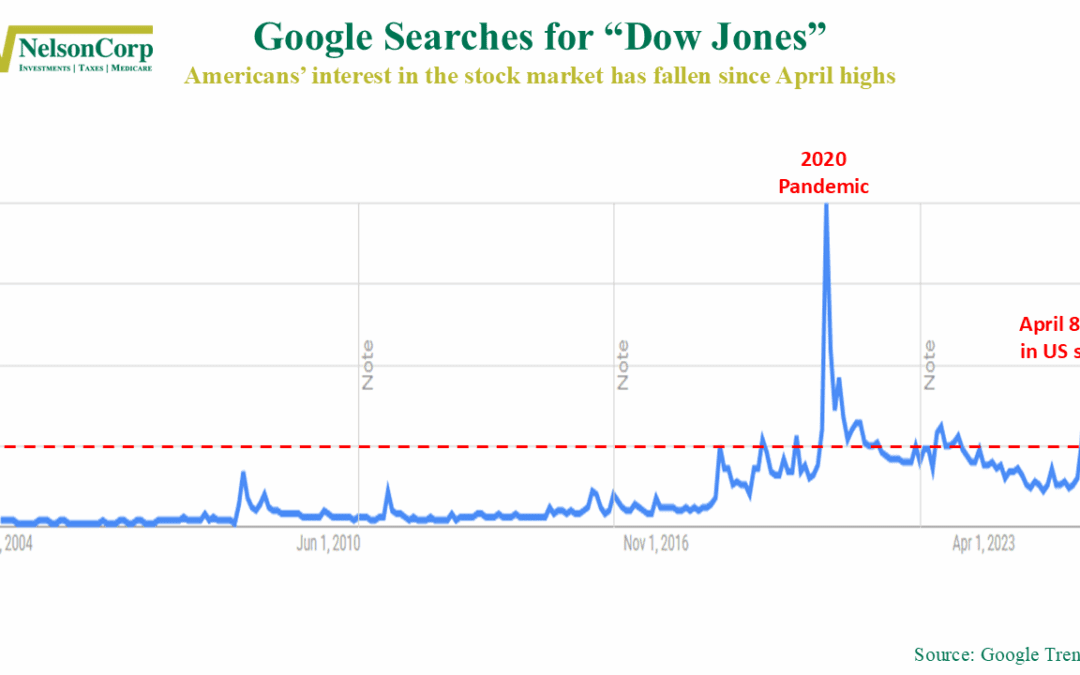

Search Party

What people search for can tell us a lot about how they’re feeling—and right now, market fears seem to be cooling off. Check out this week’s chart to see what a drop in “Dow Jones” searches might be saying about sentiment and spending.

