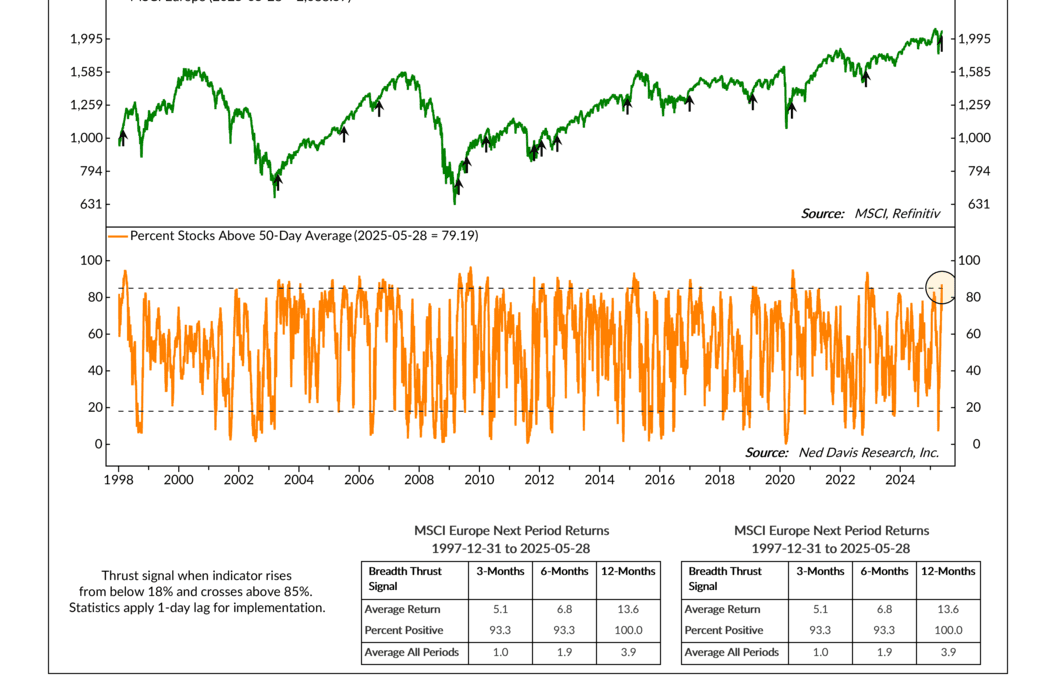

Europe Shows Strength

Most investors keep their eyes on the U.S.—but sometimes, the real story is happening elsewhere. This week, a rare and powerful signal just flashed in European markets, and history says it’s one worth watching.

Most investors keep their eyes on the U.S.—but sometimes, the real story is happening elsewhere. This week, a rare and powerful signal just flashed in European markets, and history says it’s one worth watching.

