Financial Focus – July 24th, 2024

On this episode of Financial Focus, Nate Kreinbrink and Mike Steigerwald talk about the importance of planning for retirement and understanding Social Security benefits. They stress the need to make smart decisions and suggest getting professional advice to avoid mistakes.

Greedy Investors

Have investors gotten too greedy? In this week’s commentary, we review last week’s market downturn and highlight what we’re keeping an eye on moving forward.

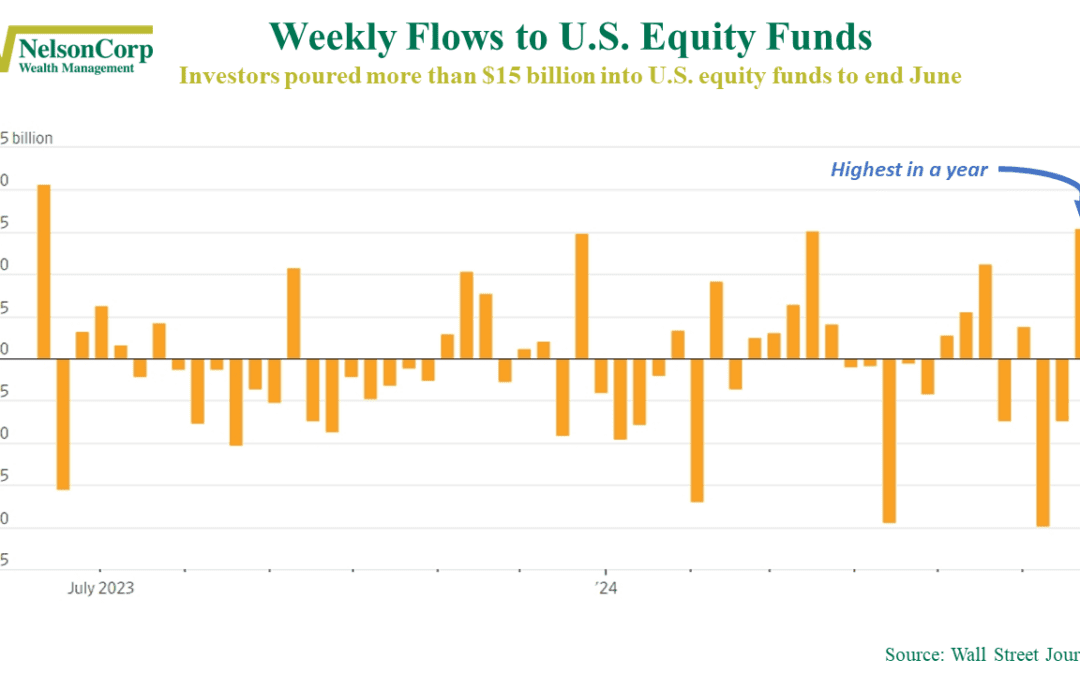

Stock Rush

Investors are gobbling up stocks at a frenzied pace. As our featured chart this week illustrates, in the last week of June, $15 billion flowed into U.S. equity funds—the highest weekly amount in a year! This surge reflects growing confidence in a stock market...

