OVERVIEW

Technology and healthcare stocks helped push the U.S. stock market higher last week.

The S&P 500 index rose 1.86 percent, and the tech-heavy Nasdaq Composite rose 3.73 percent.

Internationally, developed country stocks were on par with the U.S., rising about two percent.

Emerging market stocks did less well, gaining about 1.45 percent.

While U.S. Treasury bonds were mostly flat for the week, both investment-grade and high-yield bonds had decent weekly gains of 0.95 and 0.87 percent, respectively.

Commodities had a good week, led by rising oil and copper prices. As the world economy reopens for business, demand for these raw materials has increased significantly.

The U.S. dollar, although in a downtrend recently, had a gain last week of just under half a percent.

The VIX index, which measures stock market volatility, came down a bit last week but is still closing at an elevated reading of around 35.

KEY CONSIDERATIONS

The Path of Least Resistance – Investing, in another word, is risk-taking. Risk-taking involves uncertainties, so there is no such thing as a sure thing (otherwise it would be called sure-thing-taking). However, there are two rules of thumb in investing that generally go a long way to ensuring that the odds will lean in your favor.

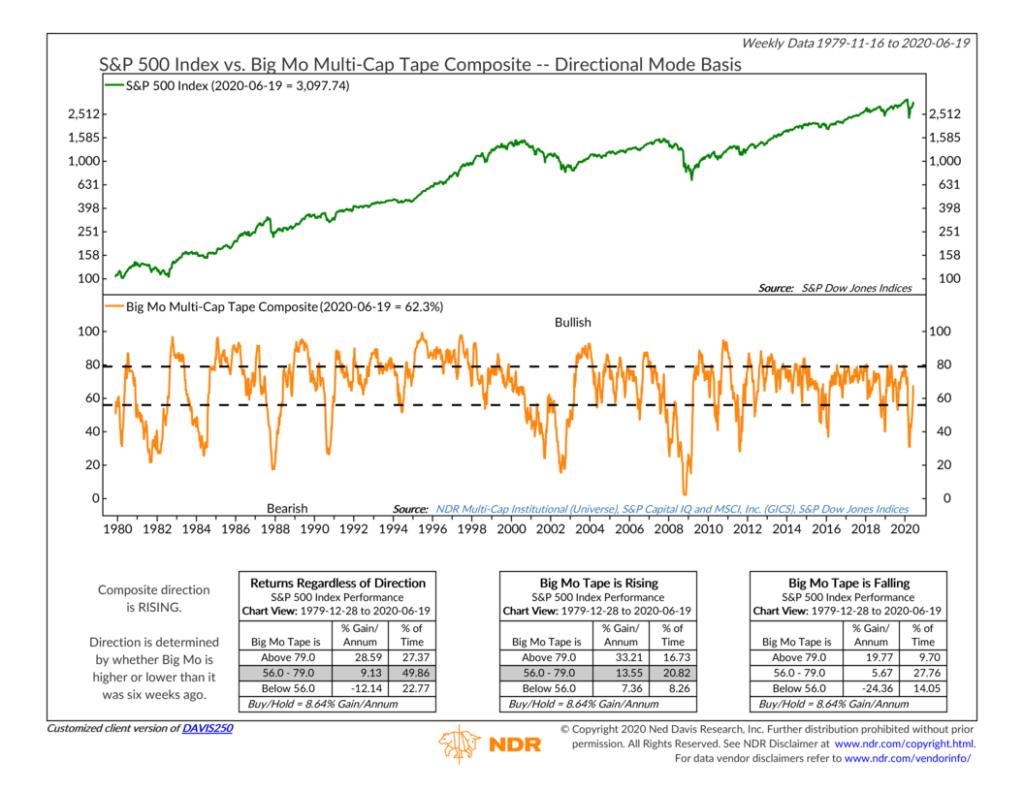

The first: Don’t fight the tape. By tape, we mean the price movement of the stock market itself. In general, this usually involves comparing stock prices today to some price (or series of prices) in the past. This can be done in many different ways, but if the trend is pointing up, it tends to indicate that momentum favors higher prices. The best course of action, then, is to follow the path of least resistance and ride the trend higher.

Currently, the trend does appear to be up. The percentage of sub-industries in the U.S. stock market that have favorable price trends is much higher than it was just six weeks ago. These trends have softened a bit lately, but in general, the overall trend remains bullish.

