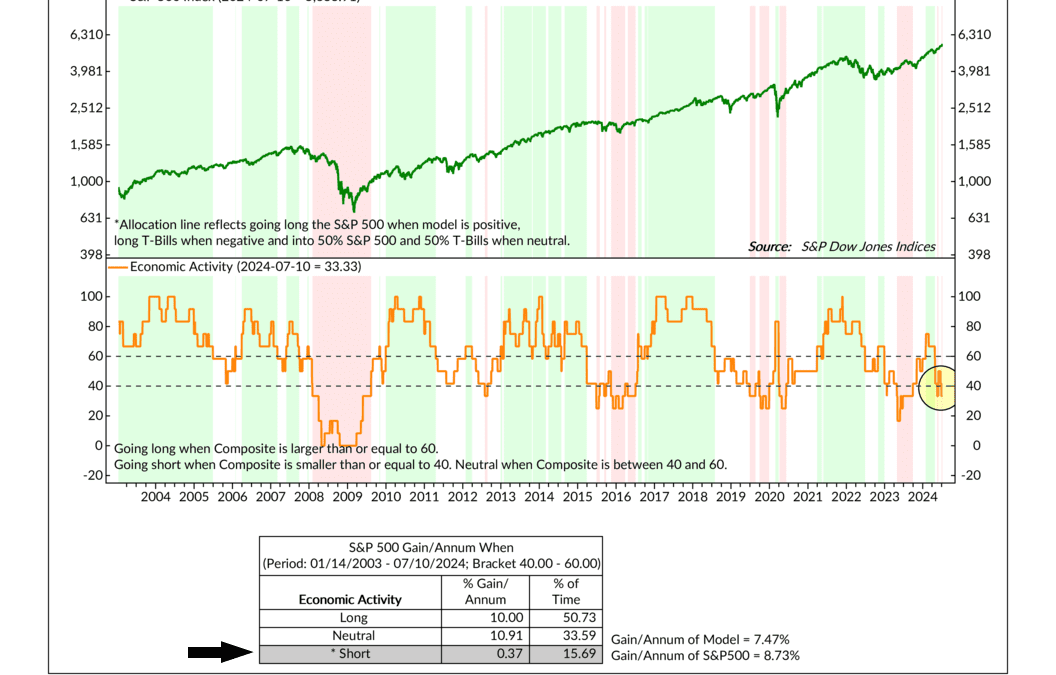

This week’s indicator is all about the economy. It’s a composite indicator comprising six individual indicators that each track some sort of economic activity—ranging from stock market earnings and industrial production to layoff announcements and various other...