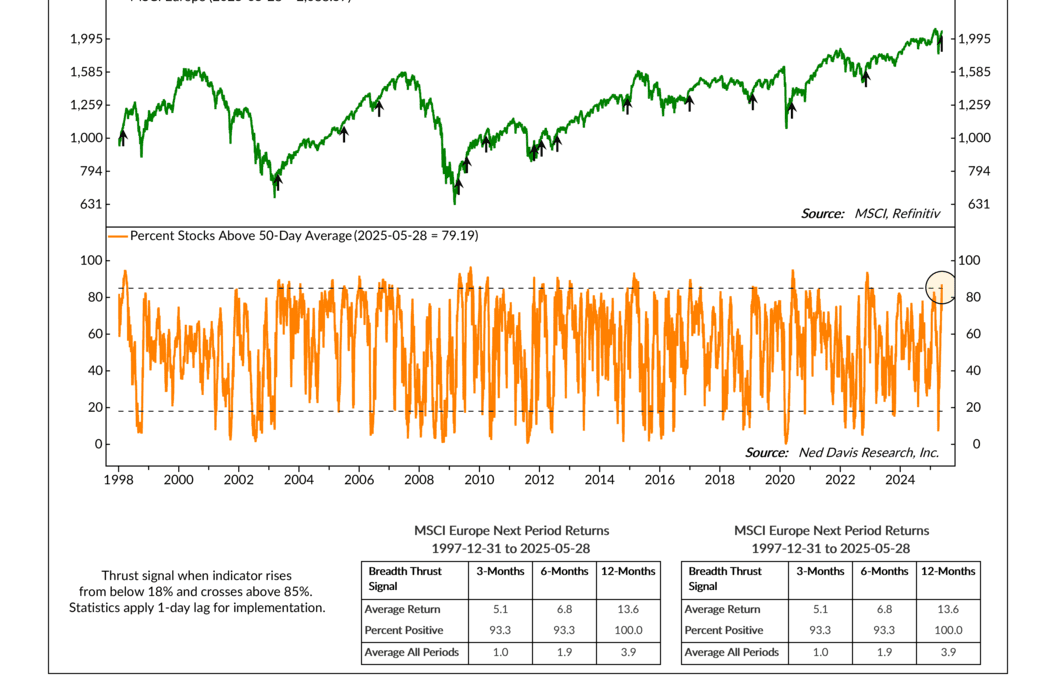

Interest rates are rising—and so are the headlines. But while the U.S. 10-year Treasury yield has been labeled everything from a warning sign to a market menace, the reality might be far less dramatic. This week’s chart puts the move in context, showing that today’s yields aren’t unusually high—they’re just not unusually low anymore.

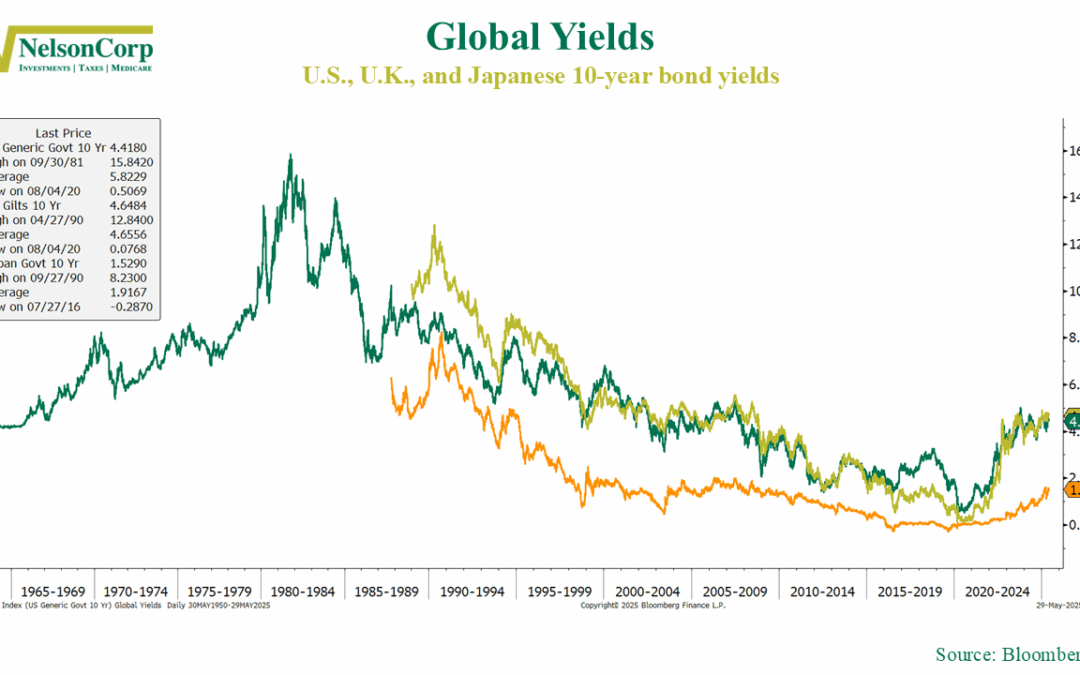

The market’s been riding a big momentum shift lately. Dive into this week’s commentary for a closer look at what’s driving the action.