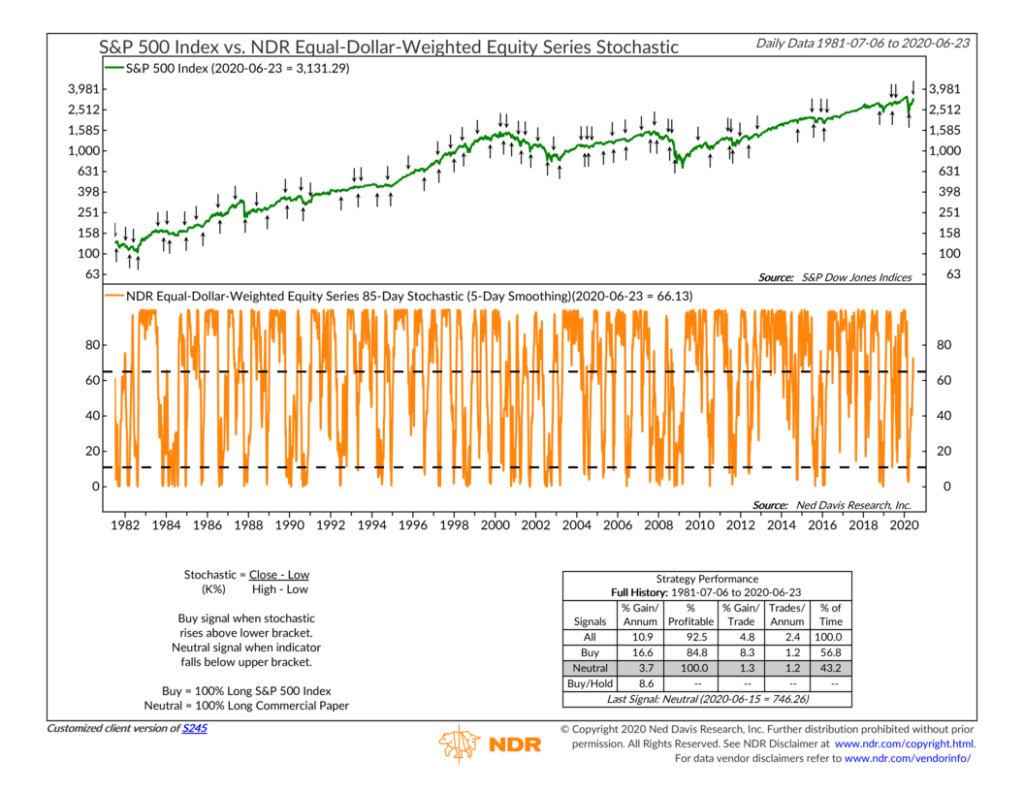

However, I would note that as a counterpoint to this bullish argument, price momentum has undoubtedly slowed recently. Last week we received a warning signal from an indicator that has been pretty darn accurate so far this year calling reversal points.

This 85-day Stochastic indicator gave a sell signal on February 25th, just four days after the S&P 500 peaked. And then it gave a buy signal on March 26th, only three days after the market bottomed. It is now back on a sell signal, an indication that the rally from the lows may have run out of steam.

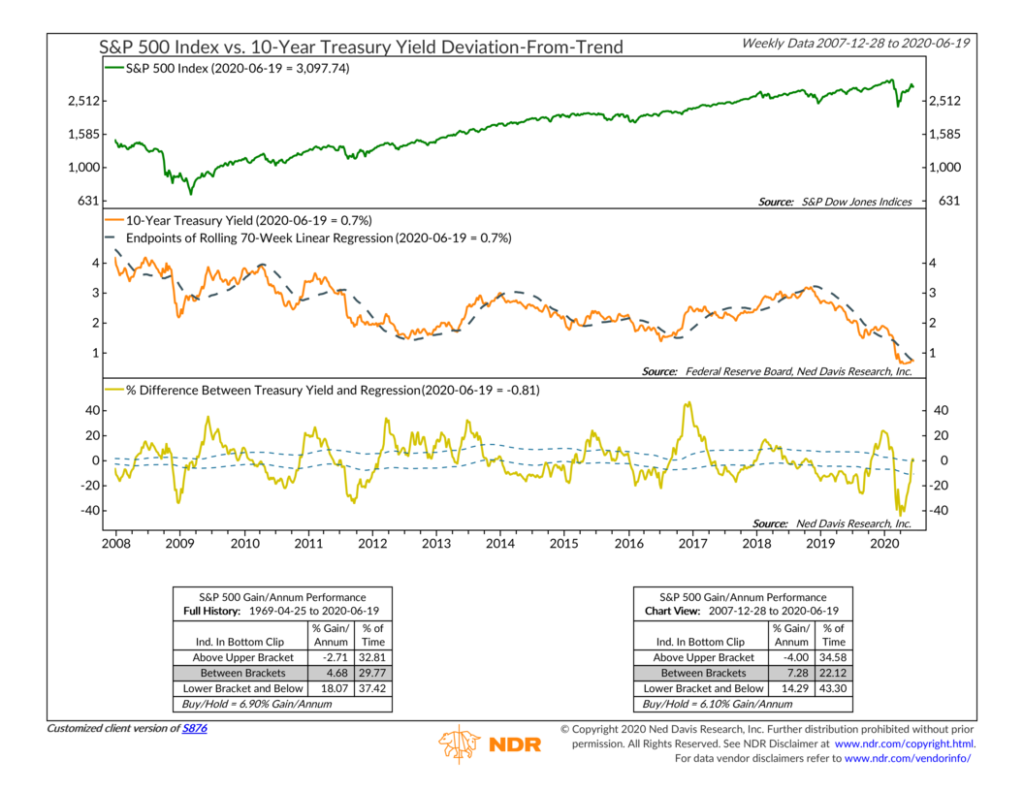

The second rule of investing, however, states that one shouldn’t fight the Fed. The Fed refers to the Federal Reserve, which sets short-term interest rates in the U.S. economy. Again, there are many ways in which we can represent how the Fed is affecting the economy, but to keep it simple, we will look at the trend in interest rates.

In this case, we examine the 10-year Treasury note yield and compare it to its 70-week linear regression line. If rates are coming in lower than their recent trend, it’s a sign that the Federal Reserve is engaging in accommodative monetary practices and pushing longer-term rates in the economy lower. This is a positive sign because lower interest rates tend to be good for borrowers in particular and the stock market in general.

Looking at recent history, the 10-year Treasury yield has been on a strong downward trend since late 2018. It looked as if rates might rise above this trend recently, but they have again started falling in line with the trend.

The path of least resistance, then, is not to fight the Fed or the tape, and ride the bullish trends until our risk measures say otherwise.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.