We’ve seen financial conditions tighten up a bit already during this new Fed tightening cycle, but so far, it hasn’t had too much of an effect on the real economy. However, that might be about to change.

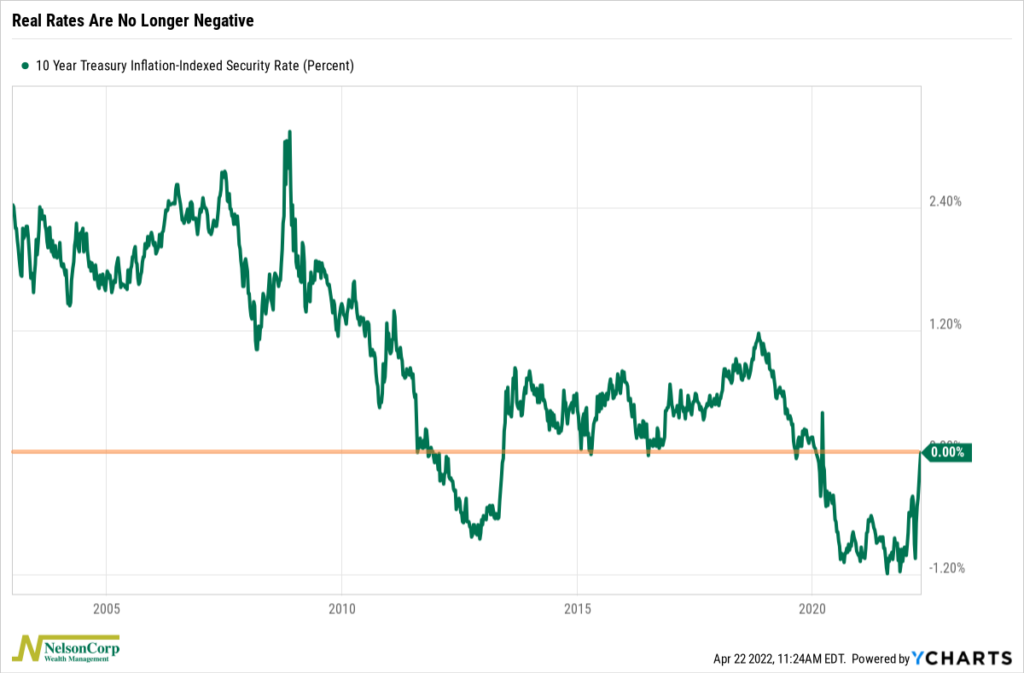

For example, our chart of the week above shows that real 10-year Treasury yields—that is, bond yields after adjusting for inflation—are about to rise back into positive territory for the first time since the pandemic hit.

Specifically, the chart shows the yield on a special kind of 10-year Treasury note that gets its principal adjusted for inflation. These are called TIPS (Treasury Inflation Adjusted Securities). And because these bonds take inflation into account, we call their yields “real yields.”

Real yields got as low as negative 1% during this past cycle. But they have risen sharply and are now roughly 0%.

Why is this important? Because when real rates on Treasuries are negative, savers who buy government bonds are essentially losing money on a real basis. That makes savings unattractive compared to spending, so people tend to spend more. But, when real rates go positive, savers are actually coming out ahead after taking inflation into account, so maybe people start to save more and spend less.

That’s the theory. Of course, like with most things, there are a lot of other factors at play, so it doesn’t mean the economy is going to tank overnight or anything. But it does mean that the more the Fed moves to bring real rates further into positive territory, the more it could affect real economic activity.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.