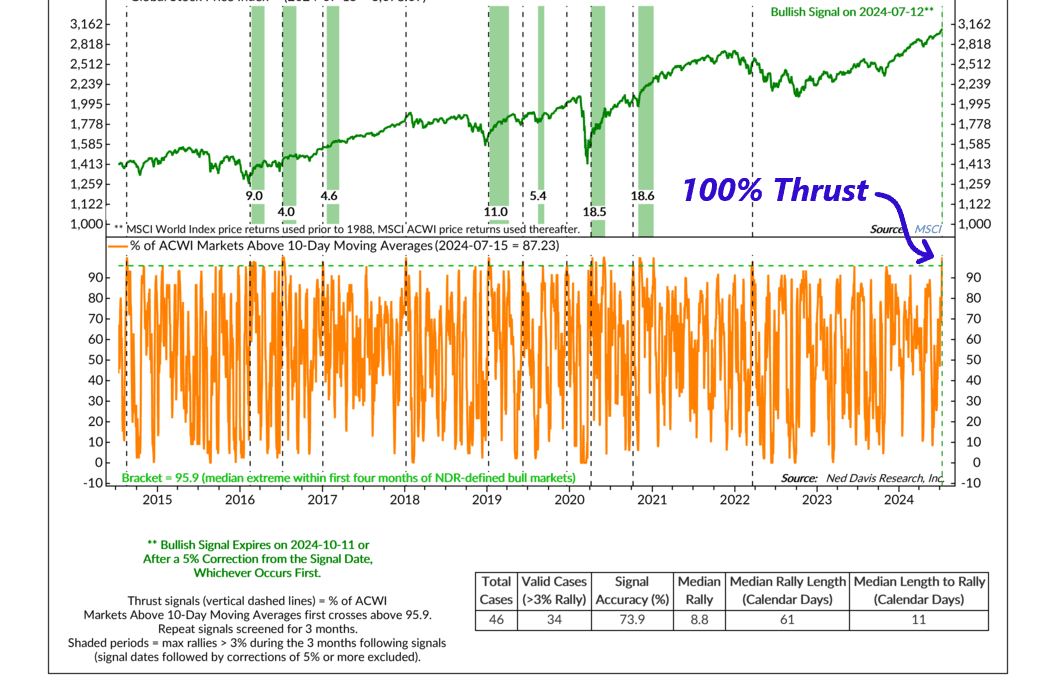

The Thrust Heard Round the World

After nearly 2 ½ years, we finally experienced a global breadth thrust last week. What’s a global breadth thrust? Well, it basically means a whole bunch of stocks around the world moved significantly higher at the same time—and in a relatively short period of...

Financial Focus – July 17th, 2024

Tune into this week’s episode of Financial Focus, where David Nelson talks with Gary Determan about the challenges of keeping up with the ever-changing financial world and the importance of helping clients make informed decisions.