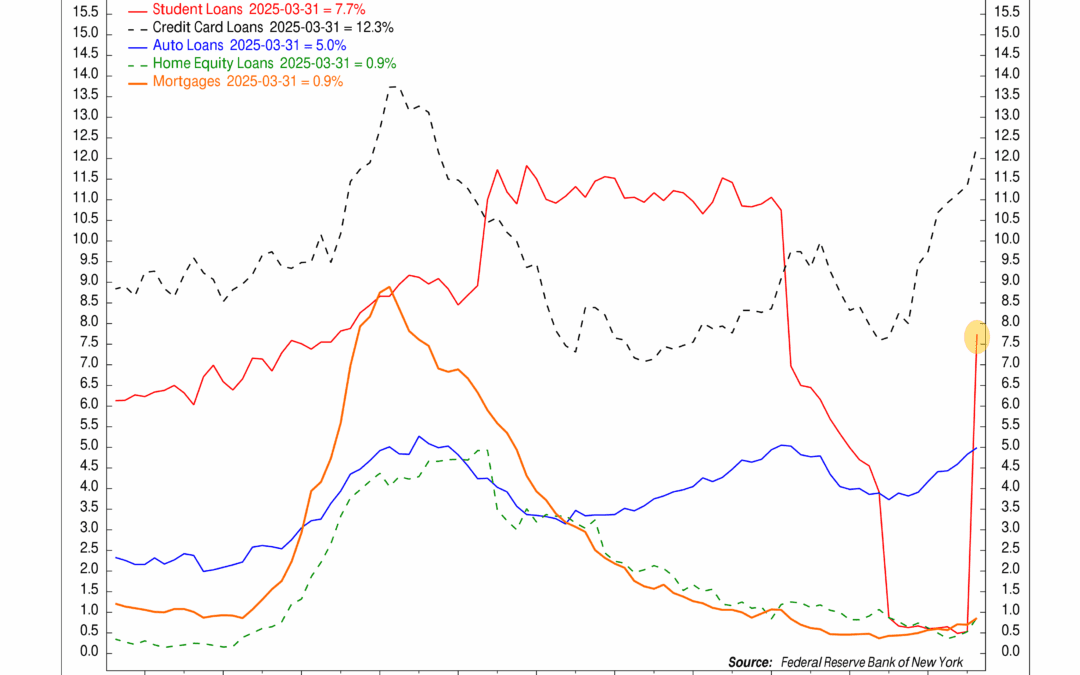

Stressed Out

Americans are falling behind on student loans at the fastest pace in years. With savings shrinking and debt piling up, the financial strain is starting to show.

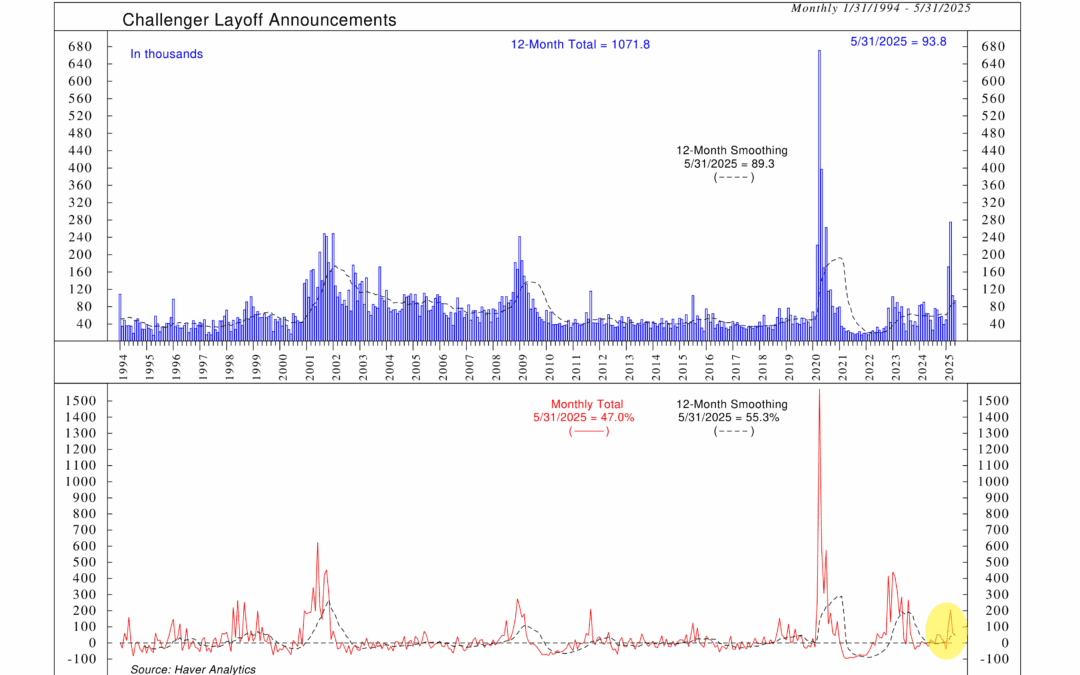

Layoff Alerts

Layoffs are on the rise, and one of our favorite early-warning indicators is flashing yellow. While the broader economy still looks healthy, the recent surge in announced job cuts could be the first crack in the labor market’s foundation.

Financial Focus – June 4th, 2025

Tax season may be months away, but now’s the time to check your withholdings and make sure you’re not giving the IRS an interest-free loan. In this week’s Financial Focus, Nate Kreinbrink walks through smart summer tax planning tips that could help you keep more of what you earn.

