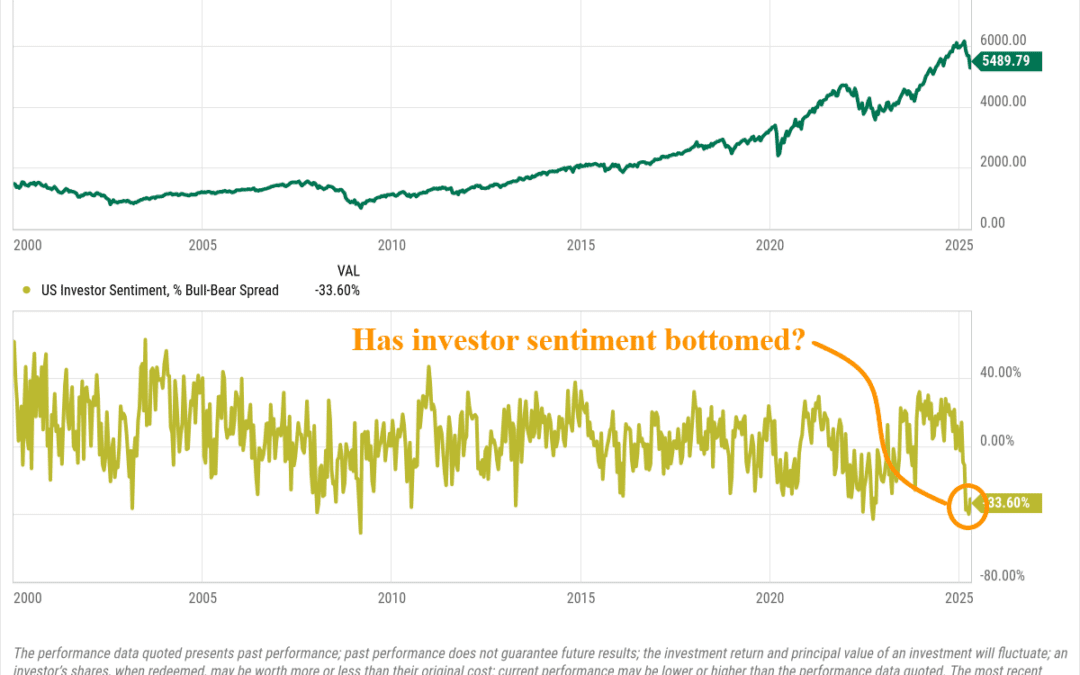

Gaining Confidence

Investor sentiment has been deeply negative, but last week’s rebound shows that confidence might be starting to return. History tells us that when fear fades and optimism picks up, even just a little, it can create some of the best opportunities for long-term investors.

