Two Paths

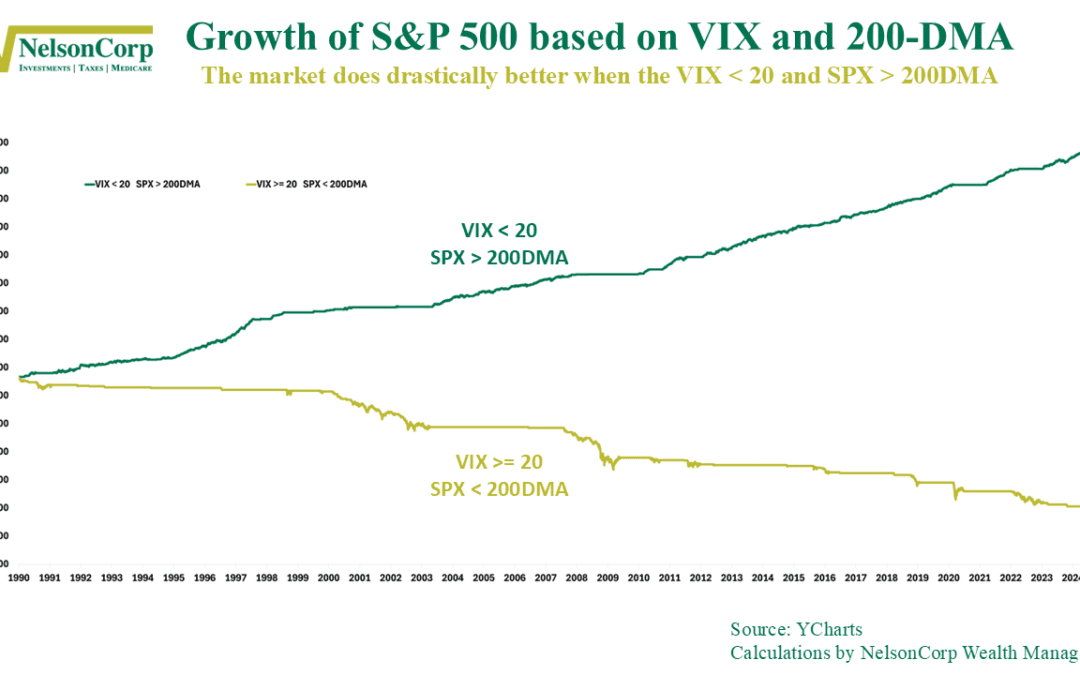

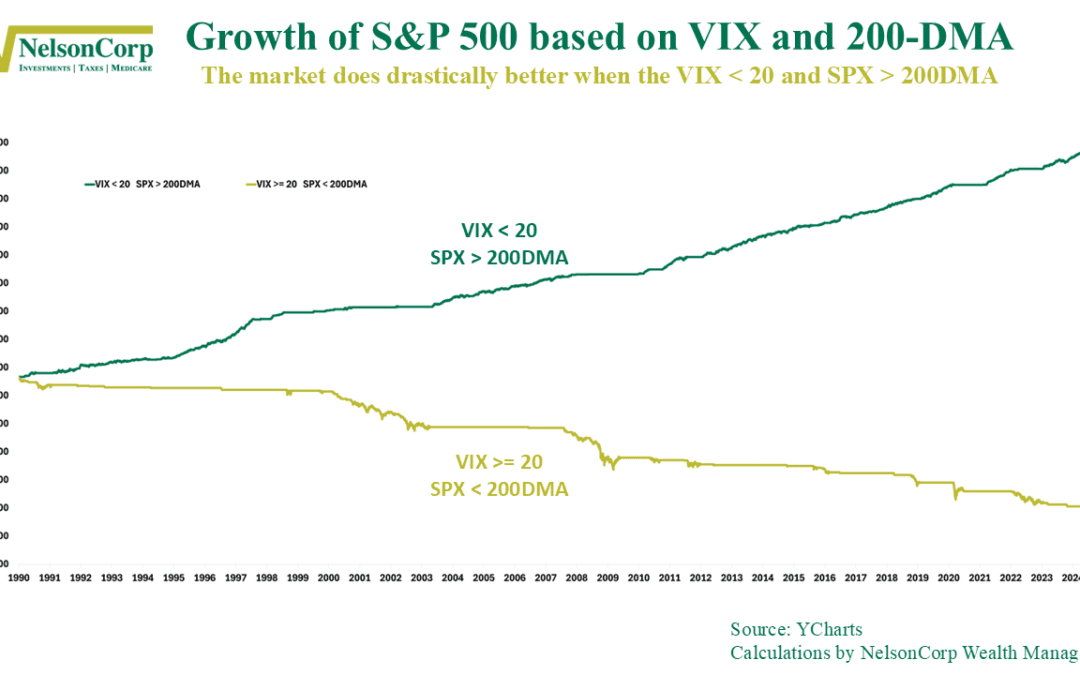

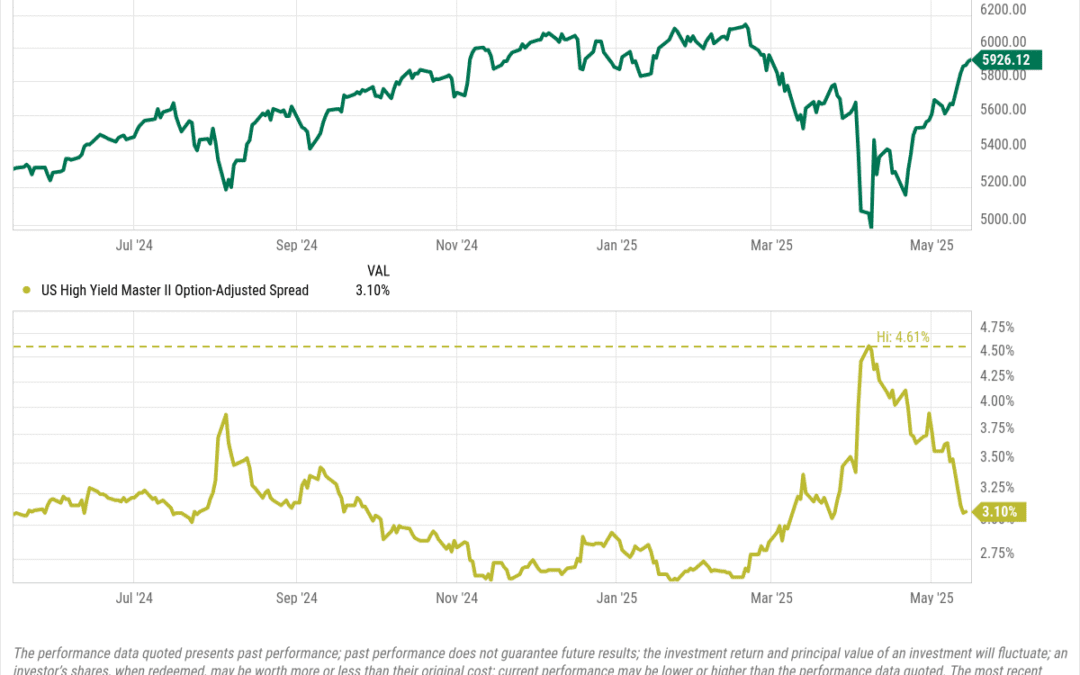

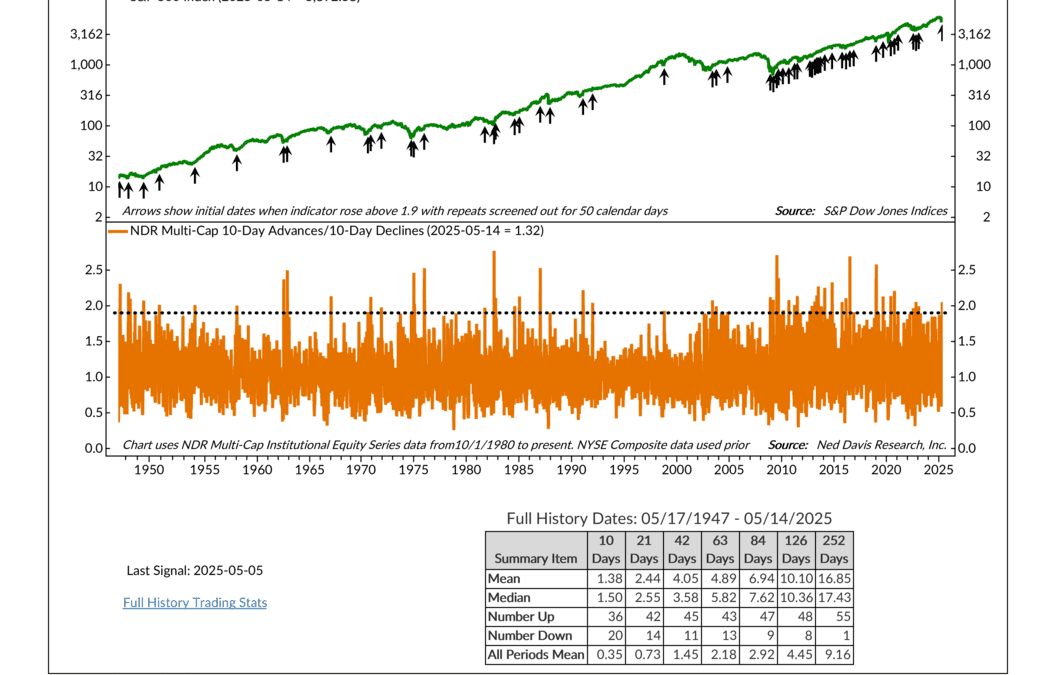

The market tends to follow one of two paths—either calm and climbing, or volatile and falling. After last week, it looks like we’ve just stepped back onto the better one.