by NelsonCorp Wealth Management | Jul 4, 2024 | Indicator Insights

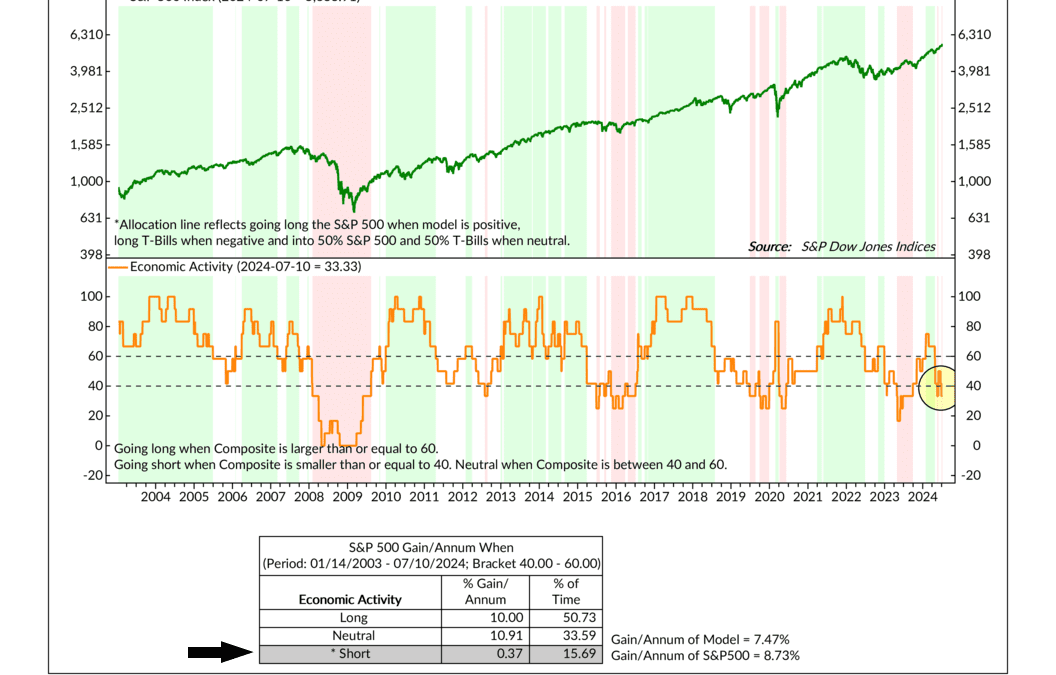

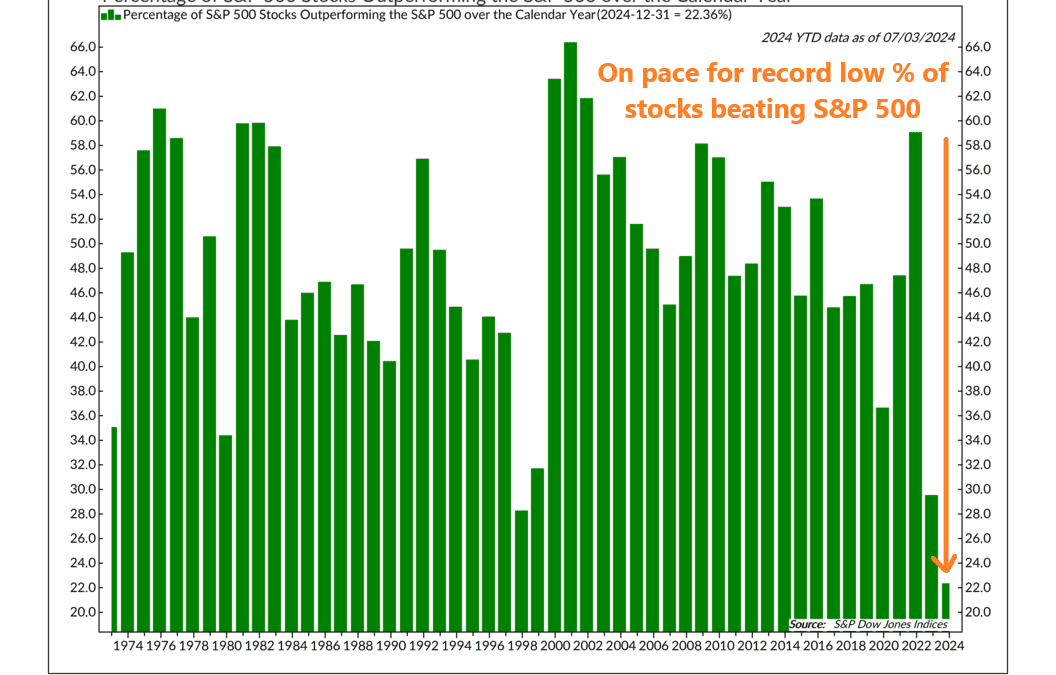

Participation is an important component of stock market returns. What do I mean by participation? Simply put, it refers to how many stocks within a market index—like the S&P 500—are joining in a rally. The more stocks trending upwards, the healthier the overall...