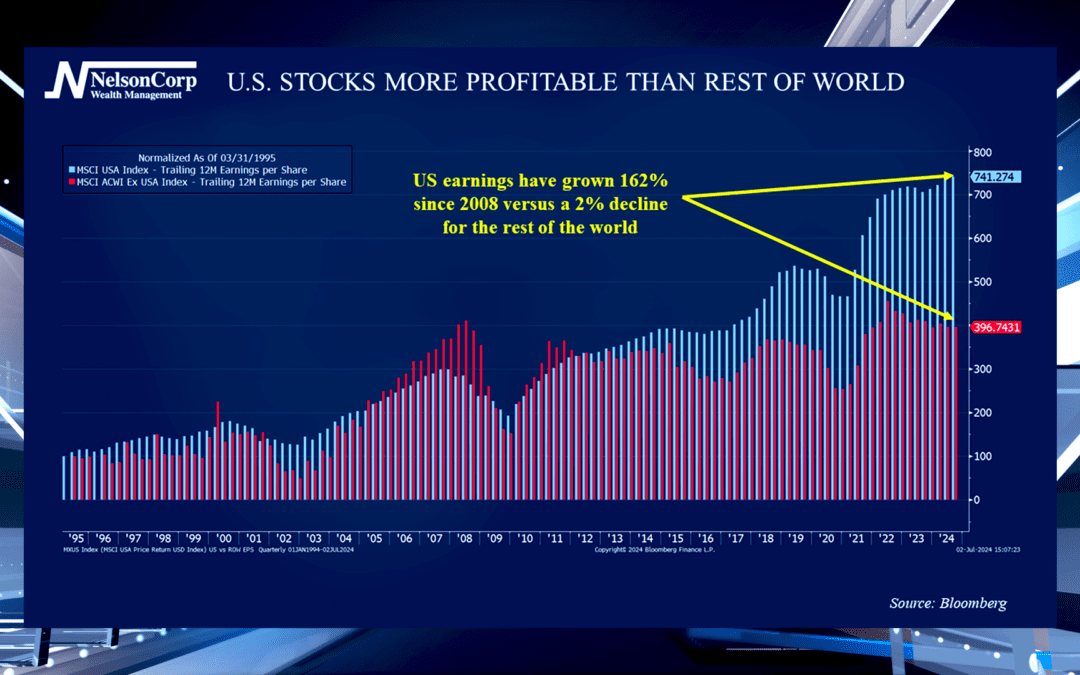

Driving Force

The U.S. stock market has been dominant in recent years. David Nelson joins us to share just how incredible the Red, White, & Blue have performed compared with the rest of the world.

