Stressed Out

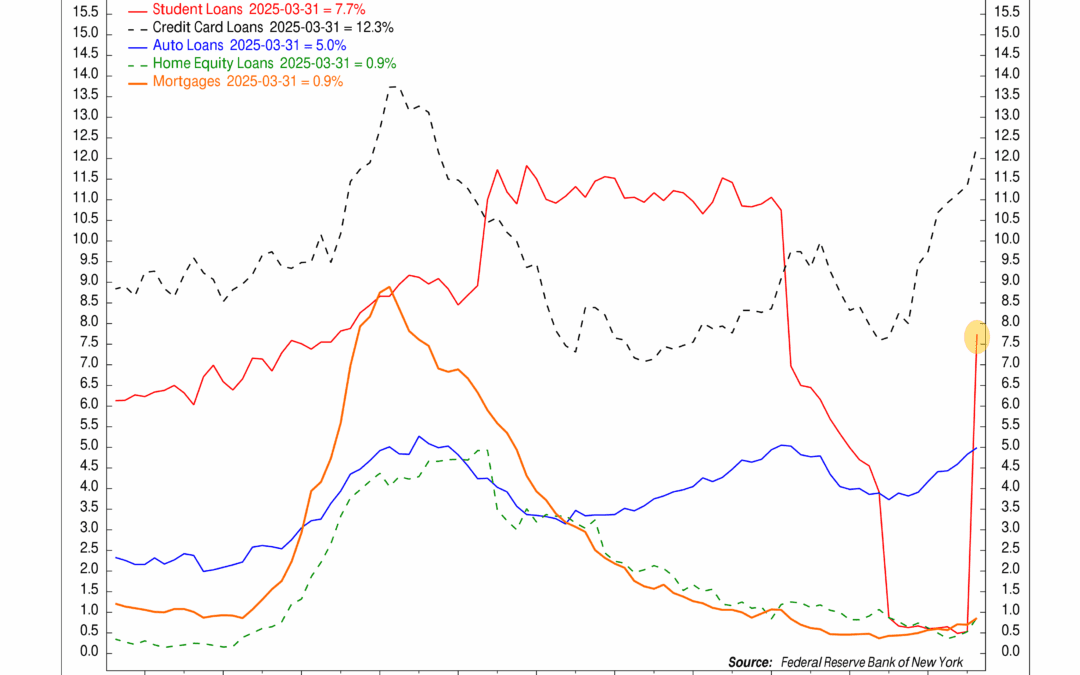

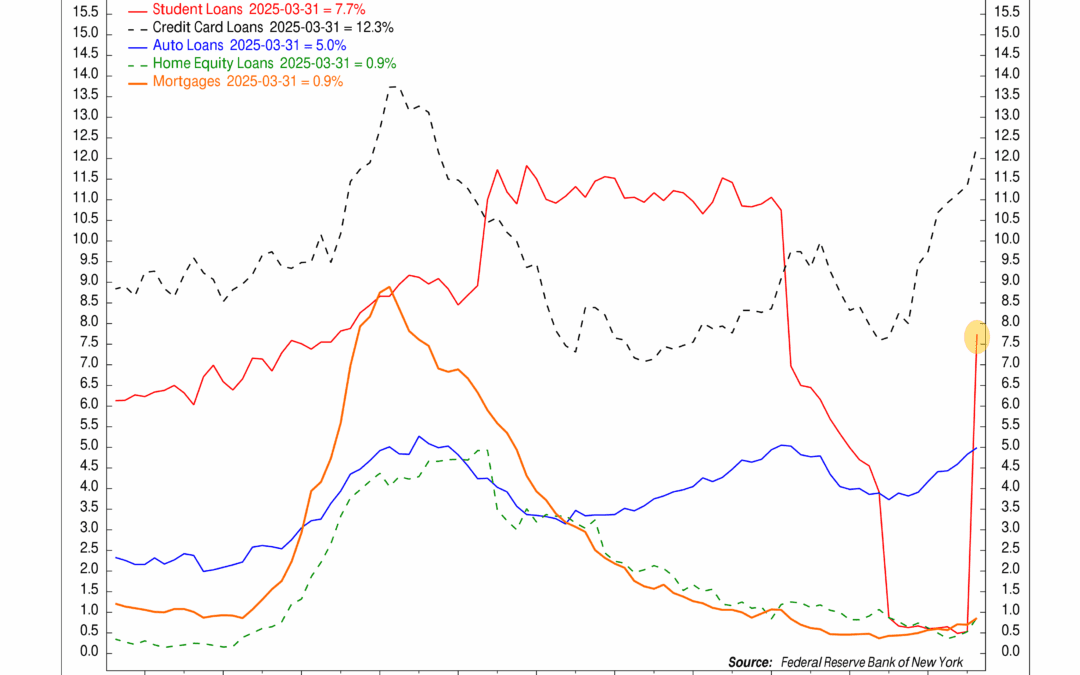

Americans are falling behind on student loans at the fastest pace in years. With savings shrinking and debt piling up, the financial strain is starting to show.

Americans are falling behind on student loans at the fastest pace in years. With savings shrinking and debt piling up, the financial strain is starting to show.