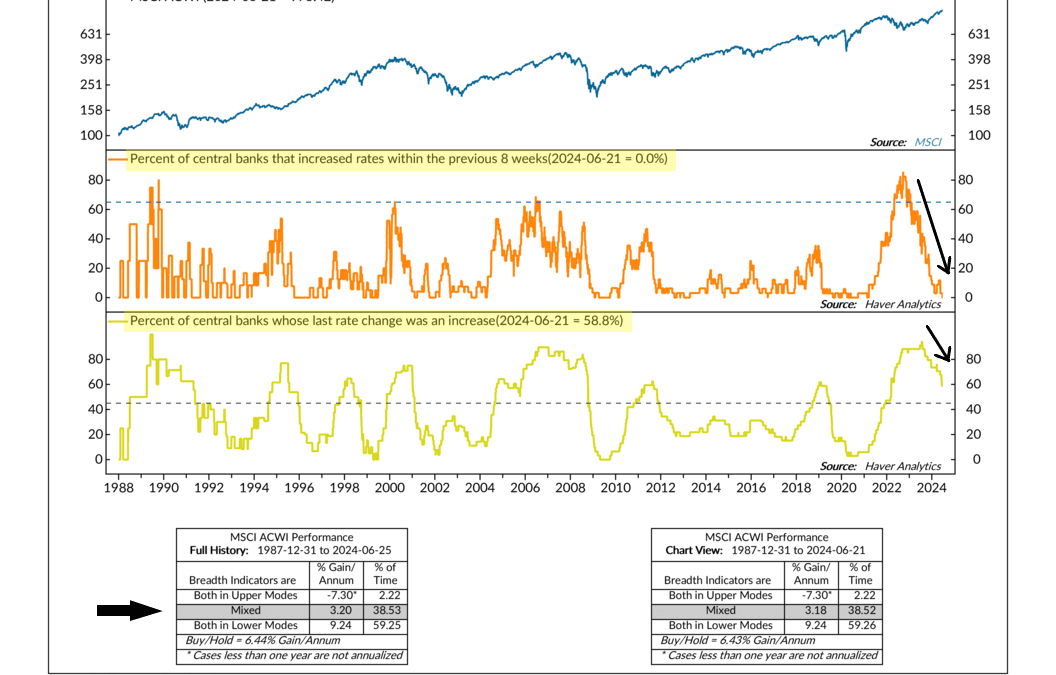

by NelsonCorp Wealth Management | Jun 27, 2024 | Indicator Insights

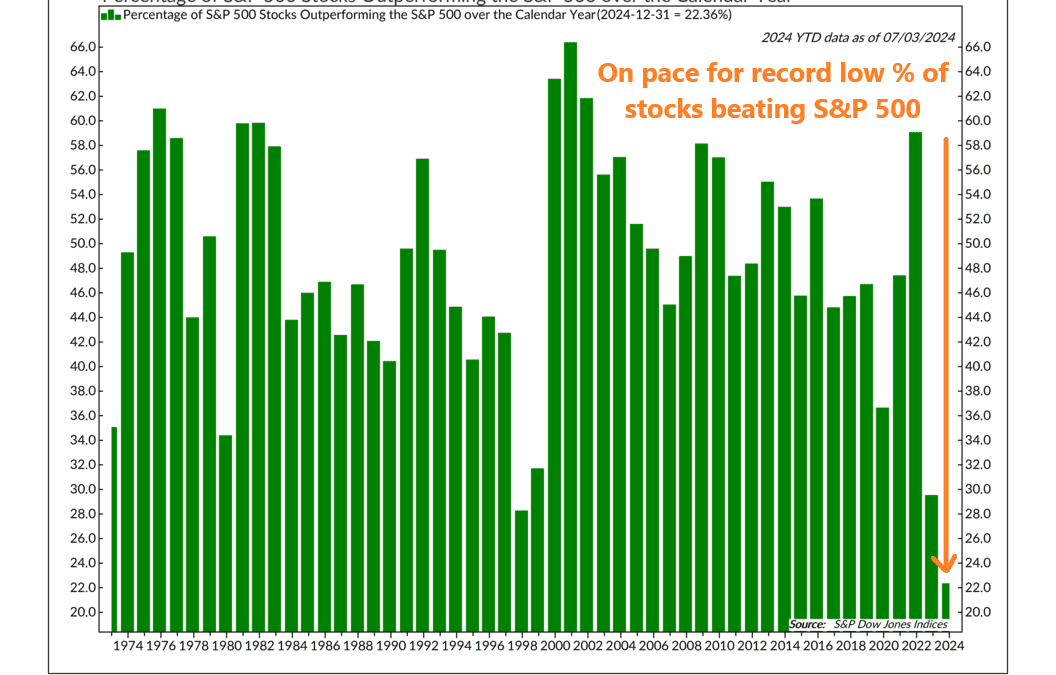

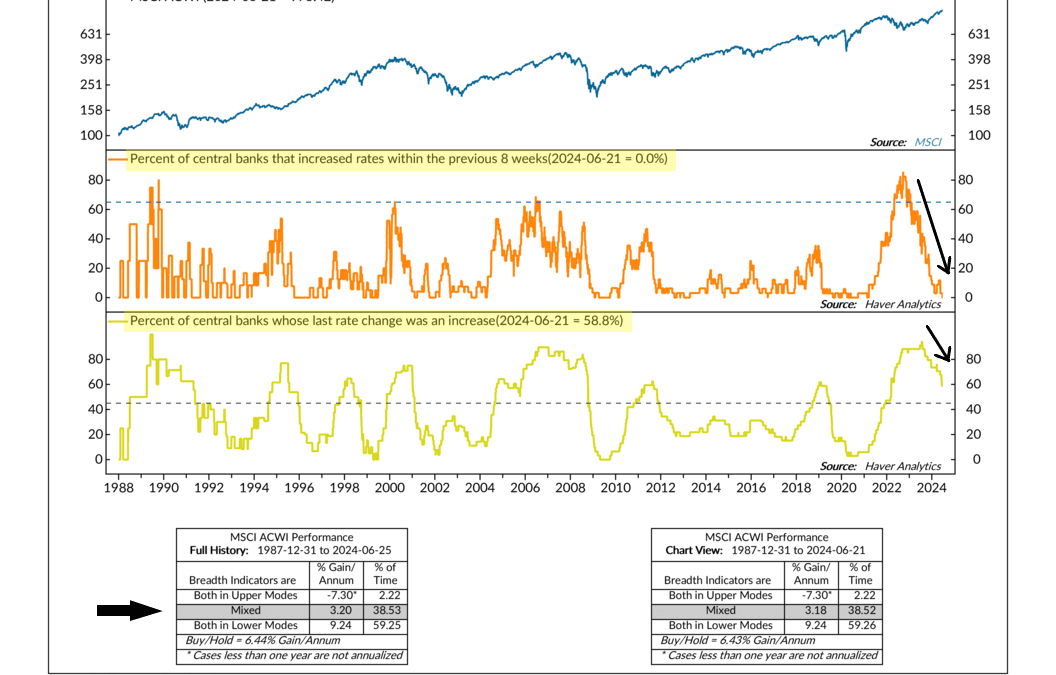

Central banks play a big role in financial markets. When they adjust interest rates—either cutting or raising them—it has a big impact on financial prices. In recent years, these interest rate movements have been a hot topic. So, for this week’s indicator,...