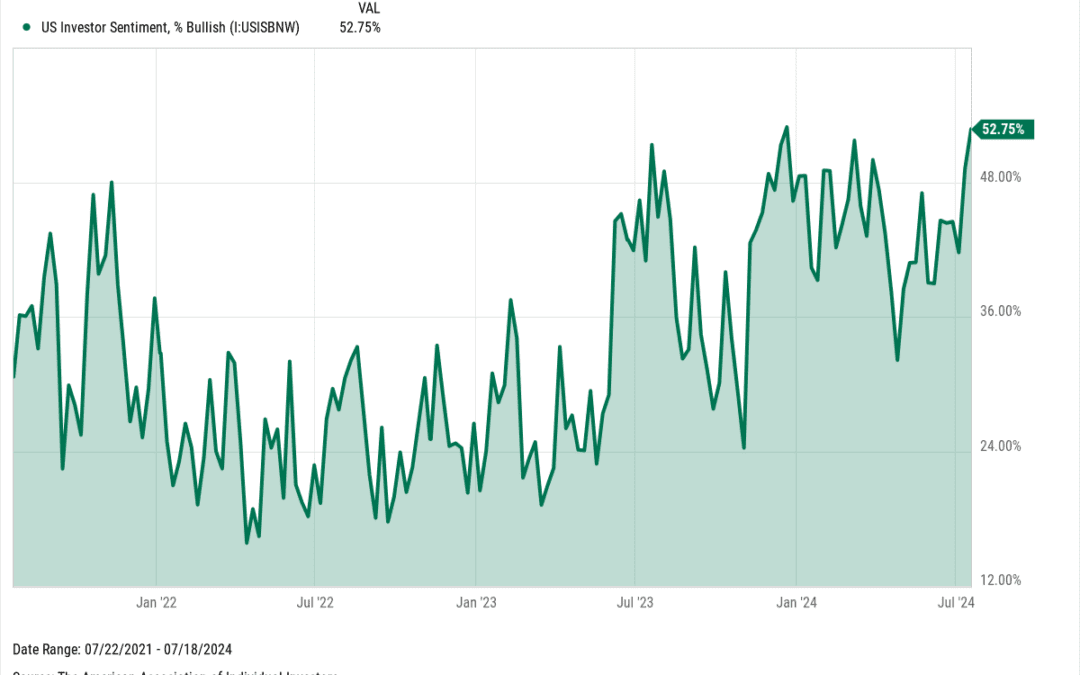

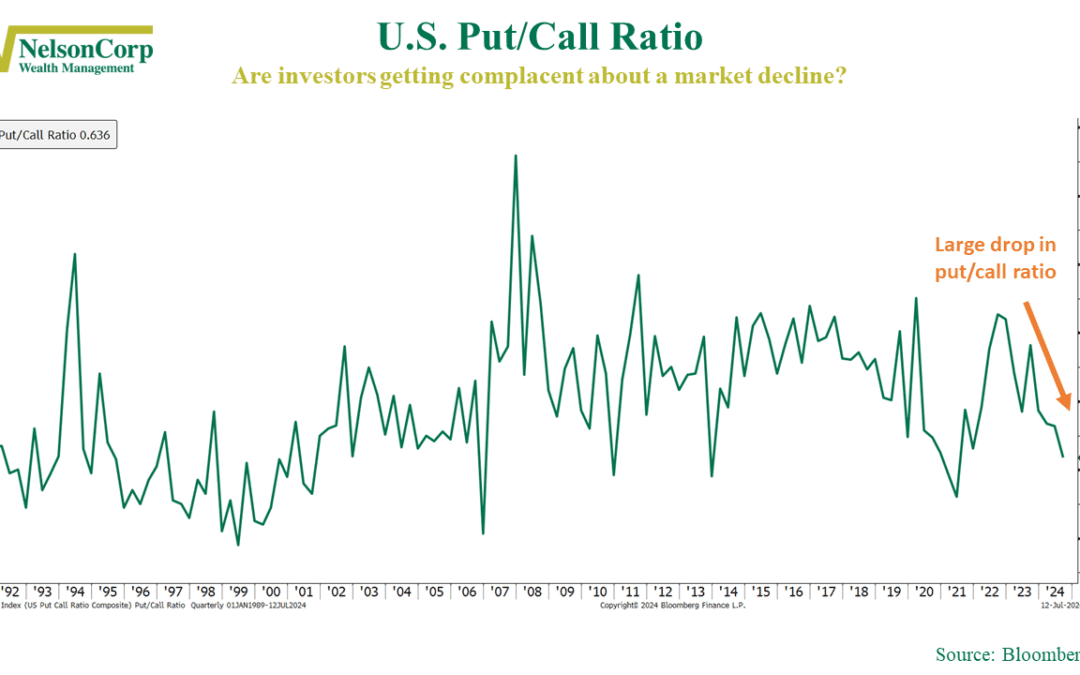

Markets Rise; Risks Persist

Curious about how recent economic shifts are impacting your investments? Explore our latest insights on market momentum and investor sentiment, as we break down what the latest data means for stocks and bonds.

