OVERVIEW

Another volatile week on Wall Street saw the major U.S. stock indices end in mixed territory. The S&P 500 rose 0.82%, the Dow declined 0.06%, and the NASDAQ rose 1.08%.

Growth stocks had a good week, climbing around 1.12%, followed closely by the 0.88% gain for value stocks.

Across the pond, returns were weaker. Developed country stocks fell around 2.6%, and emerging markets slipped by 4.85%.

The Treasury markets sold off, with intermediate-term Treasuries losing 0.38% and long-term Treasuries dropping 1.04%. Investment-grade bonds also declined around 0.5%, but high-yield (junk) bonds rose around 0.37%.

Real assets, on the other hand, had a strong week. Real estate rose 2.04%, and commodities gained 0.69%. Oil was up around 1.65%, corn rose 0.46%, and gold slipped 0.64%. The U.S. dollar strengthened around 0.47%.

KEY CONSIDERATIONS

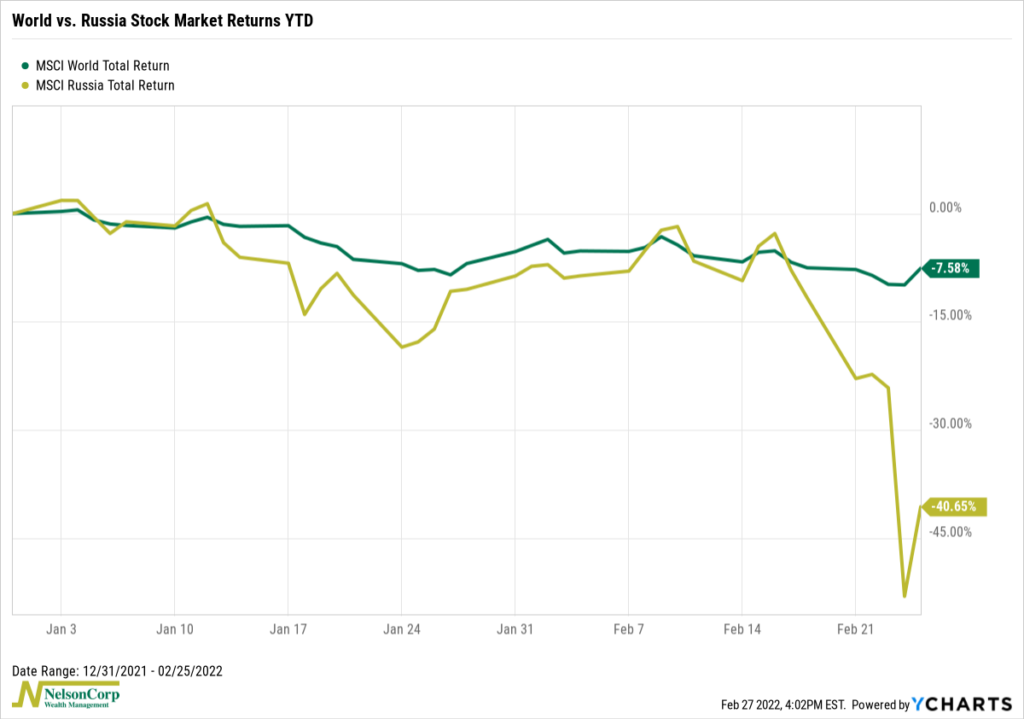

Uncertainty Abounds – Geopolitics took center stage last week as Russia invaded Ukraine, resulting in a major selloff in Russian financial assets. While the MSCI World Index—a proxy for the global stock market—is down roughly 7.6% year-to-date, the MSCI Russia Index got absolutely clobbered last week, tumbling more than 50% before rebounding to end the week down 41% for the year.

Investors punished Russian financial assets in anticipation of the crippling economic sanctions that were sure to follow from Western nations. And sure enough, we really saw the sanctions ratchet up this past weekend, with news that even Russia’s central bank could be sanctioned itself.

A big question on the minds of U.S. investors, then—other than the obvious human considerations—is will this have any spillover effects on U.S. financial markets?

It certainly could. Events in Europe could add to already strained supply chain disruptions and further increase global inflationary pressures. But, at the same time, soaring energy prices could also bring about a regional recession that depresses U.S. economic growth.

Inflation has been a hot-topic issue for the American economy as of late, which has the market expecting multiple rate hikes from the Fed this year. So, it will be interesting to see if the path or speed of these rate hikes changes at all due to what is happening in Europe.