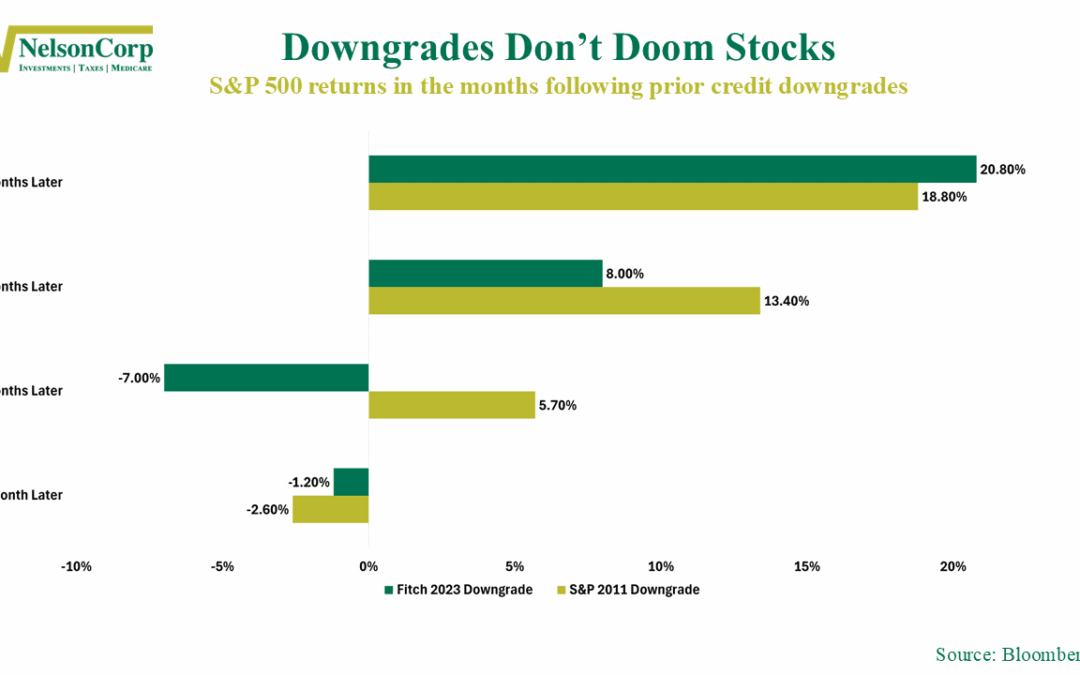

Moody’s just hit the U.S. with a downgrade—should you be worried? History says the real story might be what happens after the headlines fade.