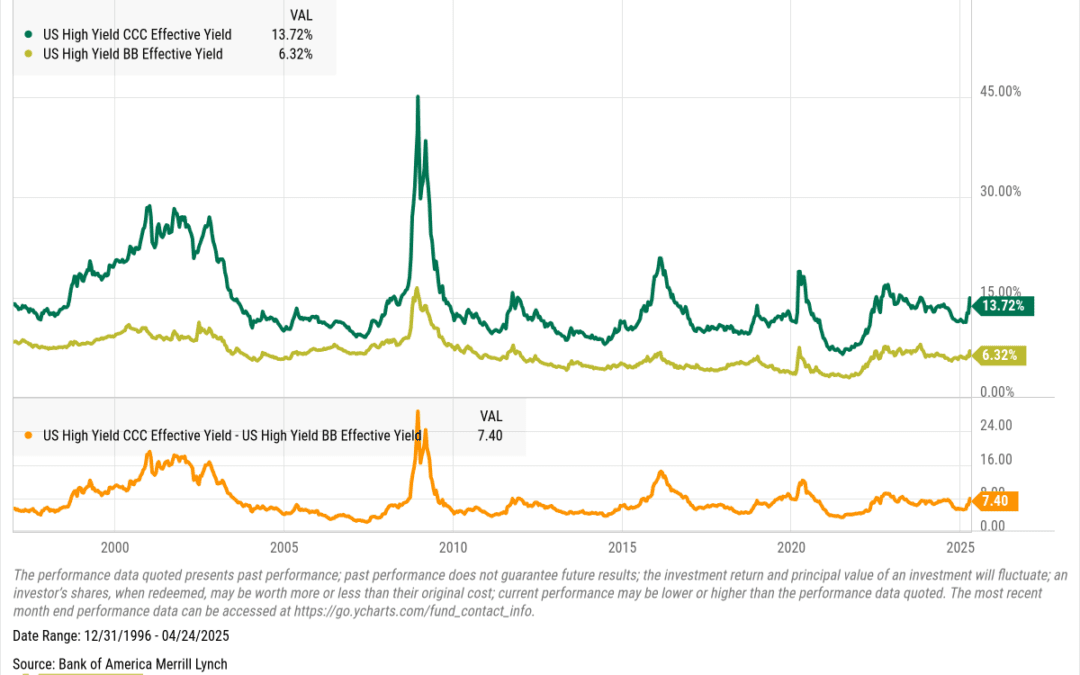

The Junk Gets Junkier

When markets get shaky, the weakest links usually show it first—and nowhere is that more obvious than in junk bonds. This week’s chart is a favorite of DoubleLine’s Jeffrey Gundlach. It compares the yields on CCC-rated bonds—the riskiest junk out there—with...

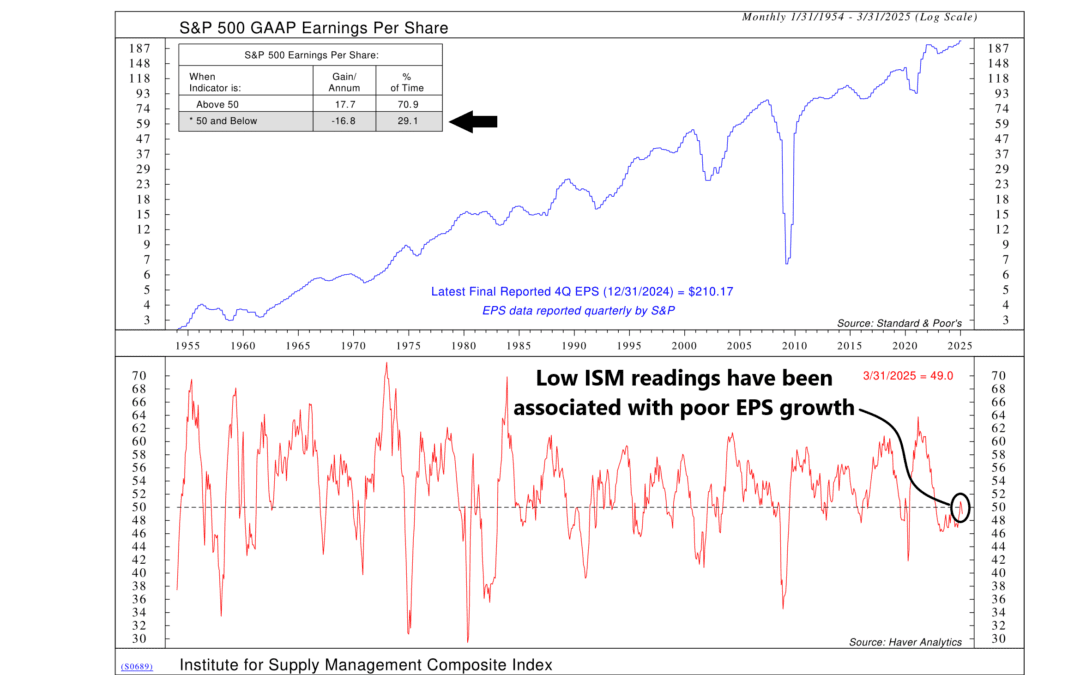

The Earnings Engine

Over the past few weeks, we’ve spent some time diving into the state of corporate earnings—how they’re holding up, what expectations look like, and whether they’re realistic. This week, we’re taking it a step further by linking those earnings to the broader...

Financial Focus – April 23rd, 2025

Check out this week’s Financial Focus as Nate Kreinbrink and Mike VanZuiden break down what you need to know about Medicare enrollment, when to sign up, and how to avoid costly mistakes. They share tips on planning ahead, asking the right questions, and making smart choices for both today and the future.