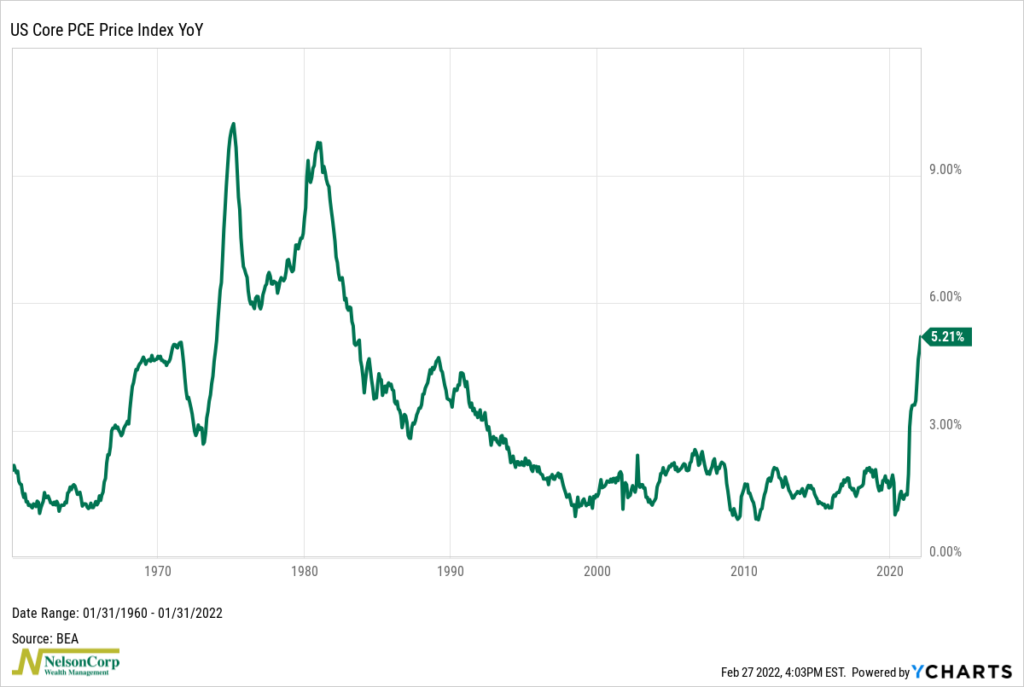

We did get the most recent reading of the Core PCE Price Index last week, shown on the chart below. This is the Fed’s preferred measure of inflation that excludes the economy’s more volatile food and energy sectors.

It rose 5.2% last month from a year earlier, the sharpest 12-month increase since April 1983. So, geopolitical concerns aside, a consistent trend of higher inflation like this is the kind of stuff that will keep the Fed pursuing a much tighter monetary policy in the coming months.

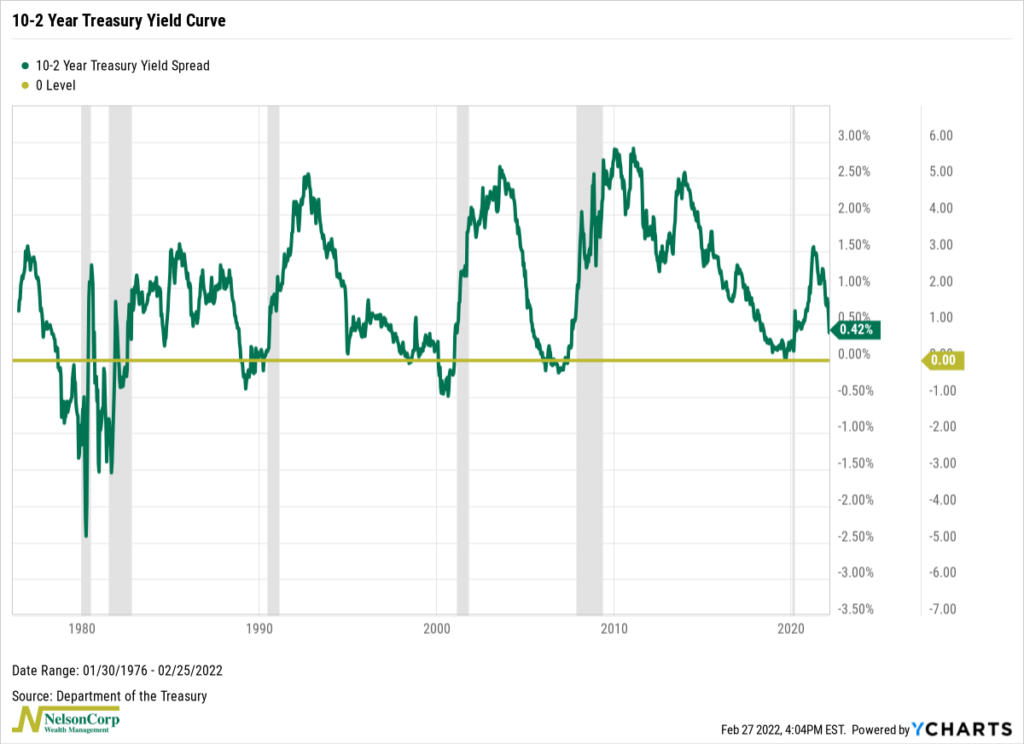

But the other concern—as stated above—is that the Fed could be getting ready to raise rates when economic growth is starting to slow. The yield curve—which we define here as the 10-year Treasury rate minus the 2-year Treasury rate—tends to invert (fall below zero) in the months leading up to a U.S. recession.

As you can see from the chart above, the yield curve widened to about 1.5% last year as we recovered from the pandemic-induced recession; however, it has reversed course since then and has fallen all the way back to around 0.42%. This might be a sign that investors expect aggressive rate hikes from the Fed to curb inflation but also slow economic growth in the process. If the yield curve inverts, it could even signify that another recession is on the horizon, which would be troublesome for the stock market.

Basically, the fixed-income markets are sending conflicting signals right now. On the one hand, they are pricing in an aggressive rate-hiking cycle from the Fed over the coming year. But, on the other hand, they are also suggesting that there is an increased risk of a recession on the horizon, which would imply fewer rate hikes.

So, all this is to say that there is no shortage of uncertainty in the marketplace today. Now more than ever it’s important to have a proper risk management plan in place to navigate through these tumultuous times.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.