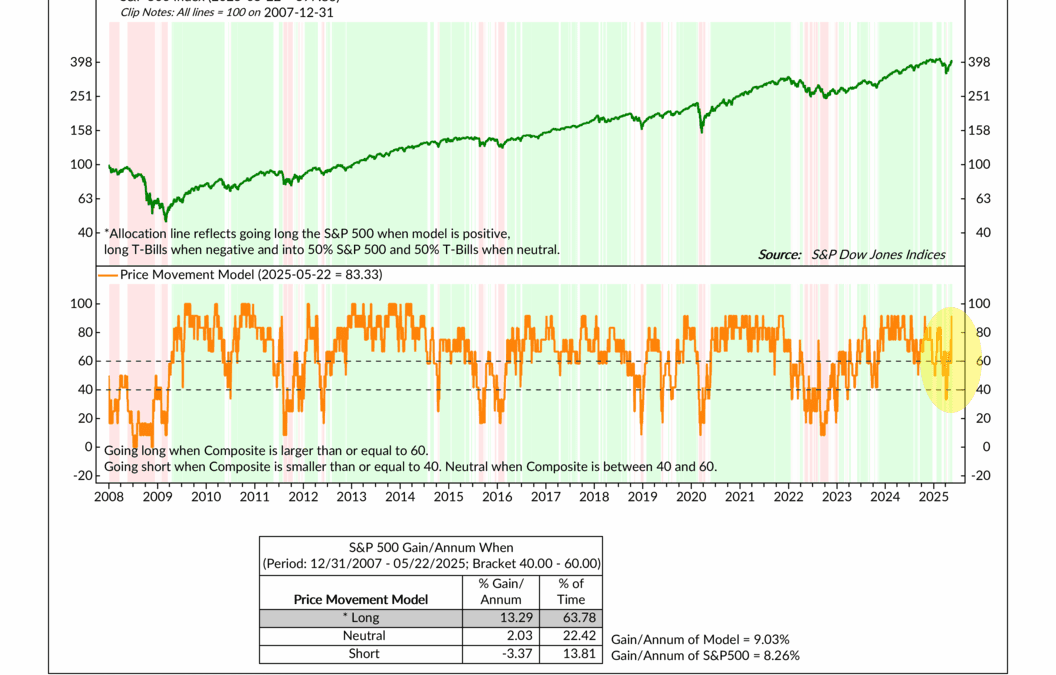

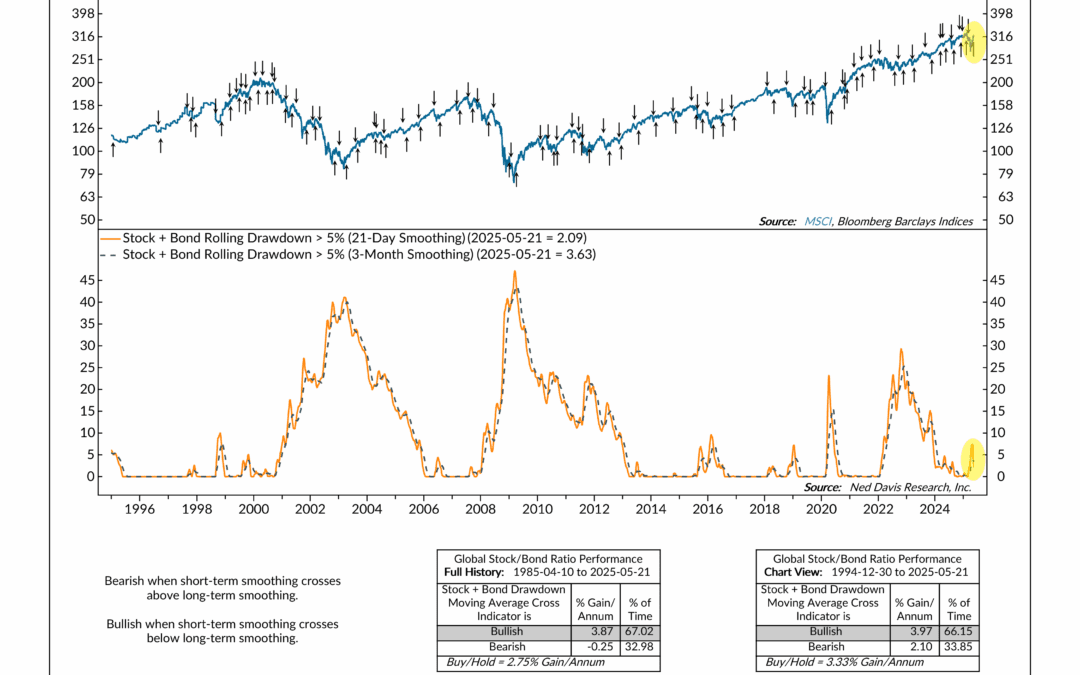

Stocks and bonds came under pressure earlier this year—but this week’s indicator suggests the worst of the pain might be behind us. A new bullish signal just triggered, and history shows it often shows up right as markets begin to recover.