OVERVIEW

The U.S. stock market’s performance was mixed last week, as the S&P 500 index rose 1.25 percent, and the Nasdaq Composite fell 1.08 percent.

The industrial sector led the market higher, followed closely by materials and healthcare. Technology, however, fell 1.2 percent.

Developed country stocks had a good week, rising about 2.19 percent. In contrast, emerging market stocks fell by 1.33 percent.

Bond yields fell, and prices rose last week, with the largest gains accruing to high-yield and investment-grade bonds.

Real estate also saw a decent weekly return of about 0.7 percent.

Commodities were mostly mixed, as gains in gold and oil were offset by losses in agricultural goods such as corn.

Finally, the U.S. dollar fell about 70 basis points and is now in negative territory for the year.

KEY CONSIDERATIONS

Airplanes and Parachutes – How is the U.S. consumer doing? Well, one way to find out is to ask them.

Every month, the University of Michigan conducts telephone surveys to gather information on consumer expectations regarding the economy. They then compile these answers into a consumer sentiment index.

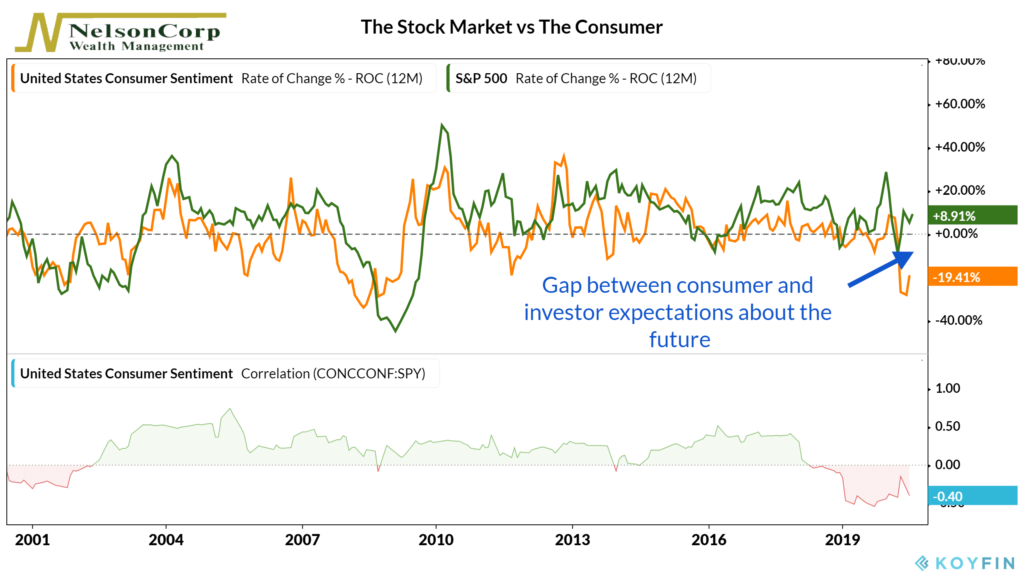

Last month, this index fell about five points. On a year-over-year basis, it has fallen roughly 19.4 percent, the steepest decline since 2008.

However, the stock market, measured here by the S&P 500 index, is up about 8.9 percent on a year-over-year basis.

This is the disconnect between the stock market and the economy people have been talking about. While one has been going up, the other has been moving down.

To see this visually, we show the year-over-year change in the S&P 500 index (green line) alongside the year-over-year change in the U.S. Consumer Sentiment index (orange line).

Historically, they have moved together. The bottom portion of the chart shows the correlation between the two, which is just a fancy way of measuring how much they tend to move together over time.

For most of the past 20 years, the correlation has been above zero. But the relationship has recently turned decidedly negative, meaning that stocks and consumer sentiment are moving in different directions.

So, are stock market investors too optimistic? Or are consumers too pessimistic?

…It’s hard to say.

From an economic standpoint, it makes sense that stock returns and consumer sentiment are linked, as consumers buy the products that companies sell. But these are both forward-looking indicators, so it’s difficult to say which one “predicts” the other.

The truth is likely somewhere in between, as these two measures will eventually come together over time. We just don’t know where that point will ultimately be.

Uncertainty over the future is the ultimate culprit here. But that’s not always bad.

It’s been said that both optimists and pessimists are good for society because as one invents the airplane, the other creates the parachute.

For investors, this translates to not being afraid to take the risks needed to capture upside returns, while simultaneously managing those risks so you’re not wiped out if and when disaster strikes again.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.