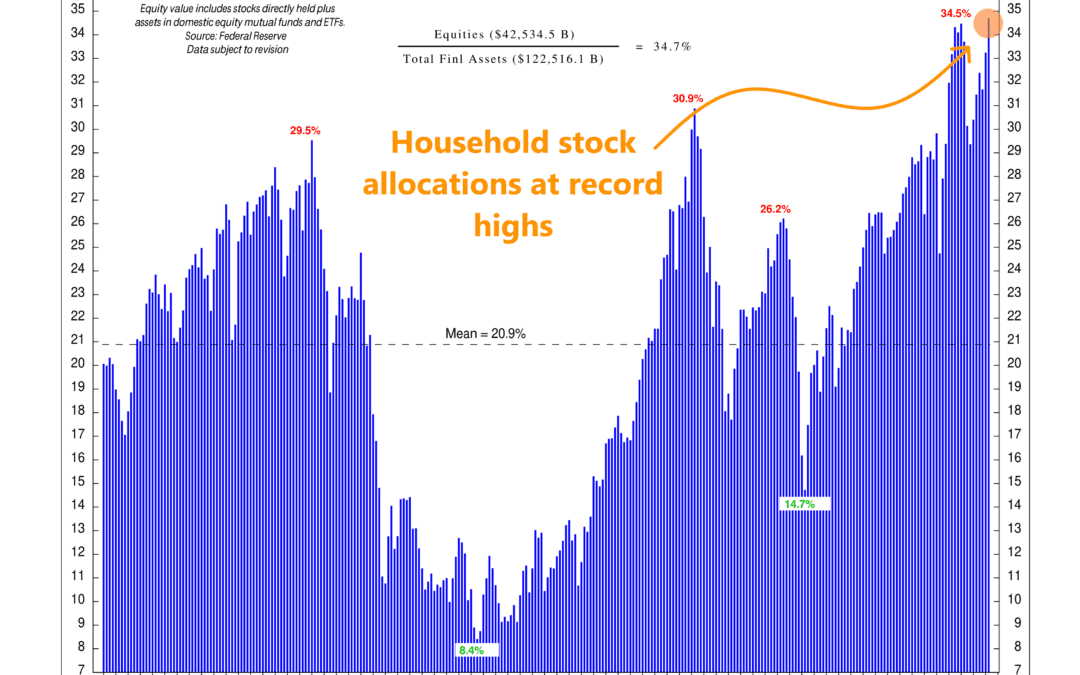

by NelsonCorp Wealth Management | Jun 20, 2024 | Indicator Insights

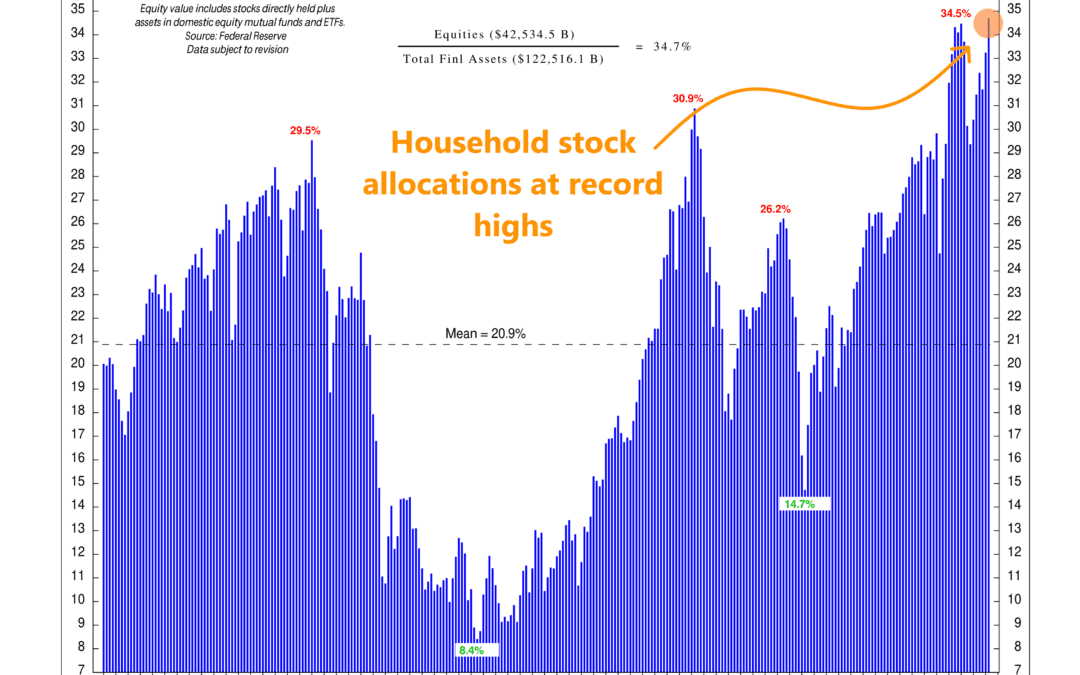

“I’m all in!” According to this week’s featured indicator, that’s what investors have been saying about the stock market recently. Specifically, the indicator above measures stocks as a percentage of household financial assets, revealing how much households are...

