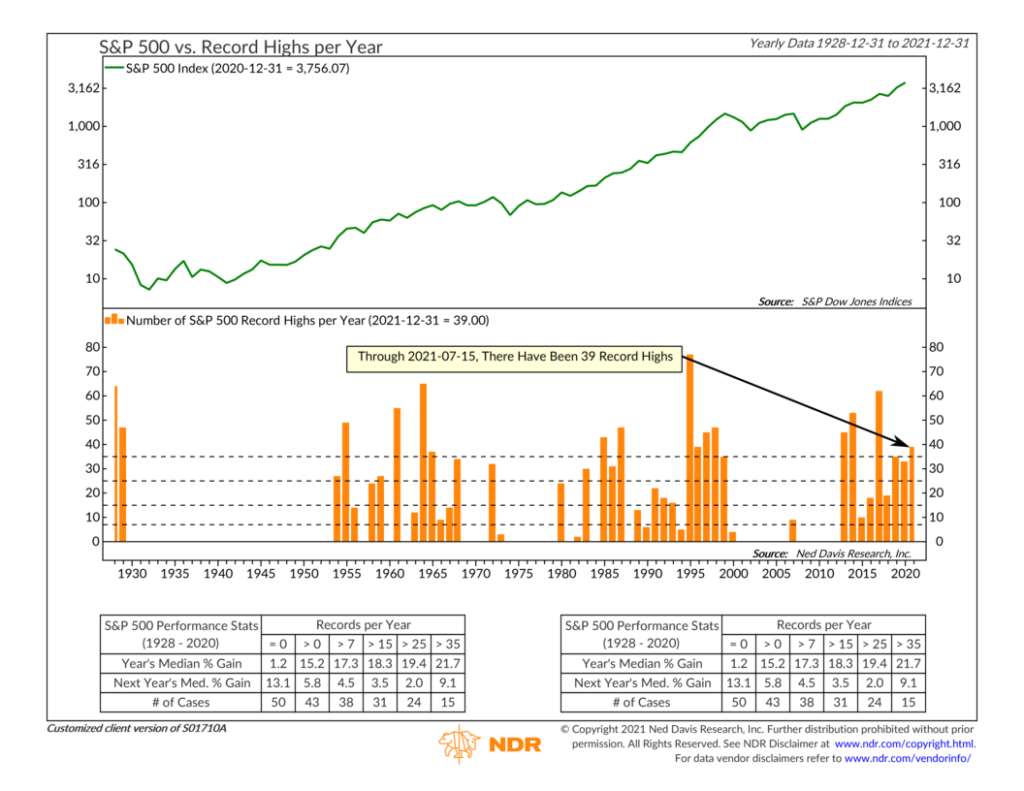

This week we have a pretty cool chart that shows the number of record highs attained by the S&P 500 stock market index per year. The calculation is fairly straightforward: Every year, you count the number of S&P 500 record highs, and that total becomes a bar on the graph for that year. Therefore, the more record highs attained that year, the higher the bar will be on the chart.

The most obvious thing that stands out when looking at the graph is that the years with a lot of record highs tend to cluster. This makes sense. The stock market is cyclical, going through bull and bear market cycles. So, during a bull market, we inevitably see a series of years where many record highs are reached successively. But then we also see many years where no record highs are reached at all. These are the gaps on the graph, and they tend to occur during bear markets.

Perhaps the most interesting thing about this chart, though, is revealed by the performance box at the bottom of the chart. When the stock market has more than 35 record highs in a year (something we’ve already surpassed this year), gains for that year tend to be the highest, on average. That makes sense. But interestingly, the following year’s gains tend to be the second-highest, on average, after the market notched more than 35 record highs in a year. (Only the year after a year with zero record highs had a better median percentage gain, probably because the returns coming out of a bear market tend to be some of the highest.)

The takeaway, then, is that this year’s returns are poised to likely be very strong, given we’ve already had 39 record highs through the first half of this year. And if history is any guide, next year’s return will likely be pretty decent, too.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.