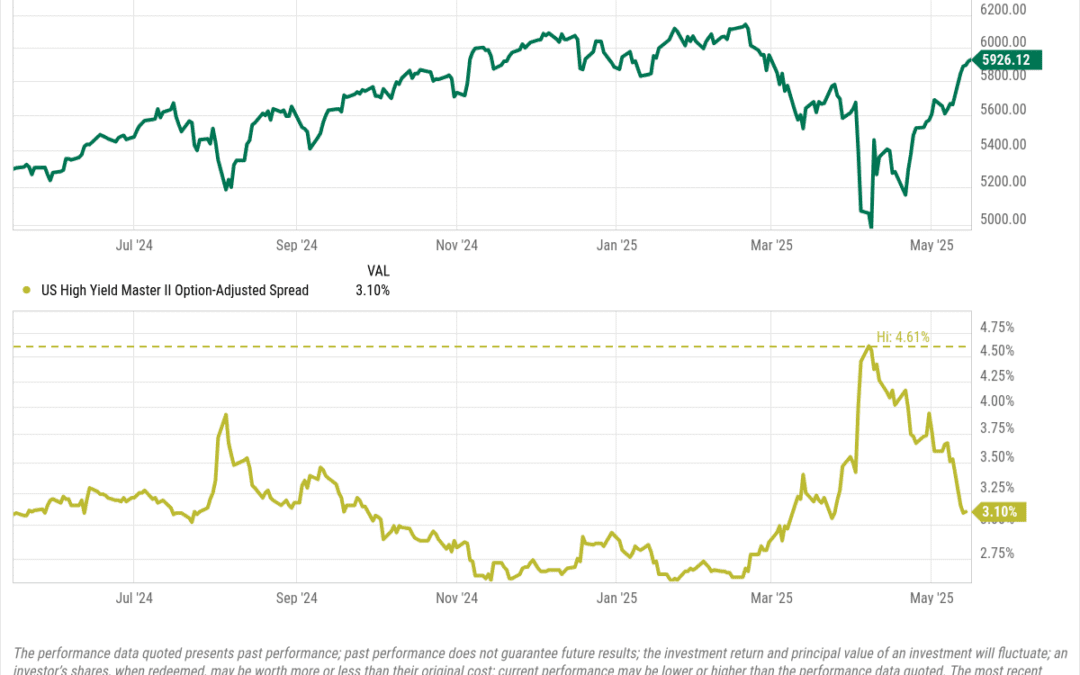

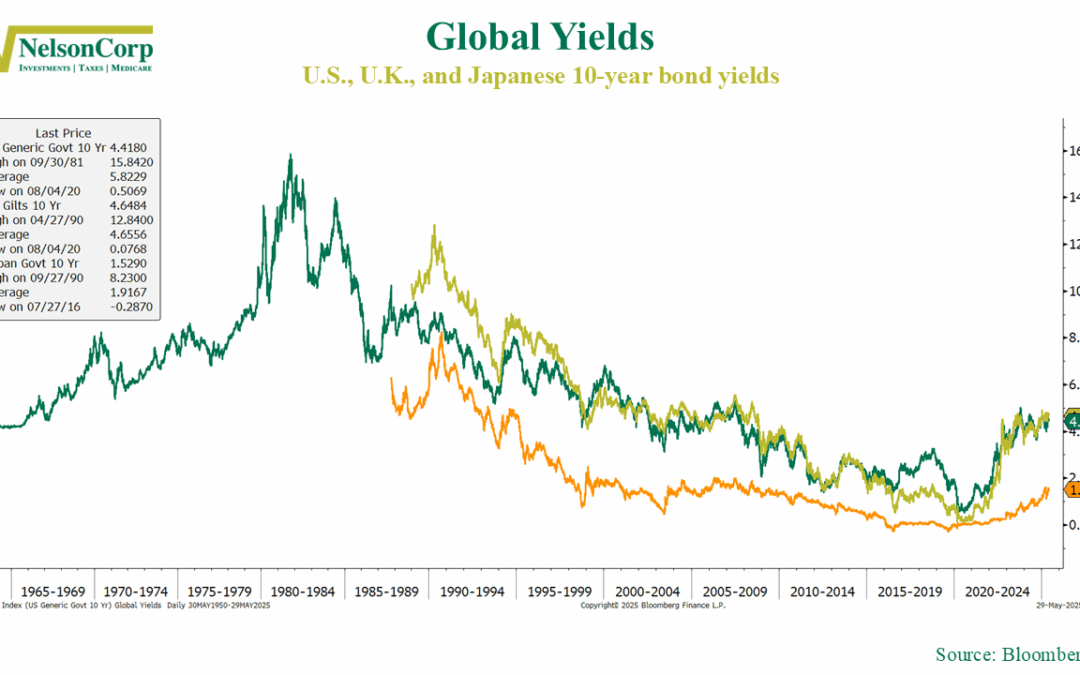

Interest rates are rising—and so are the headlines. But while the U.S. 10-year Treasury yield has been labeled everything from a warning sign to a market menace, the reality might be far less dramatic. This week’s chart puts the move in context, showing that today’s yields aren’t unusually high—they’re just not unusually low anymore.