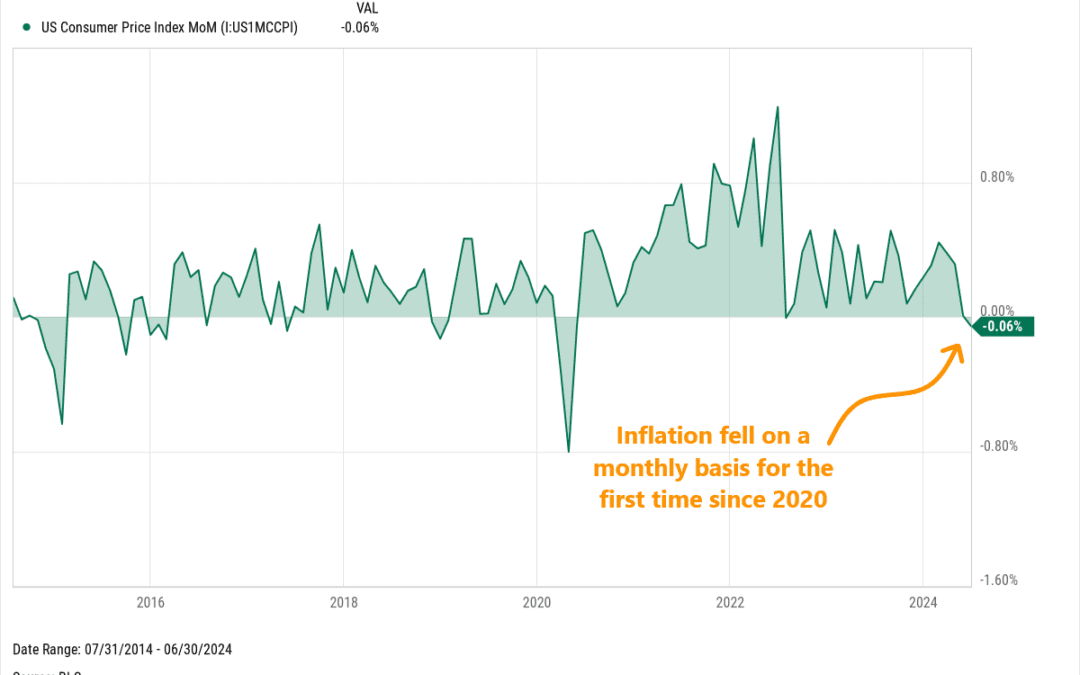

Price Drop

We got some big news regarding the economy this week. The latest inflation reading showed that June’s Consumer Price Index (CPI) fell 0.6% over the previous month. This was the first monthly decline since 2020. What caused the price drop? Used cars, mostly....

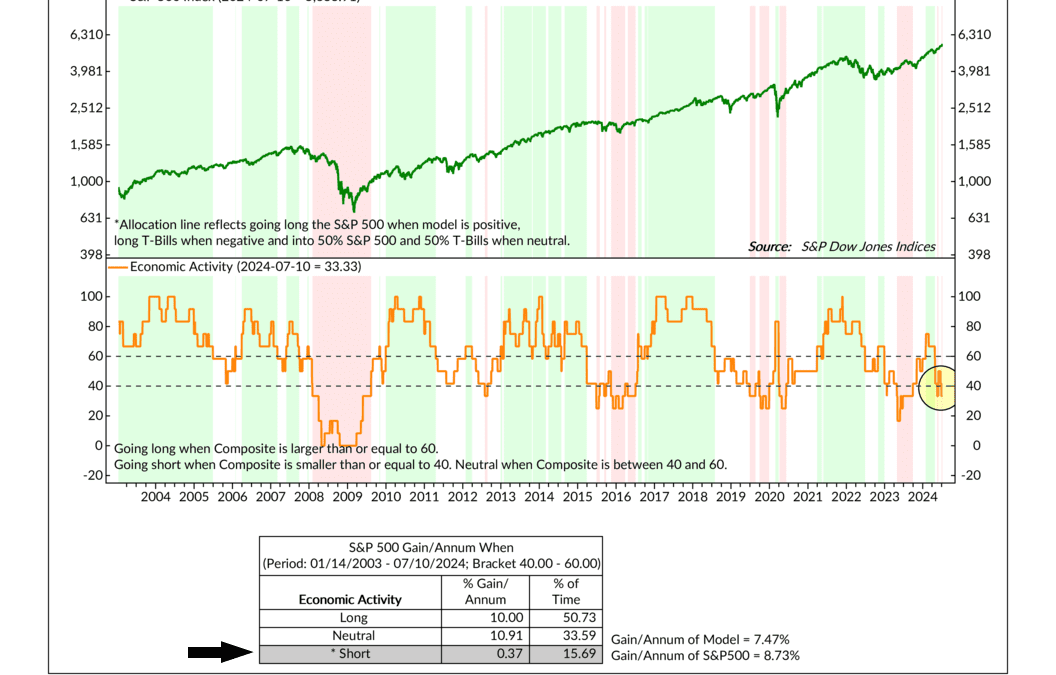

Econ Erosion

This week’s indicator is all about the economy. It’s a composite indicator comprising six individual indicators that each track some sort of economic activity—ranging from stock market earnings and industrial production to layoff announcements and various other...

Financial Focus – July 10th, 2024

On this week’s Financial Focus, Nate Kreinbrink and James Nelson discuss the ongoing economic challenges posed by inflation and interest rates. They emphasize the importance of having a disciplined investment plan, adapting to market conditions, and understanding the impacts of Federal Reserve policies on the economy and individual portfolios.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AR, AZ, CA, CO, CT, FL, GA, HI, IA, ID, IL, IN, LA, MA, ME, MI, MN, MO, MT, NC, NE, NJ, NM, NV, NY, OH, OR, SC, SD, TN, TX, UT, VA, WA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.