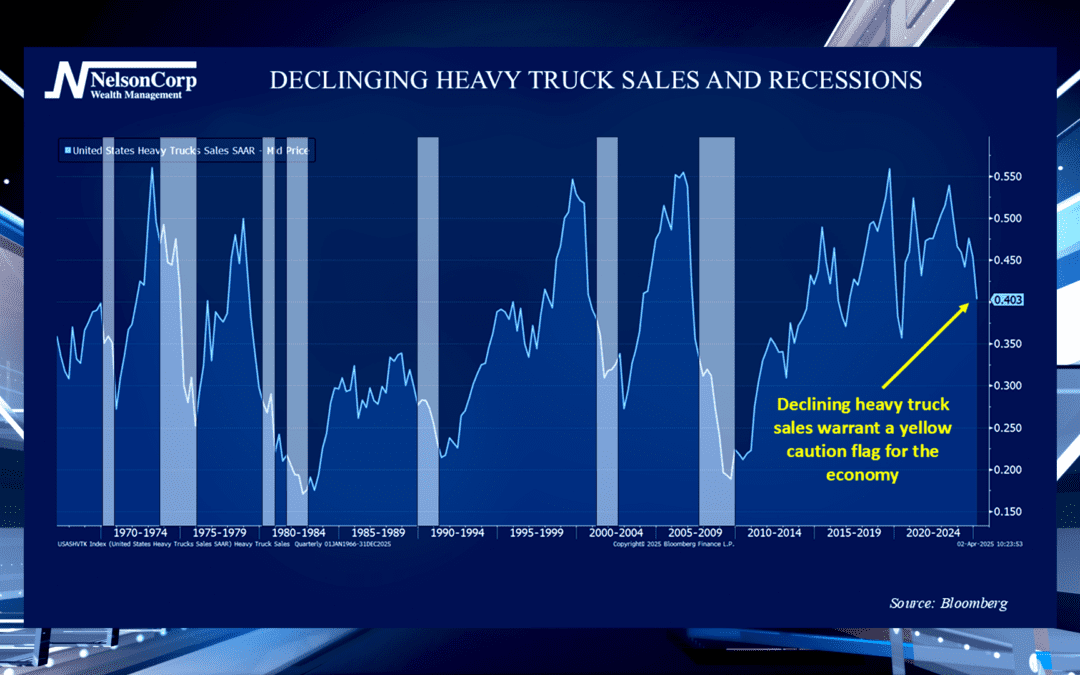

Big Rig Barometer

The sales volume of heavy weight trucks is a leading economic indicator. John Nelson is here to explain why and what heavy truck sales reveals about the broader economy.

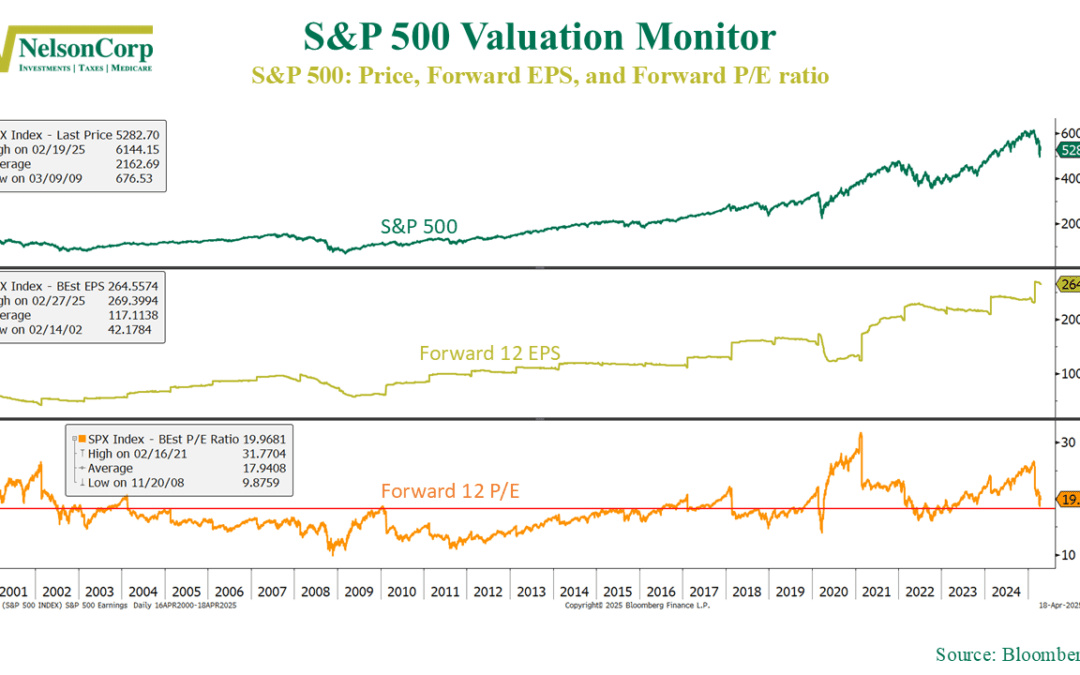

The Price You Pay

Everyone knows the price you pay matters—but where does that price even come from? This week’s commentary breaks down how the market decides what something’s worth—and what’s it’s saying right now.