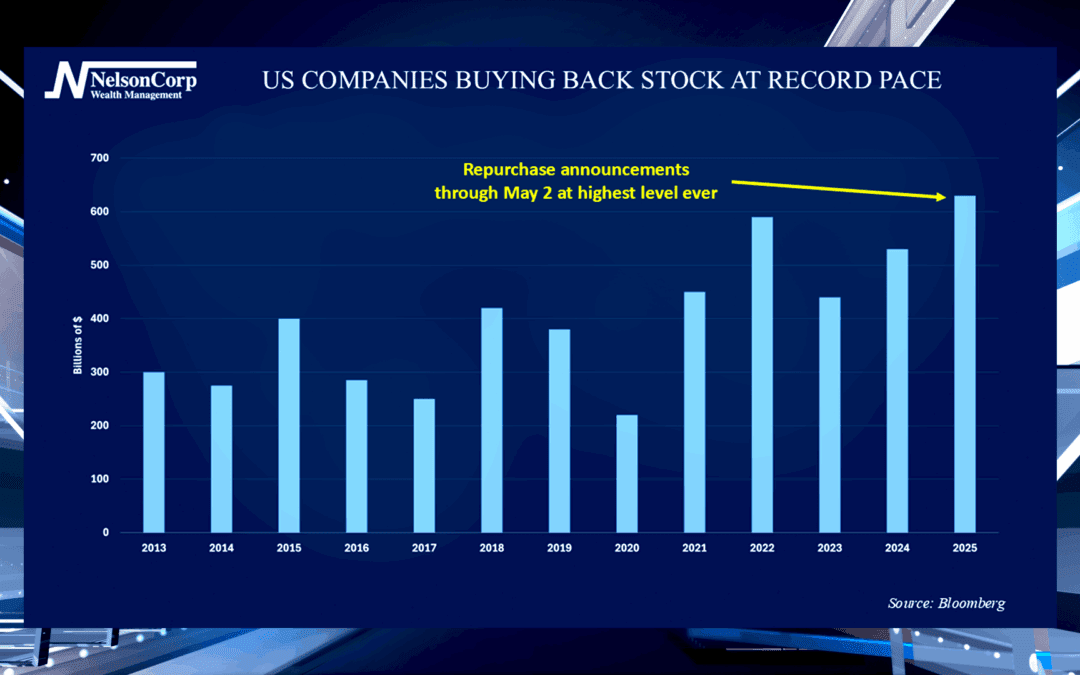

Buyback Backstop

Stocks have rebounded lately in part due to corporate buybacks. John Nelson joins us to share the historic numbers and why companies are using this tactic that is popular with shareholders.

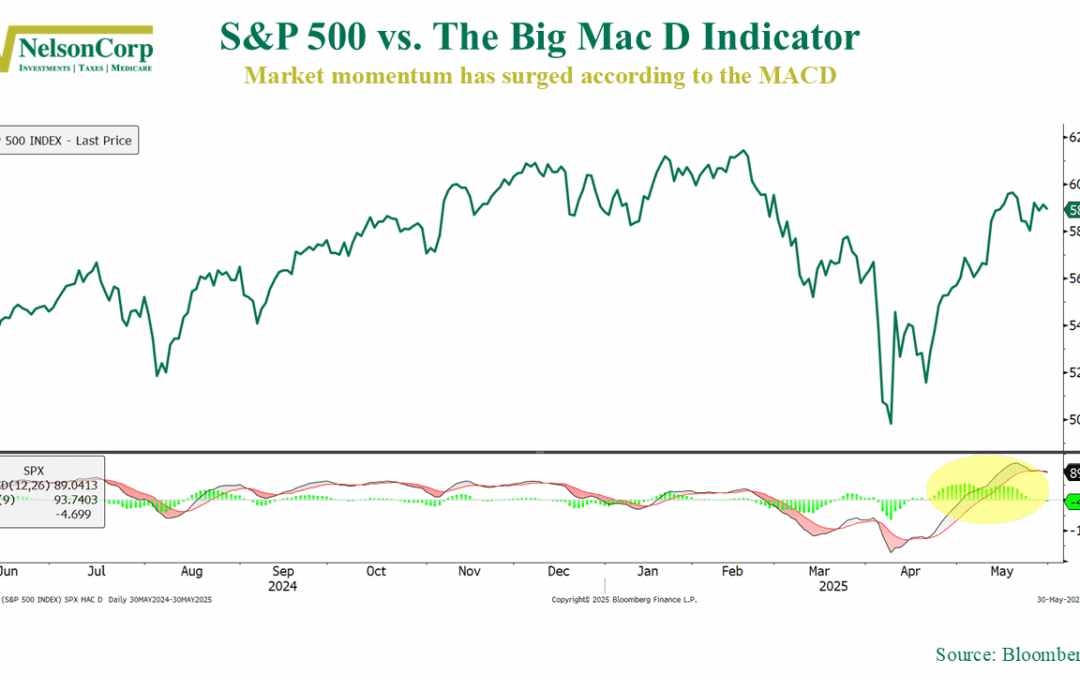

I’ll Take a Big Mac D, Please

Momentum is building again in the market, and one of our favorite indicators just turned bullish. Check out this week’s commentary to see what it’s saying—and why it backs up the broader trend.