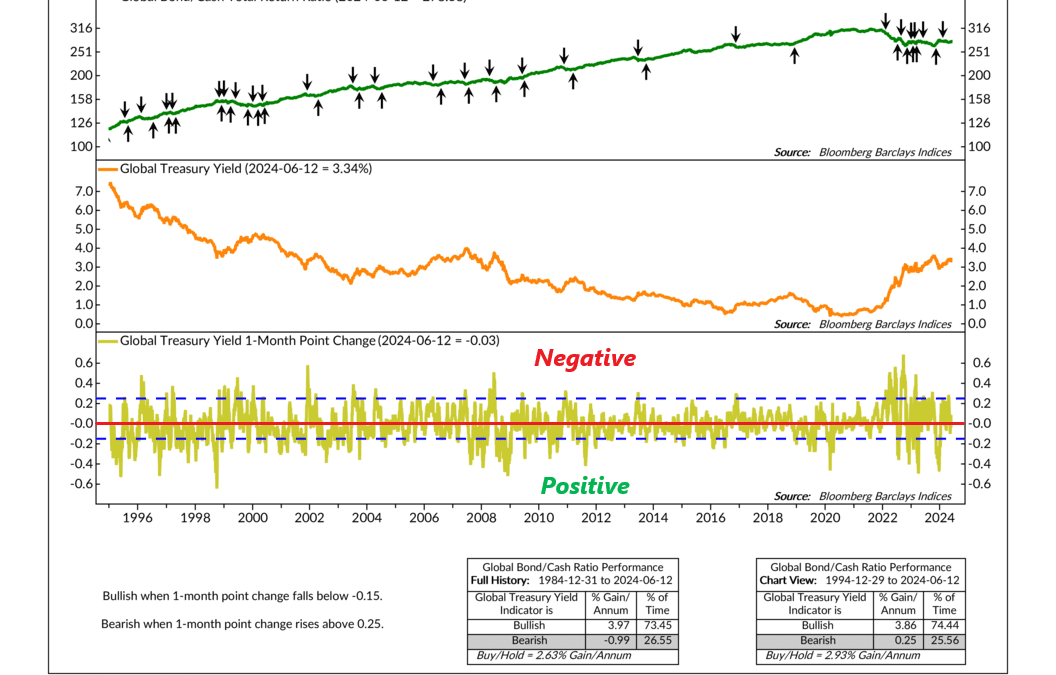

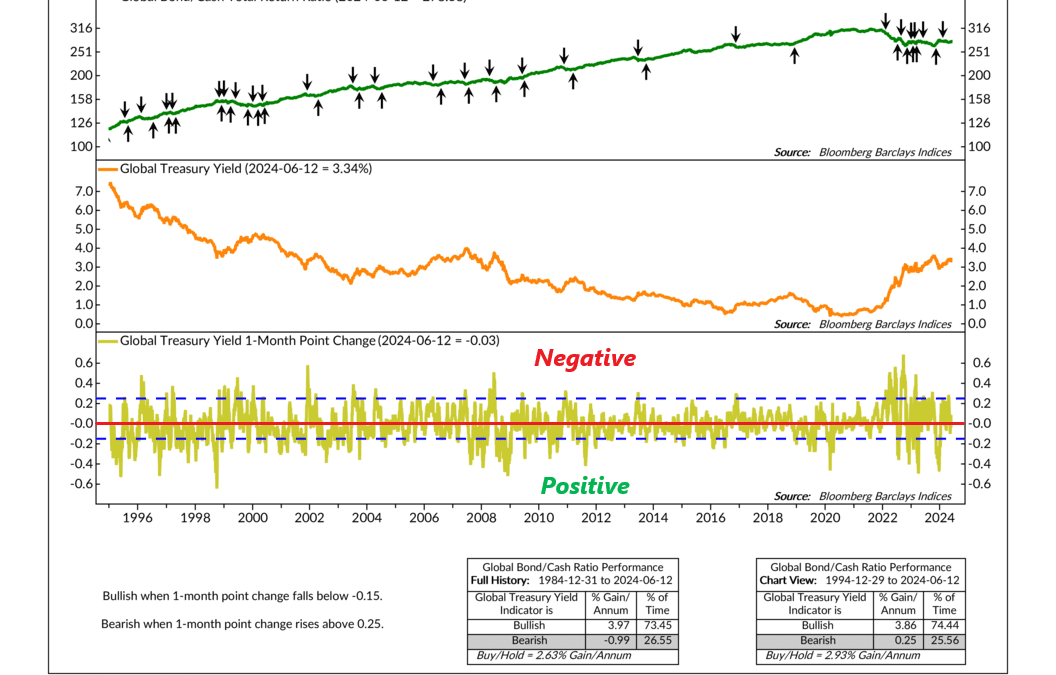

by NelsonCorp Wealth Management | Jun 13, 2024 | Indicator Insights

This week’s featured indicator is kind of like a wrench. When you turn a wrench, it creates a force called torque that helps move an object. But in this case, global treasury yields are the wrench, and the object being moved is the global bond/cash ratio. Let...