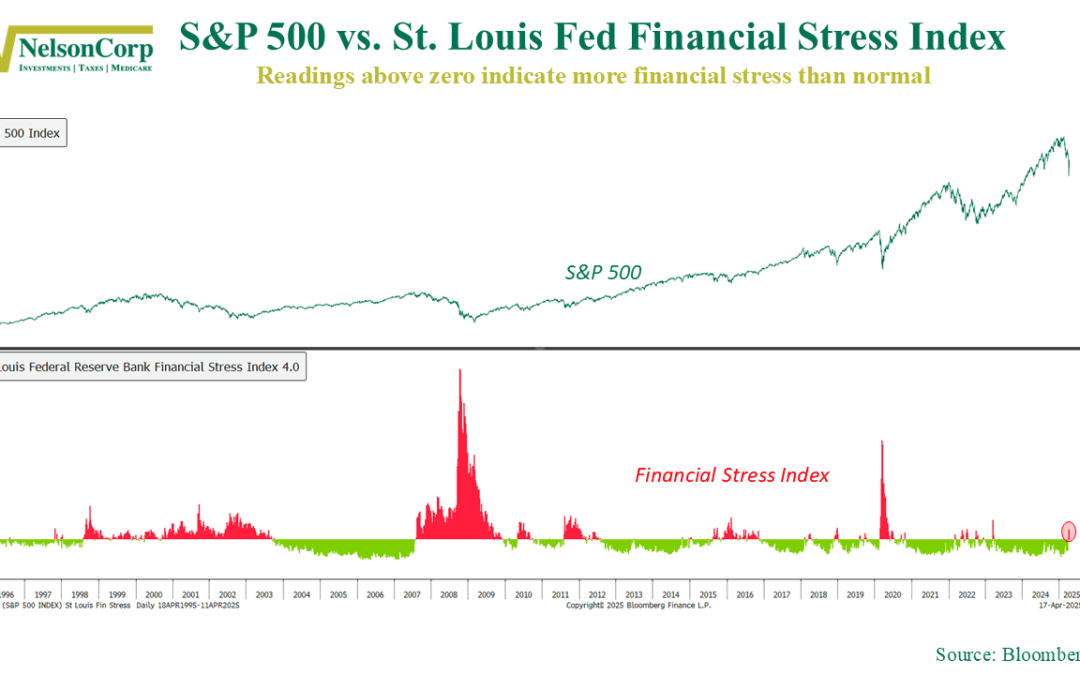

Stress Signals

After more than two years of calm, financial stress is creeping back into the market. The chart above shows the St. Louis Fed Financial Stress Index (bottom panel) plotted against the S&P 500 (top panel). The index tracks 18 different weekly data...