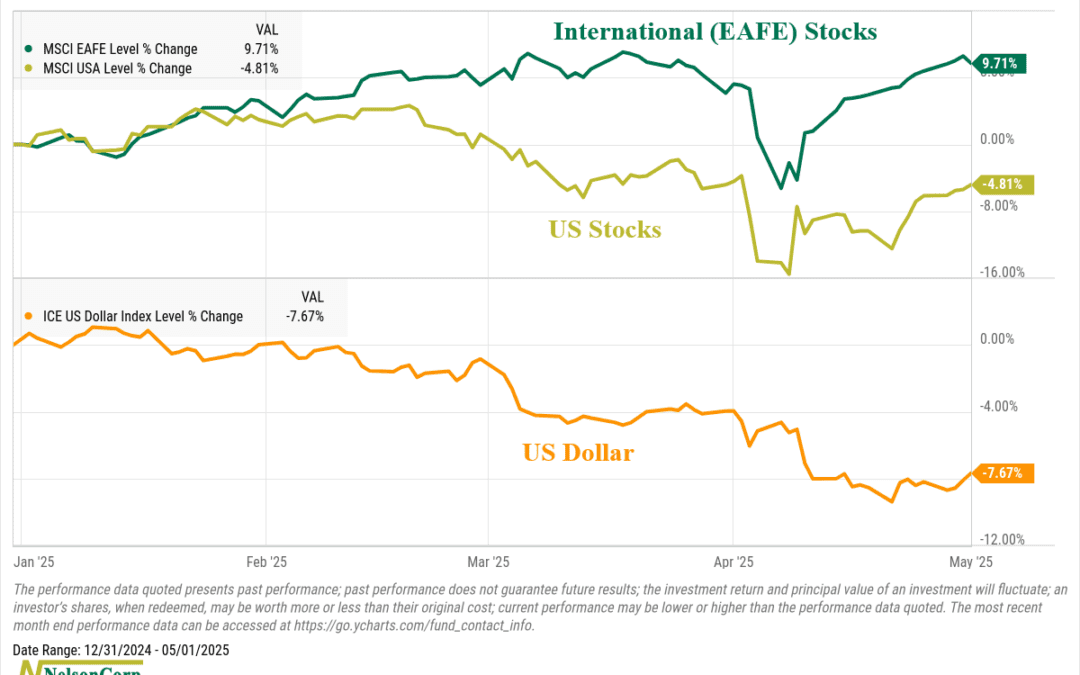

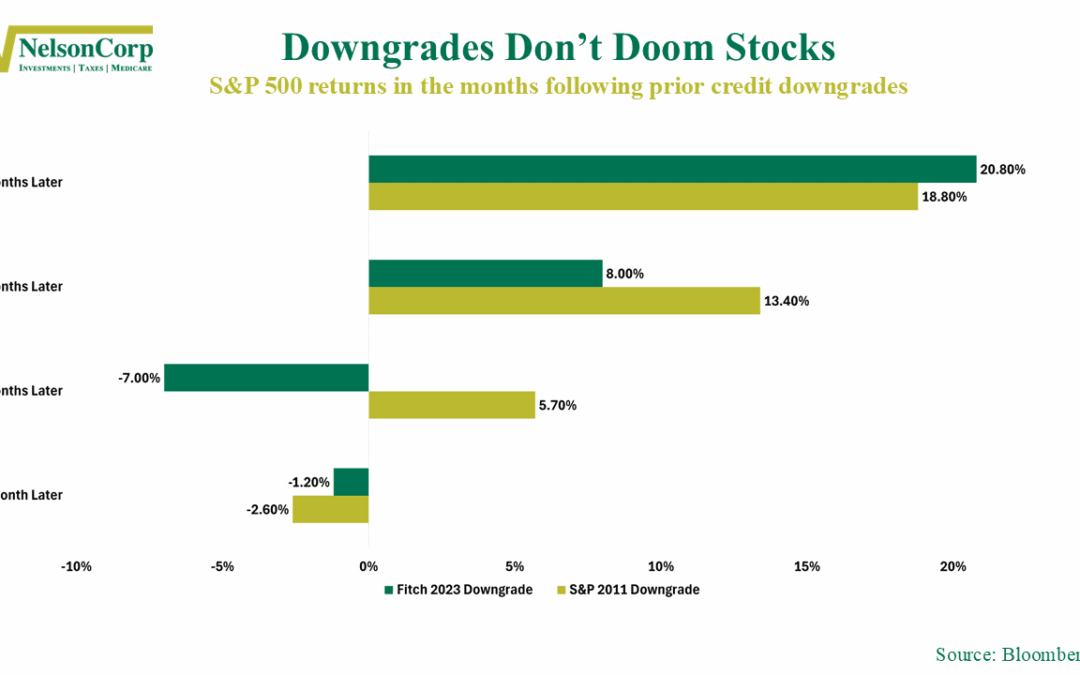

Moody’s just hit the U.S. with a downgrade—should you be worried? History says the real story might be what happens after the headlines fade.