The market tends to follow one of two paths—either calm and climbing, or volatile and falling. After last week, it looks like we’ve just stepped back onto the better one.

This week’s Financial Focus encourages young people—especially recent grads and students with summer jobs—to start saving early. Nate Kreinbrink highlights Roth IRAs as a strong option for young savers and reminds listeners that forming good financial habits now can make a big difference down the road.

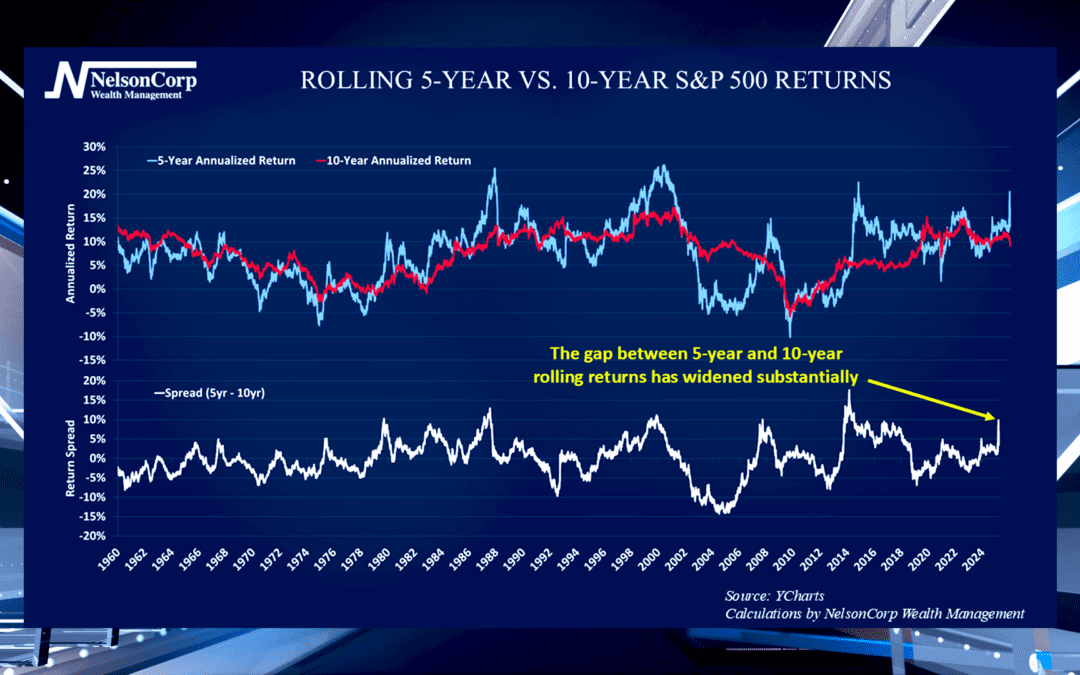

The stock market has performed well the last few years, but this year’s off to a rough start. Nate Kreinbrink joins us to discuss how a slower stretch after a strong run is normal for the markets.