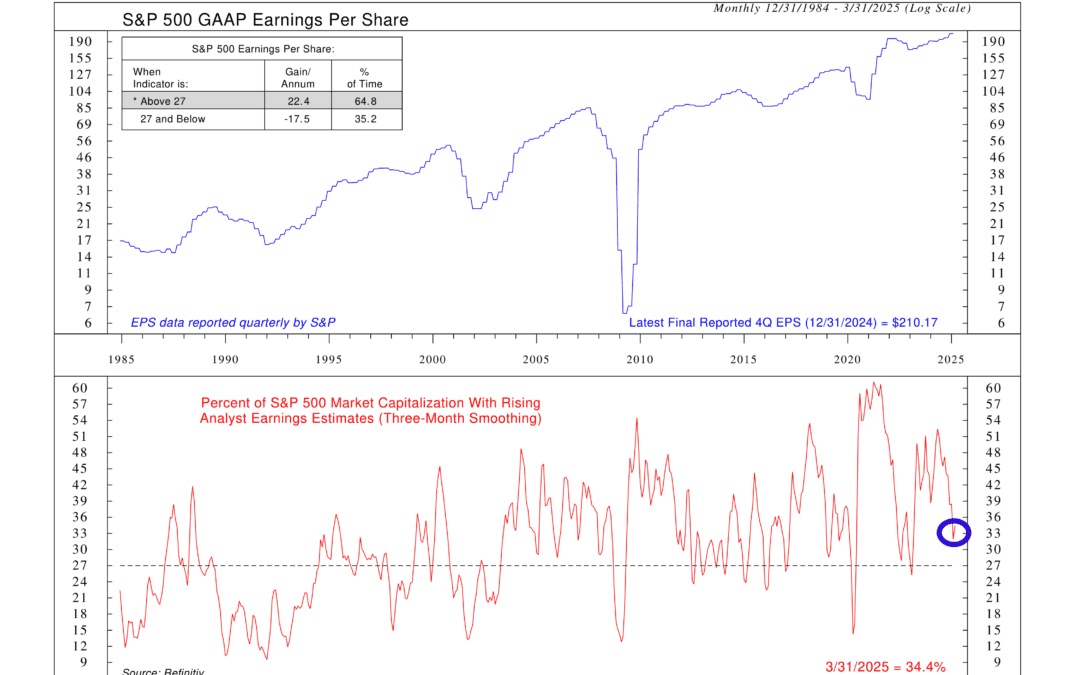

Estimate Erosion

Last week, we looked at how the market has remained fairly upbeat about earnings. This week’s discussion builds on that, digging into just how broad that optimism really is—or isn’t. This week’s indicator tracks the percentage of S&P 500 market...

Financial Focus – April 16th, 2025

This week on Financial Focus, Mike Steigerwald and Andy Fergurson dive into the end of tax season, highlighting how unexpected investment income can trigger penalties—and how to avoid them with better planning. They also clear up confusion around tax brackets, explaining why moving into a higher bracket doesn’t mean all your income gets taxed at that higher rate.

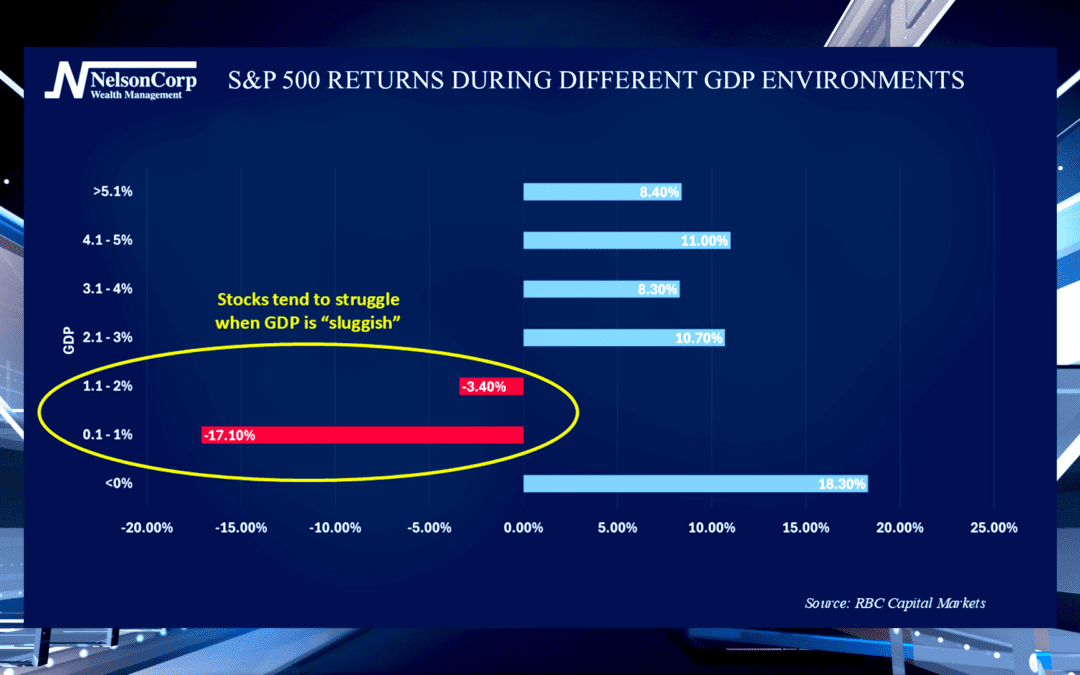

Sluggish

We often hear about GDP when experts are discussing the state of the economy. David Nelson joins us to share how important the Gross Domestic Product variable is and how it relates to stock market returns.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.