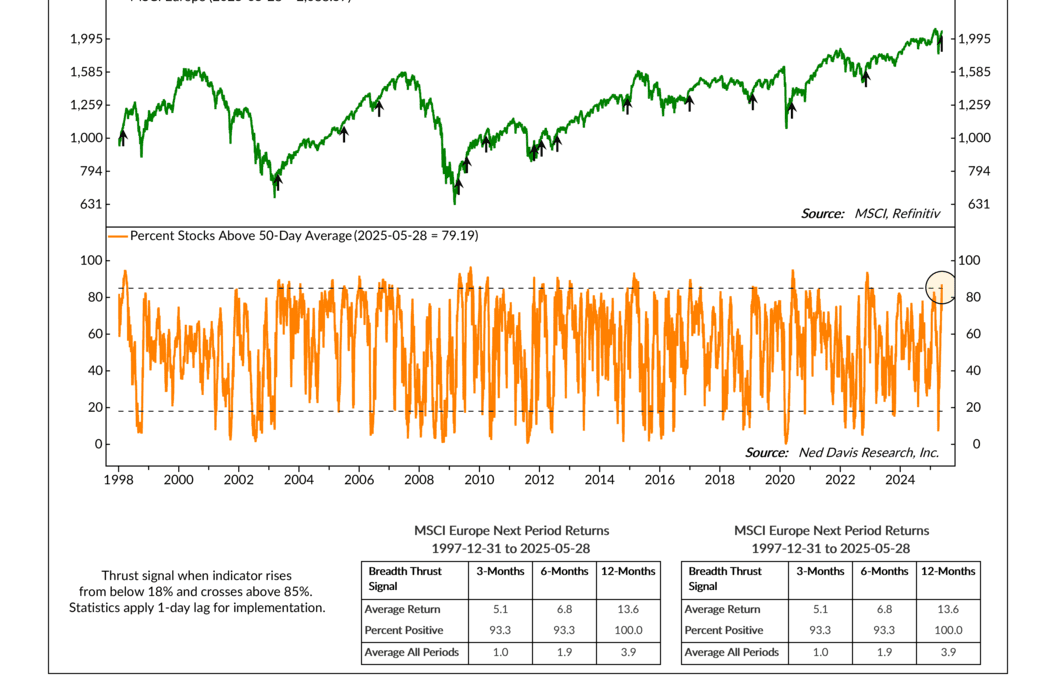

Europe Shows Strength

Most investors keep their eyes on the U.S.—but sometimes, the real story is happening elsewhere. This week, a rare and powerful signal just flashed in European markets, and history says it’s one worth watching.

