For this week’s chart, we look at the percentage of U.S. stocks that are beating their quarterly earnings expectations. Every quarter, financial analysts forecast what they believe companies will report for revenues and profits at the end of the quarter. If the company reports better numbers than what the analysts had expected, the industry calls it an earnings surprise. Many times, a stock’s price will pop in response to a surprise beat in earnings.

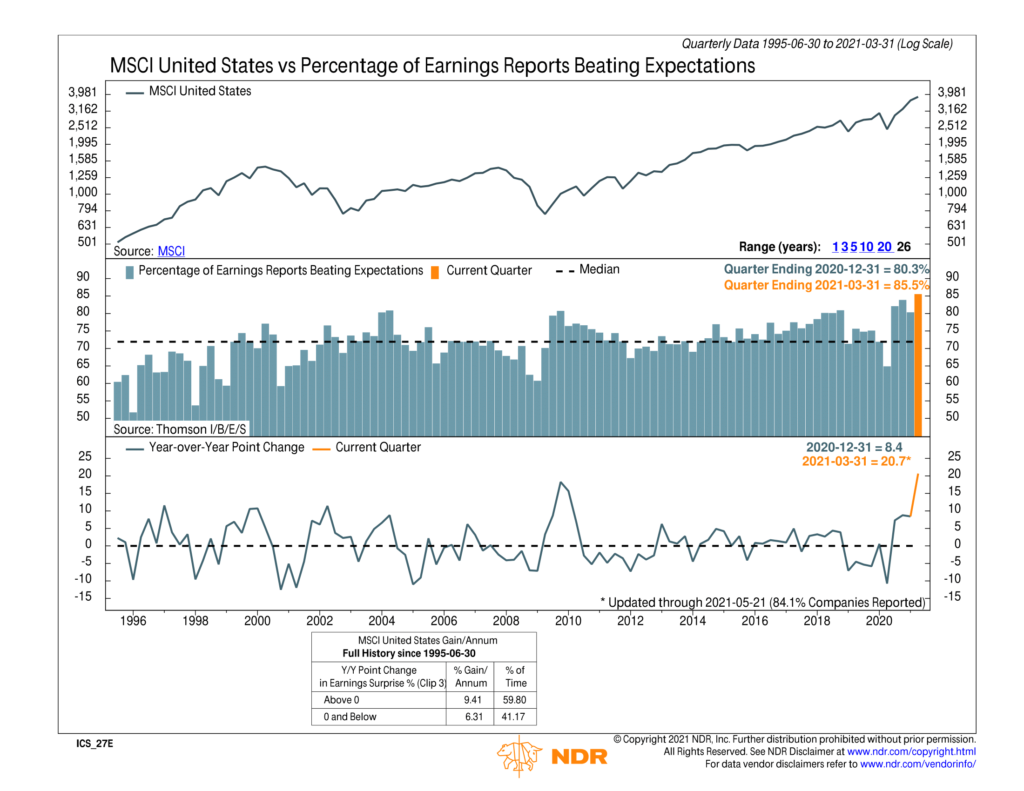

In the top clip of our chart above, we show the MSCI United States index, a measure of the performance of large- and mid-cap stocks in the United States. The middle clip shows the percentage of companies in the index that are beating analysts’ earnings expectations. And the bottom clip shows those same earnings beats but compared to a year ago.

As you can see, the most recent quarter was remarkable. With about 84% of companies reporting so far for the first quarter of 2021, 85.5% of them have beat expectations, the highest quarterly beat rate since this series began in 1995. Compared to a year ago, the measure is up nearly 21%.

To be sure, analysts slashed their profit expectations last year when the pandemic struck, but then demand came back faster than expected, so it hasn’t been very hard for companies to beat expectations. With that said, however, the historical record still shows that, on average, earnings beats this high have generally been good for stock prices in the long run.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.