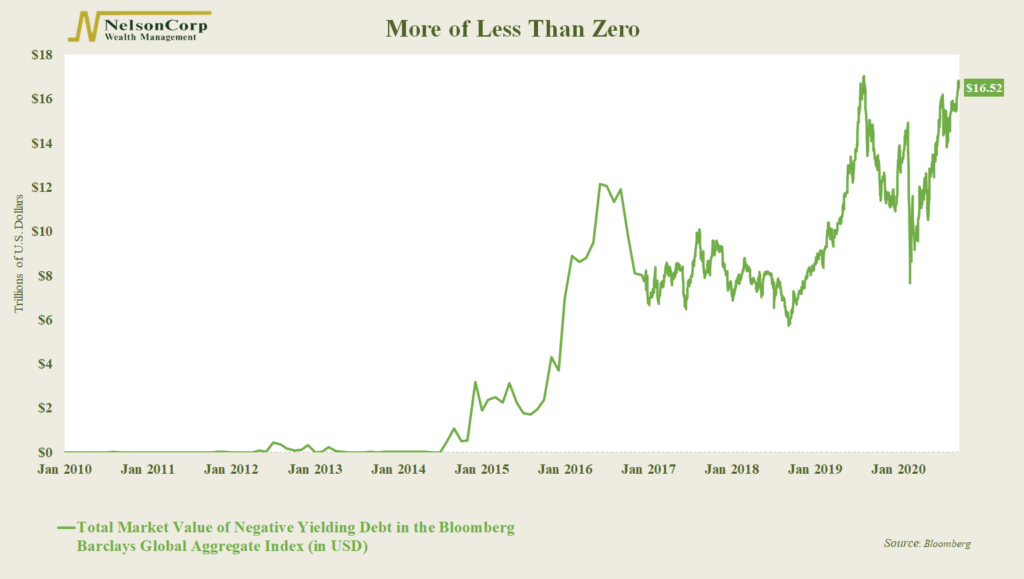

After a dip in March, investors are once again gobbling up bonds that are certain to lose money if held to maturity.

This week’s chart shows the total face value of negative-yielding corporate and government debt in the Bloomberg Barclays Global Aggregate Index. Globally, negative-yielding debt is close to an all-time high of $16.8 trillion.

Digging under the surface, we see that this recent surge is all about Europe.

The European Union (EU) recently blew the top off the bond market by issuing a record 17 billion euros of their new social-linked (SURE) bonds. Investors ate them up, even though the ones maturing as far out as ten years had a negative yield!

The EU has said that it wants to raise up to 100 billion euros to battle the pandemic and help pay for job support programs in Europe, so we may see even more negative-yielding debt in the months and years ahead.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.