Last week, we looked at how the market has remained fairly upbeat about earnings. This week’s discussion builds on that, digging into just how broad that optimism really is—or isn’t.

This week’s indicator tracks the percentage of S&P 500 market capitalization tied to companies with rising analyst earnings estimates. In other words, it shows how much of the market is seeing improving expectations. That may sound like a wonky detail, but it often acts as an early gauge of investor sentiment and corporate health. When the number is rising, it usually means earnings are broadening out. But when it’s falling, the growth picture starts to narrow—and that’s when investors should take notice.

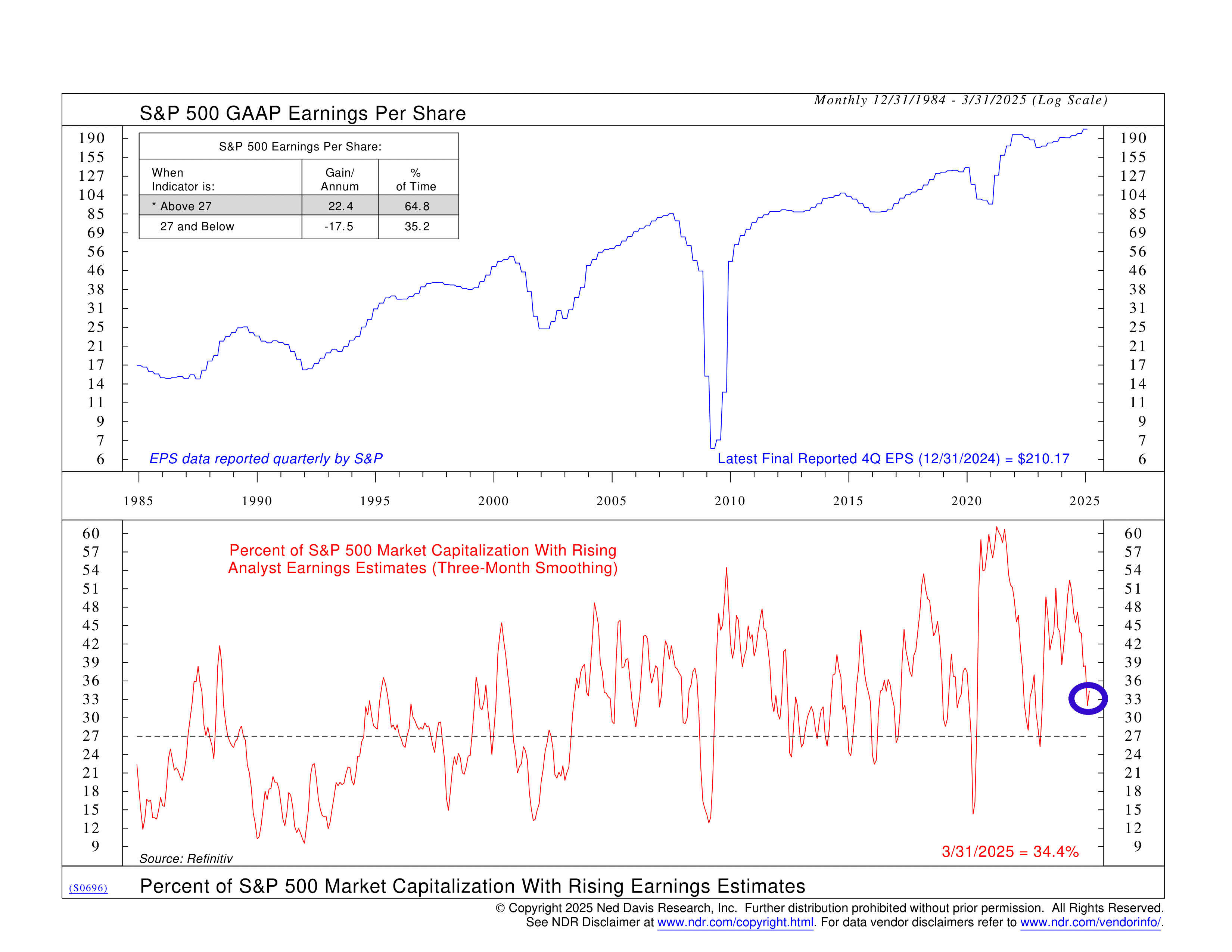

Take a look at the lower section of the chart. The red line shows the percentage of S&P 500 market cap seeing estimate upgrades, smoothed over three months to reduce the noise. It was around 47% last fall, but as of March 31st, it’s dropped to just 34.4%. That means only about a third of the market is getting upgraded, while the rest is either flat or being marked down. That’s a meaningful decline. Historically, once this measure dips below 27%, things tend to get dicey for earnings growth and, often, for the market as a whole.

Above that, the blue line shows S&P 500 GAAP earnings per share, which just hit a record high of $210.17 in the fourth quarter of 2024. So yes, earnings are still rising. But that’s backward-looking. The real story is in the red line below, where we see how analysts are feeling about what comes next.

What makes this setup important is the disconnect. Earnings have been strong, but the percentage of companies seeing improving expectations is shrinking. That tells us the growth is becoming more concentrated. In a cap-weighted index like the S&P 500, a handful of big winners can carry the numbers for a while. But if leadership stays narrow, it eventually creates a fragile foundation.

To be clear, this doesn’t mean earnings are falling off a cliff. But if estimate trends keep rolling over, markets may have to recalibrate some of their optimism. It’s not a timing signal, but it is a reminder that the market needs more than just strong earnings—it needs better-than-expected earnings across a wide base of companies.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.