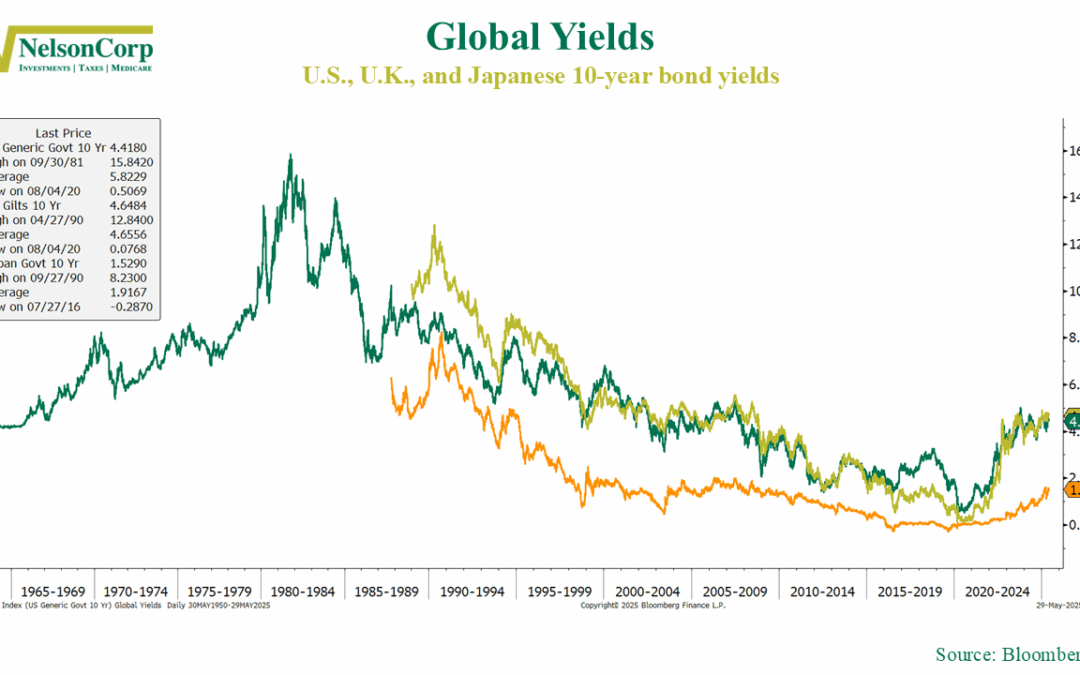

More Typical

Interest rates are rising—and so are the headlines. But while the U.S. 10-year Treasury yield has been labeled everything from a warning sign to a market menace, the reality might be far less dramatic. This week’s chart puts the move in context, showing that today’s yields aren’t unusually high—they’re just not unusually low anymore.

Financial Focus – May 28th, 2025

Summer’s here, and with it comes a fresh reminder to review your Medicare coverage—especially with midyear changes, network shifts, and potential premium adjustments starting to roll in. This week’s Financial Focus digs into what to watch for, how to make the most of plan perks, and why staying informed now can save you money (and headaches) later.

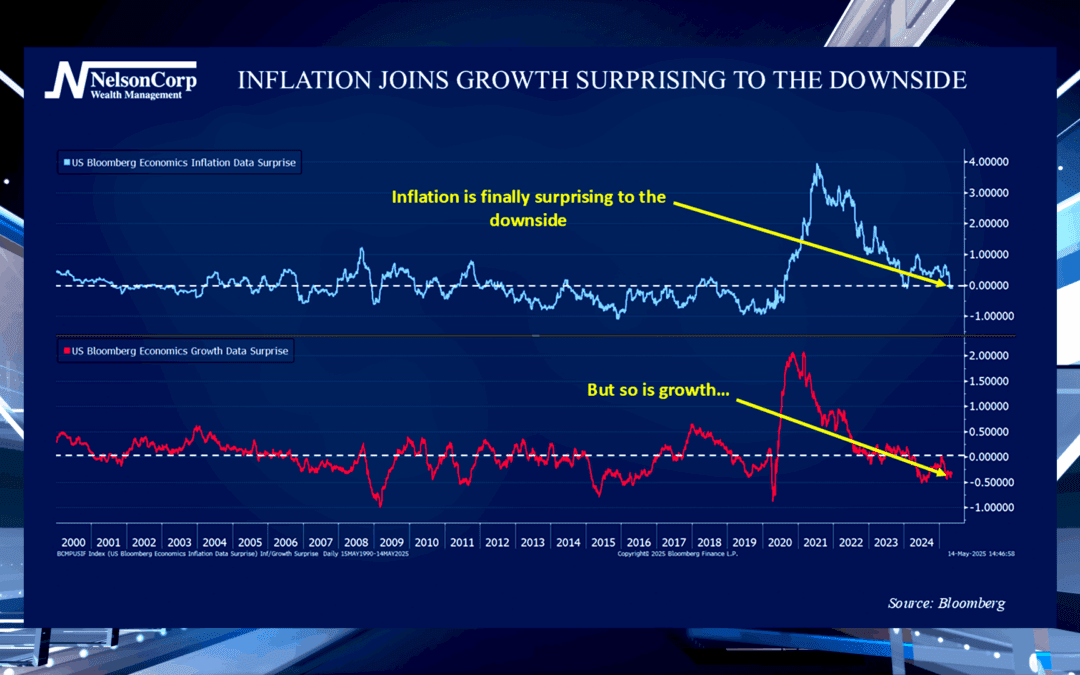

Return To Normal

There has been increased focus on market data recently as experts attempt to predict the future of the economy. David Nelson is here to explain the goals for inflation and economic growth going forward.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.